Who would benefit from this post? Share here:

Join my Financial Transformation Program (25% off)

After helping tens of thousands of expats to plan, save & invest their own money with confidence, I have created this program combining private coaching, online courses, group learning, accountability and community. It has everything you need to know, the flexibility to suit your experience and life schedule, plus the support to make sure you actually take action towards a great financial future.

It’s been a wild ride in the stock market these past few days. Should you buy? Should you panic and sell? Should you hide your cash under the bed? Here’s what I think.

Bears

Articles love to proclaim “It’s a bear market!” So what. It’s just a label. I’m not even going to talk about definitions, it’s so irrelevant. The market might go up and it might go down (a lot) further. You knew that already.

There are some interesting stats about rapidly falling markets leading to deeper crashes but remember this: every crash is kinda different and kinda the same. 1) The market falls (compulsory). 2) The market stays flat (optional). The market crashes again (optional). The market recovers and then crashes again (optional). The market recovers (compulsory).

So let’s skip the middle bits. For those of you who haven’t retired, your investments will go up again and, over the decades to come, they will go up A LOT. It really doesn’t matter if they go down further, because eventually they will go back up.

Don’t panic

Don’t think about the size of your portfolio now it has shrunk a bit. Don’t worry about your daily P&L or how you should have invested today rather than yesterday. Think about your portfolio’s future potential. If you have money to invest, put it in the market, knowing it might go down in the short term.

Warren Buffett, equipped with both genius and 89 years of experience said recently that coronavirus isn’t nearly as scary as the financial crisis of 2008. Back then, the whole financial system was close to collapse.

Now all the banks have much more spare capital and the system is more robust. There will always be a few weaker companies that get pruned out. But there will still be planes, tourists and conferences in 2022.

It’s cheering to see reports from Vanguard and others that individual investors are piling into stocks, just as institutions are fleeing them. People are finally thinking long term, with no quarterly performance reports to worry about.

Coronavirus playbook

Flu viruses are generally not very deadly, just very common. If you have one that is more deadly that the rest, like coronavirus, then over time it will slowly mutate to become less deadly. People exposed to dangerous versions stay inside feeling terrible and may die. People with milder versions move around, so these versions spread further.

This virus is sneaky because of the long incubation period before symptoms show, but there is no reason for it to get more deadly. Spanish Flu in 1918-19 infected 500 million people globally and killed 20-50 million. Then it disappeared very rapidly.

The next few weeks will be rough – many countries are well behind Italy, South Korea and China. Economies will grind to a halt. The stock market may fall every time new restrictions are announced. If things get better, another wave of the virus may spread again, but we are talking months not years. A vaccine will be developed and countries will get better at reducing the spread.

Right now the stock market is dropping because people are panicking and hate the uncertainty surrounding the spread and impact of the virus. Nobody knows how corona is actually impacting company’s financials.

We will find out in the second and third weeks of April when public companies release their Q1 2020 results. Either the market will have underestimated the financial impact of the virus, and stocks will fall further, or overestimated it and stocks will recover. My guess is underestimation but who knows, right?

By Q3 we could be in full recovery mode. Industries like international tourism and events may not be quite the same for a few years, but most will crack on with things. People will be sick of Netflix and want their new phones in September. Life will go on. Or some economies will be truly damaged and take years to fix.

You’re investing for the long term, so the lack of a sudden return to rapid market growth won’t bother you.

Get started with my free guide:

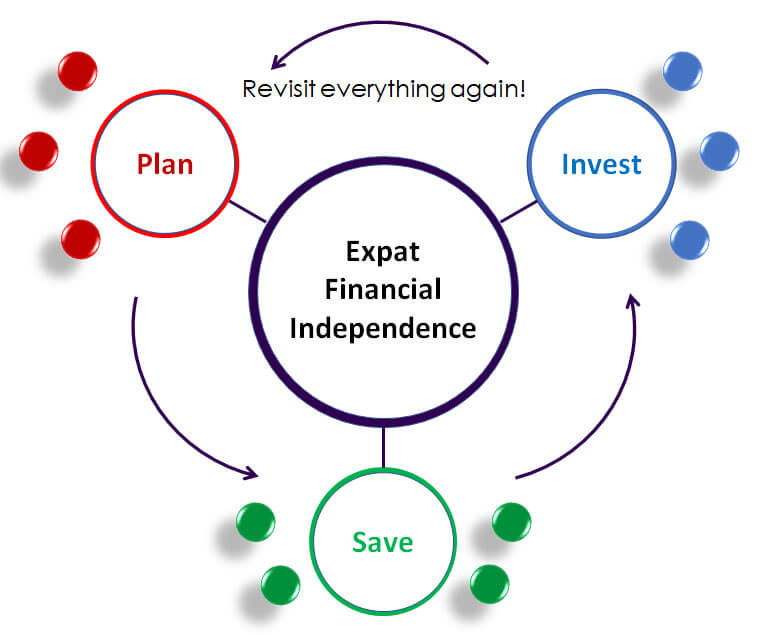

3 Steps to Expat Financial Independence

15-minute read. Discover the simple process for taking control of your finances so you never have to stress about money again.

So what to do

A) You are more than 3-5 years from retirement

Enjoy the stock market going on sale! If you have a lump sum, either put it in (knowing the market could drop further) or drip it into the market over the next few weeks and months. Try not to overthink things. If you love timing things, take 10% and have a play around. Don’t do that with all your money though.

Don’t forget about bonds! Yes bonds are ‘expensive’ at the moment, but stocks were expensive a few months ago. If stocks fall further, bonds could get even more expensive. Ideally pick an appropriate mix of stocks and bonds to match your age and risk appetite, then stick to it.

If you just want to buy stocks at the moment, know that they could go down 50% at any moment and make peace with that so you don’t panic sell at the bottom.

Make the most of the stock sale by boosting income creatively (still legally though!), reducing expenses and generating more savings to invest for the long term. Even if you have just put in a lump sum, there is still money coming along for you to invest.

B) You are close to retirement

Now is not the time to mess around, as you don’t have as much time to recover from mistakes. If you have a fixed date in mind for retirement, don’t take risks aggressively. Invest but keep your allocation of stocks and bonds. Anything more than 70% stocks feels a bit risky to me.

C) You are in retirement

Hold on to your hats! Assuming you don’t have any income, you will just have to ride this out and you will be fine. Make sure your allocation is somewhere between 60% and 70% stocks, preferably closer to 60%. If you are taking out 4% as per the 4% rule, don’t go below 60% stocks as you will need them for future growth.

Consider whether you want to nip out of retirement, sell some stuff, do some consulting? Then you can take advantage of cheap markets.

Now is an amazing opportunity to experience a proper downturn in all its glory. Stay calm, remove your emotions and make the most of it. This is an experience that will help you stay on track through all the craziness of the many decades of investing ahead of you.

Have any questions or comments? Add them below.

Join my Financial Transformation Program (25% off)

After helping tens of thousands of expats to plan, save & invest their own money with confidence, I have created this program combining private coaching, online courses, group learning, accountability and community. It has everything you need to know, the flexibility to suit your experience and life schedule, plus the support to make sure you actually take action towards a great financial future.

Who would benefit from this post? Share here:

Join Our Community

Get our articles first – practical and memorable advice on saving your money and avoiding financial pitfalls.

We won’t share your email with third parties and will never spam you.

Very sensible way of looking at things, we are in for the ride here! Might be in retirement the next time one of these comes along in 20 years (although I believe something usually happens every 10 years or so?)

Thanks for stopping by! Historically we have seen market drops every 10 years more or less but no one knows what the future holds! For now enjoy the stock on sale and buy in regularly.