Who would benefit from this post? Share here:

Join my Financial Transformation Program (25% off)

After helping tens of thousands of expats to plan, save & invest their own money with confidence, I have created this program combining private coaching, online courses, group learning, accountability and community. It has everything you need to know, the flexibility to suit your experience and life schedule, plus the support to make sure you actually take action towards a great financial future.

Revolut is useful. But when I made a list of red flags today, it quickly grew to at least 10 concerns. I don’t think that’s good enough.

The latest report of hacking is the final nail in the coffin. As we’ve seen with LastPass (please stop using it!), once a company gets a reputation for being hackable, it gets swarmed by every bad guy around.

When is the right time to warn people about a company? Is it before a reader loses money? With UAE Exchange, I’m glad I spoke out about it but I feel I could have warned people even earlier and been more blunt. Here then I am trying to alert people before disaster strikes… and it’s quite possible Revolut gets its act together and disaster never strikes.

Recommendation: only transfer to Revolut or store with Revolut money that you are willing to lose. I think the likelihood of losing money is low, but not as close to zero as I’d like. The chance of your money getting stuck (so you have to fight to get it back) is still low but higher. I’ve heard from people who faced this. I outline the red flags below so you can make up your own mind.

What to use instead? Revolut is particularly helpful for expats because of low transfer fees and excellent exchange rates. There are also low/no fees for card usage when travelling abroad. All of these features can be replicated individually elsewhere, or you make a conscious decision to pay a bit more for increased security.

Get started with my free guide:

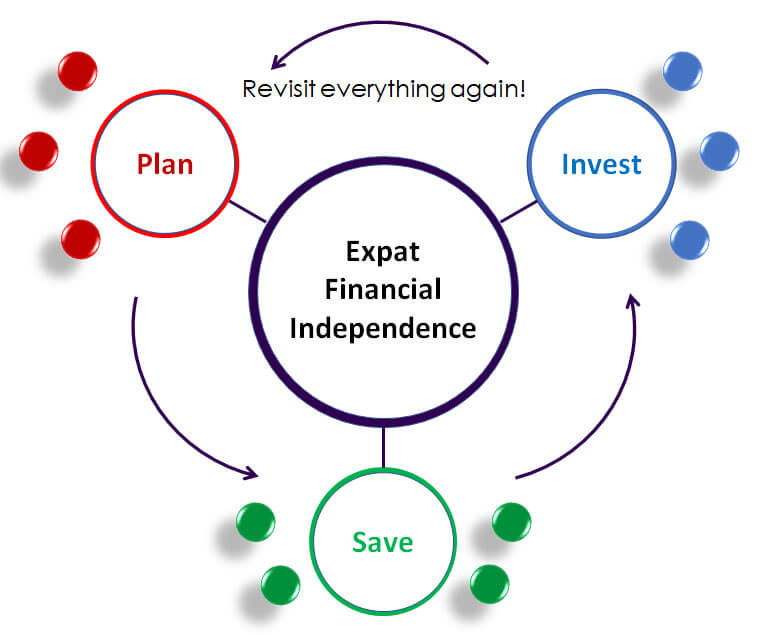

3 Steps to Expat Financial Independence

15-minute read. Discover the simple process for taking control of your finances so you never have to stress about money again.

Red flags

1) Theft

The Financial Times reported on Sunday (9 July 2023) that thieves exploiting loopholes in Revolut’s payment system caused a $20 million loss. Every smart thief will be reading about this problem and Revolut’s other struggles, and will try to have a go themselves.

The money lost was Revolut’s own money, not its customers. So you got lucky – this time.

2) Hacking

In September 2022, hackers accessed the personal details of 50,000 Revolut users. That was only 0.16% of their customer base, but it’s enough to encourage hackers to try again.

3) Scams

Fraudsters are targeting Revolut’s customers with sophisticated scams. It’s easy to set up an account, move money in and out, or even tumble it into crypto. The number of fraud complaints involving Revolut UK was second only to Barclays in January & February 2023, with Revolut having far fewer bank accounts than the big high street banks.

Beware of OTP (One-Time Password) requests that can give scammers access to your account or card. Scammed customers have also been complaining that Revolut wasn’t particularly sympathetic to their problems either.

4) Disappearing money

A SimplyFI member was transferring 50,000 AED ($13.6k) between Revolut and HSBC. It didn’t make it. Revolut and HSBC blamed each other. After a few weeks, both companies closed their investigations. So where’s the money? Who knows. It’s definitely somewhere. Neither company gave a monkey’s about the problem.

It’s not a situation I’d like to find myself in, especially when all I’d want to do is save a few dollars on transfers. What is a bank if not secure? Revolut isn’t a bank though… even if it wants to be.

5) Lack of trust

Revolut still does not have a UK banking licence after two years of trying. Most successful applications take less than a year. The regulatory authorities are strongly hinting that they are not going to grant the licence (note – this could change).

They don’t trust Revolut after concerns around poor compliance practices, weak anti-money laundering controls, an aggressive corporate culture and the number of times the EU regulator has had to ‘regulate’ the company. Without a banking licence, Revolut can’t offer its own accounts, loans and mortgages. Watch this space.

Banks and brokers have also seemed to be wary of Revolut accounts and transfers. Interactive Brokers often freezes funds for 5 days after a Revolut transfer.

6) Key staff departures

Revolut’s UK entity has recently lost its UK chief executive, chief financial officer and chief of staff / head of banking products. Who’s running the show? Reports abound of an aggressive workplace culture, even ‘toxic’. Compliance experts are said to be reluctant to work there.

That still leaves the main Revolut entity in Lithuania, but that has also faced problems.

7) EU troubles

Lithuania is in the EU, so getting a banking licence brings you under the eye of the EU regulators. So far the Lithuanian and EU regulators have slapped Revolut for the data breaches mentioned above, late filing of accounts (see below), failing to have sufficient checks in place to stop dodgy customers and not collecting sufficient information. They’ve also been worried about…

8) Russian connections

The father of Revolut’s founder is a Russian with a senior position at Gazprom, the Russian oil & gas company. That’s been sufficient for two Lithuanian parliamentary enquiries and for British embassies to ban certain staff from using Revolut.

I’m not sure this is by itself a reason to avoid Revolut, but it doesn’t help either.

9) Accounts

Revolut filed its 2021 late, though claimed to have made a profit for the first time. What’s more concerning is the auditor BDO noted that it couldn’t independently verify three quarters of the company’s revenue. Three quarters! A mere $765 milllion. BDO was also criticised by the accountancy regulator for the unacceptable quality of the accounts.

If a company can’t figure the money in its financial accounts properly, I don’t see why you should trust it with your own money. It’s also sensible to limit your relationship with companies that aren’t profitable yet. If growth stops, they can implode. While Revolut claims to be profitable, a swing of +/-75% of revenue might affect that…

10) Valuation write-downs

3 major shareholders of Revolut have recently slashed the value of their stakes in the company by around half from the previous funding round where it raised money in 2021. Lots of companies have been having a tough time since the heady almost-post-Covid days. But a rapid drop in valuation makes it harder to raise more money. If Revolut is barey profitable, where will the money for growth come from? And what is driving the drop in valuation?

None of these 10 issues is sufficient in isolation to say I recommend you stop using Revolut. But they all contribute to a concerning picture. That’s why I suggest you restrict your usuage to small amounts – what you consider ‘small’ is up to you. I won’t be closing my account just yet, but I won’t be in a hurry to use it either. I certainly won’t be recommending Revolut to people, especially those who are new to expat personal finance and potentially less cautious.

Thanks

Steve

Questions? Comments? Add them below…

Join my Financial Transformation Program (25% off)

After helping tens of thousands of expats to plan, save & invest their own money with confidence, I have created this program combining private coaching, online courses, group learning, accountability and community. It has everything you need to know, the flexibility to suit your experience and life schedule, plus the support to make sure you actually take action towards a great financial future.

Who would benefit from this post? Share here:

Join Our Community

Get our articles first – practical and memorable advice on saving your money and avoiding financial pitfalls.

We won’t share your email with third parties and will never spam you.

I want to buy stocks from NASDAQ. What alternative do you suggest?

Value of 2-6 months salary, longterm.

Hi Marko, I don’t really recommend buying individual stocks, especially not more than $60k in US stocks. Individual stocks are risky and US stocks will get hit by estate tax if you die with more than $60k.

Hi Steve,

Thank you! Estate tax even if located in Europe and long term,more than 5 years?

I thought of buying Tesla and Costco for 15-30 years.

Hi Marko, it depends if you are protected by a tax treaty between the US and your country. The length of time you invest doesn’t make a difference, it’s only relevant when you die – except you also pay 30% on dividend income. Who knows if Tesla will even be around in 30 years though? Everyone else is moving to EV manufacturing now. Also, a globally-diversified stock ETF owns about 1% in Tesla anyway, so you already own it without taking an extra risk.

Thanks for the outline of the issues Steve.

Would you suggest people use now to deposit into Interactive Brookers?

Also, do you have any recommendations for what to use for an offshore bank account? I’m an expat in Thailand and would like to keep some of my emergency fund in a bank outside of Thailand, but also with easy access such as with an ATM card – as Revolut offer. Are there any other Banks that are easy to open and access for expats? I’m a UK citizen, but haven’t lived in the UK for 13 years.

Thanks

Hi Max, there are other alternatives if IB doesn’t accept your currency directly, such as CurrencyFair and Wise. If you are sending a few thousands dollars’ worth at a time then Revolut is probably fine. It’s the large amounts where you have a big problem if the transfer doesn’t go through. I think Wise is offering cards now. The alternative is to keep your emergency fund in a bank offshore and then transfer small amounts to Revolut when you want to go on holiday and use the debit card.

So which bank offshore would you recommend though?

Thanks

Hi Anna, for depositing your money, HSBC, Lloyds, Nedbank, Standard Bank and Standard Chartered all have offshore bank accounts in various currencies. Then Wise, CurrencyFair and Interactive Brokers are good for transfers and currency exchange. Revolut is great for holiday expenses, just not for storing large amounts of cash.

Hi Max. I am in a similar boat to you. Lived/worked in Thailand for nearly 20 years but a UK citizen. I want to keep some funds in a bank outside of Thailand, but I also want access to an ATM card. Revolut seems an option. How did you resolve your issue? Cheers