Who would benefit from this post? Share here:

Join my Financial Transformation Program (25% off)

After helping tens of thousands of expats to plan, save & invest their own money with confidence, I have created this program combining private coaching, online courses, group learning, accountability and community. It has everything you need to know, the flexibility to suit your experience and life schedule, plus the support to make sure you actually take action towards a great financial future.

What is a dividend?

When a company makes a profit, they can reinvest in research & development and expansion to make even more profit in the future. Or they can pay some of it in cash back to you the shareholder, to say thank you for taking for investing in the company and taking the risk that you might lose all your money if the company goes bankrupt. [Note – this is why I don’t recommend investing in individual companies! #lehmanbrothers]

The cash for the dividend is usually divided equally across shareholders and announced as an amount per share. If the dividend is $2 per share, you will get $2 if you own 1 share and $200 if you own 100 shares. Dividends are often paid out quarterly, especially by US companies.

How much can I expect?

More established companies that generate a lot of cash but aren’t growing rapidly in mature markets tend to pay high dividends. Coca-Cola has increased its dividend slightly every year for 58 years. Fast-growing companies like Tesla don’t pay dividends, as they want to reinvest all their current and previous profit into driving growth.

Comparing company dividends is easiest using the ‘dividend yield’: dividend per share / current share price. Coca-Cola’s dividend yield is currently 3.3% and the average is about 2%, so if you have a portfolio of $100k you should expect an annual dividend of $2k. Not bad!

Why are dividends important?

If you’re going to ‘retire’ using the 4% rule, then making a 2% dividend in cash every year is going to cover nearly half of the 4% that you’re going to extract from your portfolio to cover your annual living expenses in retirement. That means you don’t need to sell nearly as many stocks or bonds to get the money for your expenses.

I say ‘nearly’ half because taxes are going to kick in and, unusually for expats, are hard to escape. More on that later.

Why don’t I just invest in companies with high dividends?

Some people do that but it has a number of pitfalls and I don’t really recommend it.

1) During a downturn, companies that were previously churning out profits and issuing juicy dividends may suddenly stop being profitable (oil companies). Or they may be banned from issuing dividends (UK banks).

2) Companies with high dividends are usually not going to grow as fast as other companies, so your capital gains (the increase in stock price over time, not taxed for many expats) will be lower.

3) Investing in individual stocks is risky, as even great companies can get into difficulty unexpectedly. A high dividend yield isn’t much use when the company’s share price crashes.

4) You’ll spend far too much time researching high dividend stocks, picking individuals stocks and jumping in and out of stocks in your search for the next great dividend. Time you could spend with your family or earning extra money.

It’s better to focus on ‘Total Return’, which is a stock’s capital gains for the year + its dividend. Even better to invest in a global fund with thousands of stocks and be happy with its roughly 2% annual dividend yield.

How do I receive the dividend?

The dividend will be paid into your broker account as cash. If you haven’t retired yet, you can reinvest it. If you have retired, you can transfer it to your bank account and use it to cover your living expenses.

Get started with my free guide:

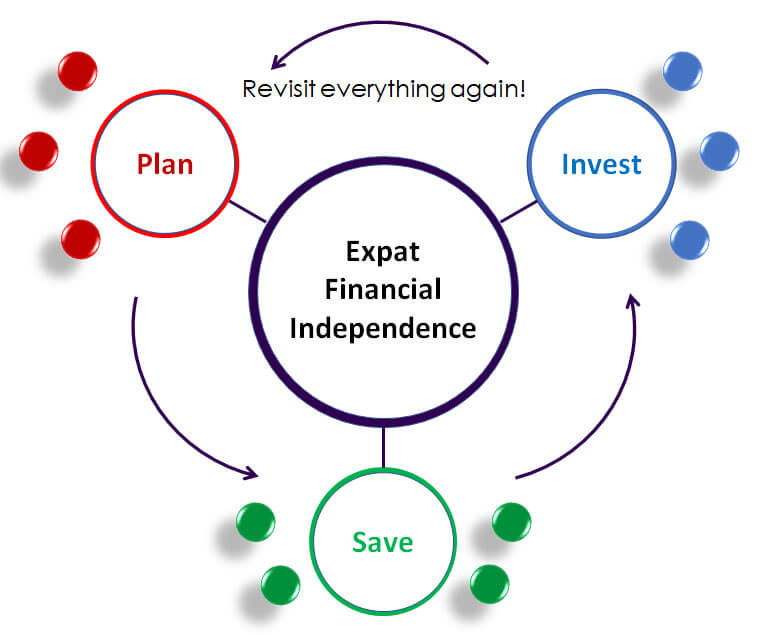

3 Steps to Expat Financial Independence

15-minute read. Discover the simple process for taking control of your finances so you never have to stress about money again.

Accumulating vs distributing dividends

When you invest in a global stock fund, many of the companies in the fund are generating dividends for you, so the fund pays an aggregated dividend for you. Same with a bond fund, the interest payments on the bonds are generating cash for you. What to do with these? You have two choices:

1) A distributing fund pays a dividend as cash into your broker account. So VWRD, the ‘Vanguard FTSE All World UCITS ETF (USD) Distributing’, pays about 0.5% of your investment quarterly for a total of 2% annually. IGLO, the ‘iShares Global Government Bond UCITS ETF (USD) Distributing’, pays out 0.5% twice a year for a total of 1% annually.

Once the cash is in your broker account, you can send it to your bank account and spend it. This is great if you’re retired, making up half of your 4% annual withdrawal for retirement expenses. It’s not so great if you aren’t retired yet and you’d be better off reinvesting the dividends back into the fund.

Brokers like IB offer to do this for you automatically but they are still going to charge you a trader fee, which will be a hefty percentage of the dividend amount. So I don’t recommend that. You can wait until your next chunk of salary savings comes in and reinvest the dividends with that. Or…

2) An accumulating fund reinvests the dividend automatically back into the fund, so you don’t have to even think about it. This saves on fees, time and brain power. If you are not retired and not particularly close to retirement, these are the funds for you.

Note that most ETFs start out as the distributing version and then an accumulating version gets added if the ETF is popular. Don’t worry if the size of the accumulating version is quite small, it’s not going to disappear and it won’t be any harder to buy or sell for a good price in the market.

VWRA and IGLA are the accumulating versions of VWRD and IGLO (yeah, I know it’s not IGLD, that would be too easy huh).

To summarise: not retired -> accumulating, retired -> distributing. If you now realised you’ve got the wrong one, don’t worry – you don’t have to change if you don’t want to.

Dividend pricing

People worry that their accumulating funds are not getting the dividends, as they don’t get any notification or price bump or extra shares. What if Vanguard is sneakily siphoning them off and stealing your money?

Well don’t worry, they’re not. What’s happening is a bit subtle though and Detective Simple Saving had to really dig to get to the bottom of this.

What dividend has your accumulating fund received? Google the factsheet of the distributing version (e.g. VWRD factsheet) and under Distribution History it will show you the latest dividends. That’s what the accumulating version has received too!

How does the accumulating version absorb the dividend? Let’s take a step back. When the distributing version pays out a dividend, the price of the fund goes down. You had a share in a fund worth $200, now your share is worth $199 plus you have $1 in cash.

With the accumulating version, the cash from the dividend is used to buy the stocks or bonds in the fund, so the value of the fund stays at $200. Regardless of which version of the fund you own, you have $200!

Tax on dividends

Dividend tax makes people’s heads spin (as if your head wasn’t spinning enough already). The one tax you cannot escape is the Withholding Tax on US-based companies. This is 30% of the dividend, though you can get it reduced to 15% by investing in Irish-domiciled ETFs like VWRD/A.

The tax is taken at source long before you see the money, so you will not see it taken out of your account.

If you move back to a country that has income tax, you will probably have to pay tax on dividend income (even after you paid withholding tax!). In many countries it also doesn’t matter whether you have an accumulating fund or distributing fund, you still received a dividend even if it was reinvested. Yes, this is annoying.

Dividend currencies

When you buy a global stock index fund, you are effectively buying USD as this is the underlying currency of global trade. You may be able to buy this global fund in other currencies for convenience, e.g. GBP, EUR, CHF, AUD. But remember, it’s still really a USD investment! Some funds like VWRL (the non-USD version of VWRD) like to emphasise this by paying out dividends in USD, even though you bought the fund in some other currency. Don’t say I didn’t warn you.

Buying just before or after the dividend

Is there a clever strategy to wait until just before the dividend to buy the fund? Or just after? Actually it doesn’t matter. You either get slightly fewer stocks for your money and a bit of cash, or slightly more stocks and no cash. More importantly, trying to be clever sets you on a slippery path of trying to be even more clever. And we know that ends up with you having less time to spend with your friends and family… and less money.

Join my Financial Transformation Program (25% off)

After helping tens of thousands of expats to plan, save & invest their own money with confidence, I have created this program combining private coaching, online courses, group learning, accountability and community. It has everything you need to know, the flexibility to suit your experience and life schedule, plus the support to make sure you actually take action towards a great financial future.

Who would benefit from this post? Share here:

Join Our Community

Get our articles first – practical and memorable advice on saving your money and avoiding financial pitfalls.

We won’t share your email with third parties and will never spam you.