Who would benefit from this post? Share here:

Join my Financial Transformation Program (25% off)

After helping tens of thousands of expats to plan, save & invest their own money with confidence, I have created this program combining private coaching, online courses, group learning, accountability and community. It has everything you need to know, the flexibility to suit your experience and life schedule, plus the support to make sure you actually take action towards a great financial future.

Can you really have love and money? Will your other half chew through all your cash? Or will you slave away at your job so hard that the love of your partner and family slowly evaporates?

You will have to work at finding a balance, because it isn’t easy. I think it’s worth it though, as the alternatives are fairly grim. I always say you should find a partner after discovering the concept of Financial Independence, in case your sig other ruins your chances or doesn’t like the idea of careful spending at all.

What if you’ve found your partner already? Fear not. Yes money is the number one cause of breakups. But really it is poor communication about money. You’ve got to discuss your present and future calmly:

1) Take the emotion out of it (money issues are horribly emotional and personal)

2) Get the facts (by which I mean the numbers – stop being scared of numbers!)

3) Agree on financial priorities now and for the future, and how those priorities will affect your future… together.

Short-term: Valentine’s Day

Should you splurge on Valentine’s Day? I’m enjoying ‘Billion Dollar Whale’, about a young guy who stole billions of dollars from the Malaysian government with the backing of a corrupt prime minister. He takes a girl on a date to Atlantis on the Palm, but this is no ordinary date. They eat on a private beach, with the best food, musicians and a private fireworks display. A helicopter appears and delivers a Cartier necklace. But there is little chat and the girl is bemused.

WHAT A WASTE OF MONEY!

Don’t be that guy. The job of both partners (yes, both) is to make Valentine’s Day memorable, if you choose to celebrate it. That does not have to cost much money at all. Better that it costs you a few minutes thinking time and creativity. Make a card using a funny photo (we all have a printer, right?). Arrange for 5 vendors to give your beloved a rose as you walk to a favourite restaurant. These things cost very little.

Be aware of your other half’s love language: receiving gifts (possibly an expensive language), acts of service, physical touch, words of affirmation, quality time. Many of these have very little to do with money!

You can listen to more on this subject in my recent radio discussion with Dubai Eye’s Helen Farmer here:

https://omny.fm/shows/dubai-eye/how-much-should-we-spend-on-valentine-s-day

And if you are single, don’t worry, you are much closer to meeting someone amazing (should you want to) than a person who is with someone not amazing! And know you know to look for somebody who won’t blow up your finances.

Get started with my free guide:

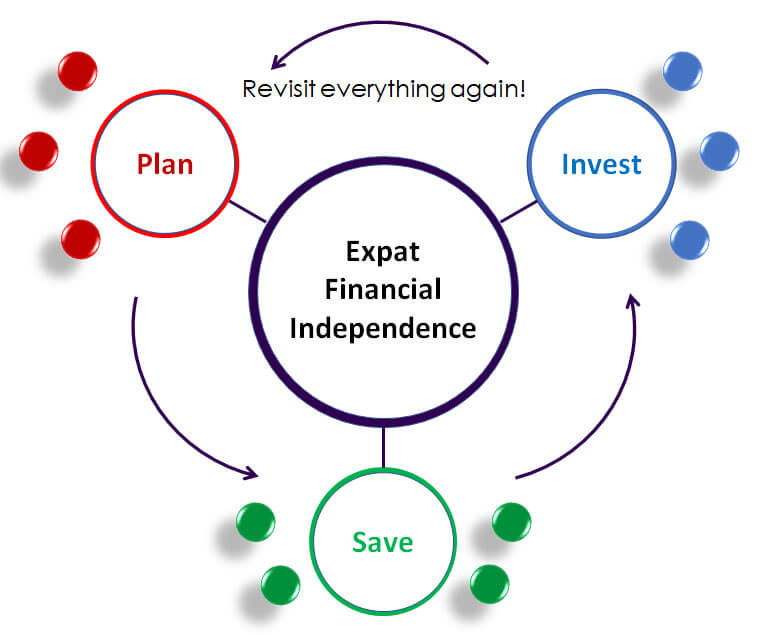

3 Steps to Expat Financial Independence

15-minute read. Discover the simple process for taking control of your finances so you never have to stress about money again.

Long-term: planning a life together

DO: review your expenses together, discuss what you both value (and don’t value), and debate how you could boost your income and trim your expenses

DO: agree on what major expenditures you have coming over the horizon in the next 2-5 years, as you can’t save for those in the stock market

DO: learn about investing together and take joint responsibility for your financial future. You’ll make much better decisions and one of you might still get hit by a bus or a live a very, very long time.

DON’T: let money issues trigger arguments. Track your numbers and let them speak for themselves. Use numbers (e.g. how long it will take to reach your target portfolio size for retirement) to help with important life decisions (should you go and work in Saudi for a year?!).

DON’T: forget happiness. You’re in this for the long-term, so any frugality has to be sustainable. Equally: you’re in this for the long-term, so any spending has to be sustainable. Spend money on things that will make you happy for many years to come: holidays, quality items, activities etc.

DON’T: put your financial future in the hands of a bank or financial advisor. What if they care more about their commission? Is your portfolio up 10% on last year? Well it’s not bloody good enough! The FTSE All-World index has risen 20% over the past year, and you don’t need to pay an advisor to invest in that.

I could write a million words on this topic but you need to start on your planning, so I’ll stop there.

Have any questions or comments? Add them below.

Join my Financial Transformation Program (25% off)

After helping tens of thousands of expats to plan, save & invest their own money with confidence, I have created this program combining private coaching, online courses, group learning, accountability and community. It has everything you need to know, the flexibility to suit your experience and life schedule, plus the support to make sure you actually take action towards a great financial future.

Who would benefit from this post? Share here:

Join Our Community

Get our articles first – practical and memorable advice on saving your money and avoiding financial pitfalls.

We won’t share your email with third parties and will never spam you.