Who would benefit from this post? Share here:

Join my Financial Transformation Program (25% off)

After helping tens of thousands of expats to plan, save & invest their own money with confidence, I have created this program combining private coaching, online courses, group learning, accountability and community. It has everything you need to know, the flexibility to suit your experience and life schedule, plus the support to make sure you actually take action towards a great financial future.

In case you think the US election is the only thing people are thinking about, you can also think about investing before/during/after the results! I never expected to write about investing during the results, but here we are.

Many people have been nervous about investing before the election, in case there was a massive crash immediately after. Others have been piling in, certain that a huge boom is on its way as soon as the winner is announced.

Don’t sweat the short-term stuff

As with anything related to news and investing, your best course of action is to take the 30-year view. Things could get pretty wild between now and 20 January:

– Armed militia take to the streets to protest

– Joe Biden gets coronavirus

– Even more people get coronavirus than are already getting it

– Recounts drag on into December

– Trump is dragged screaming from the White House

I would say coronavirus tallies and their impact on the economy are more likely to have an impact on the stock market right now. And of course, taking our 30-year view, nothing is going to have such an impact as to stop you investing on Monday if you have money sitting there ready to go.

What do stock markets like?

People always claim ‘markets like certainty’ or ‘markets climb a wall of worry’, among many other things. As these two statements are contradictory, it’s pretty clear that nobody knows what markets like. It tends to all be backwards-looking analysis based on what’s happened that day.

It’s pretty clear that markets don’t like once-a-century pandemics (see March 2020) but have got used to one now, as have we all. The US’s S&P 500 index has been steadily rising since March, though scary images of overflowing hospitals and a tough lockdown hitting the economy hard could drag it down. A panic crash similar to March seems unlikely though, as we all know what’s going on by now.

Some good vaccine news might kick the markets upwards, though stories of mutations, side-effects and disappearing immunity makes me feel a ‘magic bullet’ that takes out the spiky sucker once and for all is unlikely.

Red or blue markets?

Do markets prefer Trump or Biden? It seems the right answer is ‘meh’. Traditionally, Republican tax cuts and ‘business-friendly’ policies have been seen to help markets while fear of Democrats raising taxes, breaking up big businesses and piling on red tape hold the stock market back. Comparing Obama’s and Trump’s last few years in office would suggest otherwise, but there are a few confounding factors like a big fat pandemic.

Trump is unpredictable though and not exactly a favourite of Wall Street’s newly popular ESG (Environmental Social Governance) funds. Biden is not exactly a Bernie-style radical leftie and he might bring the sort of behavioural certainty that markets allegedly like.

What apparently makes markets salivate even more is the prospect of political gridlock, with a Democrat president and Republican-controlled Senate (and possibly House). If nothing can change, then businesses can carry on making money more or less as now – as everyone is now used to the 2020 way of doing things, efficiency and stabilty should boost profits. For every Boeing there will be a Zoom.

Get started with my free guide:

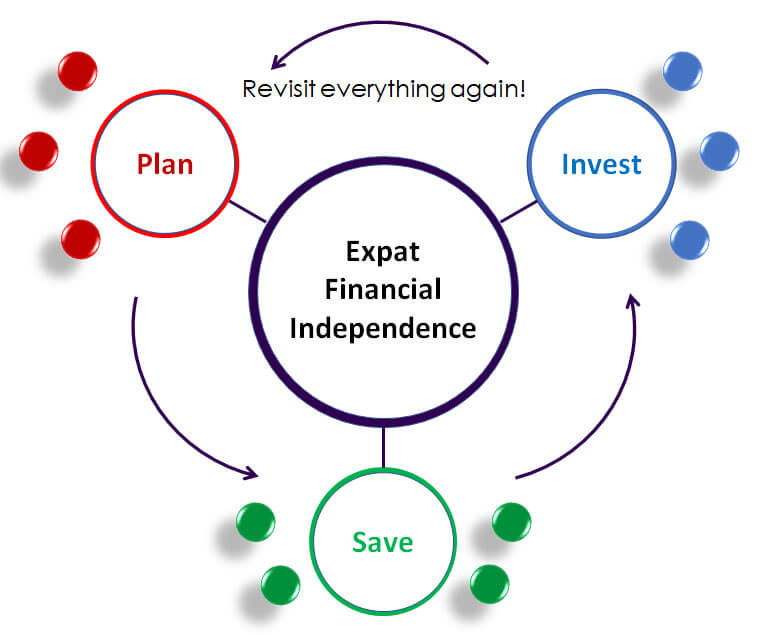

3 Steps to Expat Financial Independence

15-minute read. Discover the simple process for taking control of your finances so you never have to stress about money again.

The election that never ends

What if recounts start flipping the results around? Given the average change in all past recounts has been 430 votes, I don’t expect any sudden changes in Trump’s (mis)fortune. And what if the Pennsylvania election official’s mask is pulled off Scooby Doo-style to reveal Hillary Clinton busy marking up ballots for the Democrats (though seemingly not for the Senate races, looks like the Dems missed a trick there). Well it ain’t gonna happen.

The best thing you can do for your investing is to set at date to invest (whether a lump sum or your regular amount) and stick to it, regardless of what is happening in the world. Nothing will improve your future faster than discipline like this.

News dictator tries out mind control

My last warning against letting the news dictate your investing is the immense power suddenly revealed by Ruport Murdoch in the past few days. As the owner of Fox News (virulently pro-Trump), the Wall Street Journal (business-like but tough on Biden) and the New York Post (tabloid Trumpian fodder), he has forced them all to distance themselves from Trump.

They have called Arizona for Biden, all suggested today that Trump needs to go gracefully to preserve his legacy and now instead of “Another day of hidin’, help us find Biden” the New York Post has “Biden this close to winning the presidency”.

Do you see how much power Murdoch, one man, has to dictate the news to you and those around you? Every newspaper has an agenda, and it is not your agenda. Stay focused on making money, loving your family and friends, reducing your expenses, investing your savings every month and clawing your way to Financial Independence. Don’t let an election get in your way.

Do you have any (non-political) questions or comments? Share your thoughts in the Comments section below…

Join my Financial Transformation Program (25% off)

After helping tens of thousands of expats to plan, save & invest their own money with confidence, I have created this program combining private coaching, online courses, group learning, accountability and community. It has everything you need to know, the flexibility to suit your experience and life schedule, plus the support to make sure you actually take action towards a great financial future.

Who would benefit from this post? Share here:

Join Our Community

Get our articles first – practical and memorable advice on saving your money and avoiding financial pitfalls.

We won’t share your email with third parties and will never spam you.