Who would benefit from this post? Share here:

Join my Financial Transformation Program (25% off)

After helping tens of thousands of expats to plan, save & invest their own money with confidence, I have created this program combining private coaching, online courses, group learning, accountability and community. It has everything you need to know, the flexibility to suit your experience and life schedule, plus the support to make sure you actually take action towards a great financial future.

There are some questions about expat saving and investing that get asked again and again. Which is understandable – these are the things expats worry about AND can’t find the answers to easily.

Here is a selection with some brief answers that should set you on the right track. You should be able to find more details on my site or at my workshops (they are 11 hours in total, so I’d hope they cover most questions!).

1. How do I access Vanguard funds as an expat?

You can’t go to Vanguard directly, as it’s too much paperwork (and risk?) for them to deal with expats . You have to use an offshore brokerage like Interactive Brokers or Saxo Bank. These are the best and cheapest I’ve found that allow you to invest in Irish-domiciled funds (non-US residents should avoid US-domiciled funds for tax reasons). Through the brokerage you can buy Vanguard Exchange-Traded Funds (ETFs) easily.

2. What if Vanguard or my broker goes bust?

If you have an Interactive Brokers account based in the US or UK, you are protected by the SIPC (insurance body for US brokerages) no matter where your account is. The protection is up to $500k in shares & ETFs for individual accounts. If you have a joint account with your partner, that gives you another $500k for the joint account. Non-US brokerages do not offer this kind of protection.

If Vanguard goes bust, the fund you invested in physically owns stocks and your assets are ring-fenced away from Vanguard’s own assets and liabilities as a company. Your money won’t therefore just evaporate, as it is invested in stocks that have real value. The fund might be taken over by another company, or the fund liquidated and the money returned to you.

3. How do I save for my children’s education?

First, don’t buy an education savings plan from some unscrupulous financial advisor! You can manage this yourself.

Assess how much you will need and by when. 3-5 years out, the money should be in a high-interest savings account, fixed deposit or partially in bonds. Not stocks in case they crash just before the money is needed – or 25% max if you have other sources of income that can easily make up for a shortfall.

5-10 years out you might get away with 50%-60% stocks and more than 10 years out you might as well go 80-100% stocks to make sure your education fund is growing rapidly. This is not a decision I can make for you, have a think about your risk appetite and the consequences of slow growth or a crash.

You don’t need a separate account – you can lump the money in with your own brokerage account for retirement, just buy similar but different ETFs so you can tell who has what instantly.

Get started with my free guide:

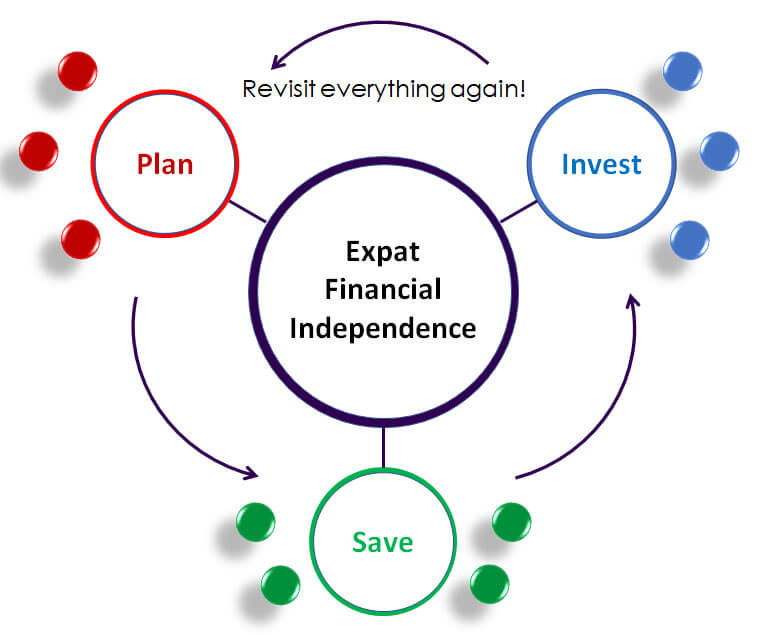

3 Steps to Expat Financial Independence

15-minute read. Discover the simple process for taking control of your finances so you never have to stress about money again.

4. What mix of stocks and bonds should I have?

Again, this is a personal decision and you need to make up your own mind. Here are some guidelines. Your asset mix should be driven by your time to retirement, other sources of income (e.g. rent) and your ability to stomach stock market falls.

100% stocks is very aggressive – your portfolio may grow fast but will also fall fast when a crash happens. If you have lots of other income source and an iron stomach, you might get away with it. Don’t sell your stocks in a panic during a downturn!

80% stocks / 20% bonds will give you some downside protection, as bonds tend to go up in value when stocks fall. If you have 10+ years before retirement and can handle some portfolio volatility, you might be ok.

60% stocks / 40% bonds is your retirement portfolio. If you are within 5 years of retiring, this should give you enough growth to live on and enough protection to stop your portfolio crashing.

5. I am retiring or moving back to my home country within 10 years, so can I still invest in the stock market?

Lots of people imagine they will exit the stock market as soon as they retire or move back to their home country. But you won’t. You’ll stay in the market until you die and then your beneficiaries can stay in too. You’ll take some money out every year to live on in retirement, but most of it will stay invested. This is different to an education fund, where most of the money will get used up at a specific time.

So while you may have to make some changes just before moving back or retiring, you won’t need to exit the market permanently. You don’t have a 10-year horizon – more like 30-50 years hopefully!

Do you have any questions or comments? Share your thoughts in the Comments section below…

Join my Financial Transformation Program (25% off)

After helping tens of thousands of expats to plan, save & invest their own money with confidence, I have created this program combining private coaching, online courses, group learning, accountability and community. It has everything you need to know, the flexibility to suit your experience and life schedule, plus the support to make sure you actually take action towards a great financial future.

Who would benefit from this post? Share here:

Join Our Community

Get our articles first – practical and memorable advice on saving your money and avoiding financial pitfalls.

We won’t share your email with third parties and will never spam you.

Hi Steve, I am not a US resident. If at the time of my death I have over USD 40 000 invested in US equities, eg Google, Amazon etc,

will I be liable for US inheritance tax?

1)If my broker is US based?

2)If my broker is not based in the US?

Regards

James

Hi James, US inheritance tax kicks in over $60k so you’ll be ok. Once you are over $60k, there is a greater chance you will get taxed if your US-based investments are purchased through a US broker. You could invest in a tech sector ETF instead or more preferable diversify into a broader ETF. Tech stocks won’t outperform every year.

Hi Steve, if you have extra cash to invest but are concerned about a market crash/correction, where is the best place to put it in other than bank where it earns nothing. A bond? my IGLA bond shares have not gone up at all in 2 years, they have actually lost value slightly.

Hi Gary, if you are invested for the long-term i.e. until you are 90 and beyond, then it doesn’t matter if there is a crash. There will be a recovery after that crash. Put your money in, keep adding monthly and try not to follow the market or polish your crystal ball too much. Otherwise you will miss loads of gains and the market will crash to a level that is still higher than where you could have put in your money in the first place.