Who would benefit from this post? Share here:

Join my Financial Transformation Program (25% off)

After helping tens of thousands of expats to plan, save & invest their own money with confidence, I have created this program combining private coaching, online courses, group learning, accountability and community. It has everything you need to know, the flexibility to suit your experience and life schedule, plus the support to make sure you actually take action towards a great financial future.

This is a happy week for people living in the UAE, as IB now accepts AED! I’ll go through the various implications of this great development below…

[Unfortunately, people living in other GCC countries and places with ‘minor’ currencies won’t be able to benefit from this yet, carry on trying to find the best exchange rate you can to get your money into IB.]

People have been asking IB for a long time now to accept dirhams and now it has finally happened. This has three big implications for UAE residents:

1) Cheaper investing

2) Investing smaller amounts (if required)

3) Cheaper currency exchange and moving money around the world

Note it’s early days for this, so some of the details could change a bit over time but accepting AED should be here to stay.

Cheaper investing

In the bad old days (i.e. September 2022), you had to use your bank or an exchange house to convert AED into USD (or other currency) so you could send it over to IB. You’d get hit by an exchange rate spread (the difference between the rate you receive and the rate Google shows), maybe a transfer fee and for USD, a hefty correspondent banking fee of $20-30. Or you could use an alternative route like Revolut or CurrencyFair and face some unexpected surprises when your transfer didn’t go through quickly or at all.

No more. Now you can send AED straight to IB and then convert your AED at a great rate into USD and then on into another major currency:

Your AED bank account in UAE (or elsewhere) -> IB’s AED bank account in UK -> your IB broker account in AED -> your IB broker account in USD -> invest or transfer or convert to another currency.

The rate you get for USD is a fantastic 3.6731 (the pegged rate is 3.6725) plus a $2 fee. If you want to convert your AED into GBP or EUR etc. then you need to convert them into USD first and then onto the target currency. Despite knocking you back a whole $4, IB is still likely to be the cheapest place to convert your AED into any major currency.

You won’t be able to use your money to invest in any funds until you convert the AED to your fund’s currency (I almost always recommend USD, with a few exceptions).

The business case for using IB for your investing just got even better, as the total costs are so low:

Transfer fee: 0-150 AED (depends on UAE bank, see below)

- Correspondent bank fee: none

- FX spread AED/USD: 0.016% (that’s very good)

- Platform fee: none

- Minimum amount: none

- Inactivity fee: none

- Trade commission: from $2 to $5 per $10k (or less) invested

- Fund management fee: 0.2-0.25% per year for a global stock ETF (non-US domiciled)

Investing smaller amounts

Previously, it could cost you $50+ to send convert some AED to USD and send it over to IB. Now, depending on your UAE bank’s fees, it can cost from $2+.

I don’t recommend ever spending more than 1% of a transaction on fees. That previously meant you might have to wait to save up $5,000 and invest every quarter or so rather than every month. Now you can send over 100 AED a month if you want to, though I recommend you try to invest more if you can. The pendulum has swung perhaps too far the other way – it is so cheap to transfer and invest that the temptation is to send over less than you shoul

Get started with my free guide:

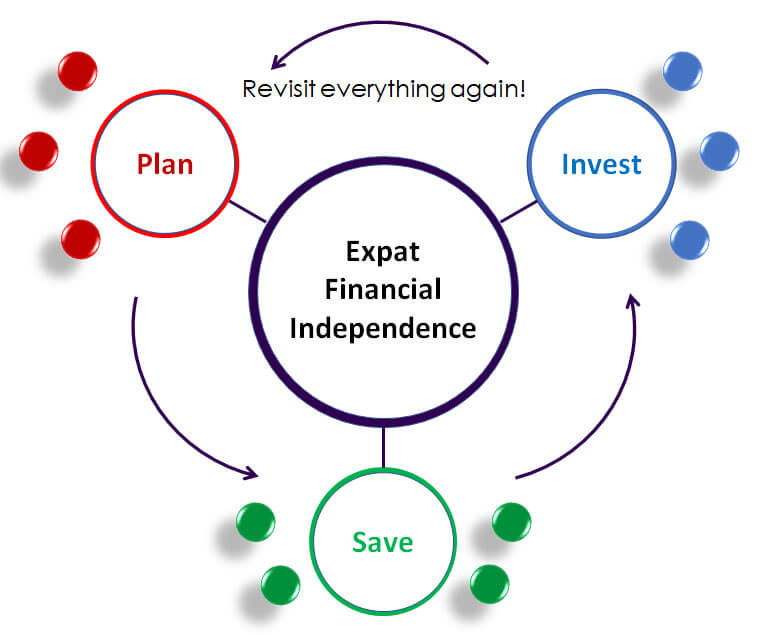

3 Steps to Expat Financial Independence

15-minute read. Discover the simple process for taking control of your finances so you never have to stress about money again.

Cheaper currency exchange

IB has always been the cheapest place to exchange money as you get a fantastic rate and very low fees. The problem was getting your AED over to IB cheaply, but that problem has now disappeared. If you want to convert your AED into any major currency* and then send it to your bank account in another country, IB is now clearly the best place to do it.

* That’s AUD, CAD, CHF, CNH, CZK, DKK, EUR, GBP, HKD, HUF, ILS, JPY, MXN, NZD, NOK, PLN, SEK, SGD, TRY, USD and ZAR.

However, you can only send money from IB to an account in your name (and you can also only send money to IB from an account in your name). So if you want to send money to someone else and you don’t have a bank account in that currency, IB is not the answer.

By the way, some people are getting confused by IB’s reporting currency and asking if they need to open an IB account in EUR, GBP, AED etc. That’s not how IB works. Your account will accept any of the above currencies and store that currency in its own little pocket for when you need it. But if you want to know what your total cash is across all currencies, you have to add it up in a single currency and that is your reporting currency (USD is usually a good idea).

If you are ever leaving the UAE to move to a country that has one of the currencies above, convert all your leftover dirhams from your gratuity: send them over to IB, convert them (via USD) into your currency of choice and send the money over to your account in your new home country. This will save you hundreds, possibly thousands, if you are converting large amounts.

How to send it

Here’s how to send your AED safely over to IB and back out again.

Note that not all UAE banks allow you to send AED outside of the UAE. ENBD and HSBC have been tested and dirhams have made it safely to IB in a working day or less from these banks. It’s a good reason to open a current or savings account with one of them. You don’t need to keep much in there – you can send money over from your other bank when you need to make a transfer to IB.

ENBD transfers seem to be free, though they have in the past hit people with a chargeback of around 25 AED months or years later for prior transactions. 25 AED is still a good price though.

HSBC charges around 150 AED, which is not particularly cheap, though it looks like they might not charge for transfers through their mobile app (which you can do once you have set up a new beneficiary using your laptop).

To make a transfer, log into IB and go to Transfer & Pay > Transfer Funds > Make a Deposit > Use a new deposit method. Scroll down to select United Arab Emirates Dirham (AED) from the dropdown list and then click Get Instructions. Type in your UAE bank’s name and the amount of AED you plan to send in, then click Get Wire Instructions.

This gives you the bank transfer instructions. The important info is the ‘Wire funds to’ address in the UK, the SWIFT code, the IBAN and the reference number. You can ignore the correspondent bank details. Make a note of the important numbers somewhere (I usually press Control+A to select the whole page and paste it into a Word doc to save for later) and then use them to set up the transfer from your bank. When setting up transfers from ENBD, you can search using the SWIFT code and then enter the IBAN later.

Do a test transaction first to test the pipes, with a maximum of 4000 AED (roughly $1k). I cannot emphasise enough the importance of testing before you send large amounts over. The banks are always changing their transfer pages, charges and permissions, so be careful with that first transfer and again if you haven’t made a transfer for a while.

Sending money in AED from your IB account to your UAE bank account is also possible, removing the need for a USD/EUR/GBP account with your UAE bank. You get one free transfer from IB per month (though really you should be investing for the long term and not need this!).

When the dirhams turn up in your IB account, you can convert them to USD using the Currency Converter.

Good news

So after a week/month/year of relentlessly bad news, here some good news! Cheap transfers and investing are here to stay. Tell everyone you know in the UAE (or send them this article).

Thanks

Steve

Questions? Comments? Add them below…

Join my Financial Transformation Program (25% off)

After helping tens of thousands of expats to plan, save & invest their own money with confidence, I have created this program combining private coaching, online courses, group learning, accountability and community. It has everything you need to know, the flexibility to suit your experience and life schedule, plus the support to make sure you actually take action towards a great financial future.

Who would benefit from this post? Share here:

Join Our Community

Get our articles first – practical and memorable advice on saving your money and avoiding financial pitfalls.

We won’t share your email with third parties and will never spam you.

Hi, thanks for the article Steve it was so helpful. Here is my experience perhaps someone will find it useful. I have used NCB, transferred 18,500 AED (Got 5036$), and paid fixed fees of 105 AED. Converted inside the IBKR for an excellent rate to USD.Got money within a day easy peasy. Also, you can try WISE as an option, as a test I sent 100 $, and I paid 3,5 $ fee, but the rate isn’t that good, so I didn’t want to try a bigger amount, but the fees might be different also. Cheers.

Hi Yaroslav, what’s NCB? Don’t know that one. Wise is great except for AED FX rates.

My apologies, I mean NBD

Hi Steve,

Thanks for the article.

Quick question before I open all the accounts (IB + HSBC) :

On IB, can I convert USD to AED and send the AED to my UAE bank account?

Regards,

patrick

Hi Patrick, yes you can. Note that HSBC is no longer allowing international AED transfers via their HSBC UAE app.

Hi Steve/All

Great blog… I tried this morning via the HSBC mobile app to transfer AED to IBKR via the UK route into their AED account. As you stated, the app usually allows you to select the currency (to select AED), but today it is greyed out to only allow GBP. has anyone else faced this issue or is it unique to me?

thank you in advance

Rob

Yes they have recently changed it. Apparently it still works using the HSBC Expat app or you can use the website portal on your laptop but that could cost up to 147 AED per transfer.

Wio have launched a personal bank. Does anyone if it can transfer to an overseas AED account and associated charges? Struggling to find information online!

Hi Chris, good question. I’m not sure, so I will leave it out here for the Wio users. As they are linked to FAB and FAB doesn’t allow international AED transfer, I suspect not…

So I decided to sign up and find out. Sign up process took 2 minutes. Info is as follows:

– can’t transfer to an overseas AED account

– can transfer to overseas USD account (and is transparent about rates and fees). The rate you get is 3.6750 and the total transfer fees are fixed at AED 63 (correspondent bank).

– I transferred to the IBKR USD account and the funds arrived and cleared in about 30 minutes

I’ve gone back to Wall Street Exhange.. one day funds transfer.. no need to visit branch anymore.. 157 aed.. seems like a no hassle and most transparent option now.

Hi Ryan, it’s great that you don’t have to go to the branch anymore. 157 AED is a problem if you are sending small amounts (vs ENBD 100 and less at Wio Bank), but for large amounts the exchange rate is more important.

Hello there, many thanks for the article!

quick question: apparently I can’t do this transaction from my ENBD app, I needed to visit a branch and they made me download the Telegraphic Transfer form, to fill in and submit at the branch.

Also, apparently the transfer cannot be set to be done on a monthly basis (example: transfer AED 10,000 every 1st day of the month) did any of you faced this challenge with ENBD?

Thanks

Hi Michele, yes ENBD have stopped allowing international AED transfers sadly – I need to update this article. It’s only HSBC now via their app.

HSBC have also stopped this to IB’s GBP account as of Sunday sep 16, 2023 🙁

Yes, very annoying!

Hello everyone

I used Mashreq to do AED fund transfer.

No online facility. Need to visit Branch.

Took 30 min to finish but it is bit confusing for staff to send AED (as they put wrong IBAN).

Next day again they called to get the right IBAN

However, after 3 days got funds credited at IBKR.

All for a fees of AED 6.30 Dhr

Hope above information assists anyone.

Thanks Gaurav, good to know that option exists. Nice and cheap! Sounds like it’s quite a lot of effort though, most people hate going to bank branches.

I transferred 50 AED from HSBC UAE mobile app to IB for testing in UAE Dirham. It works fine with 0 charges and transaction completed within one day.

It is the biggest achievement ever for UAE investors, EarlierIt cost around 40 USD for one transaction via exchange.

Fantastic! Yes it’s been a long time coming but it’s made life a lot easier now, as long as you can get your AED over to IB successfully.

Hi Jax,

I have been trying to do this but twice my payment has failed. I am using the Transfer Internationally option from the HSBC mobile app, then selected the Destination as UK, then selecting the HSBC Global Money Transfer option. Sender Currency and Payee Currency is defaulted to AED & GBP automatically.

Then I enter the IBAN provided by IBK in the Wire Instruction which automatically updates the Bank Name and Bank Address.

However, the payment has failed and when I checked with HSBC support, they said that the beneficiary account is invalid.

Please can you let me know if I am making some mistake in the above setup.

Hi Steve,

If I have USD currency bank account in dubai,can I just transfer USD from my currency bank account to IB directly ? Which bank is best for doing this as I haven’t opened one yet. I have some USDs in a brokerage (E-trade) account in the US so I want to move them to Dubai so i can use them in IB.

thanks

Hi Raza, most of the time you will have to pay around $25 to send USD across the world. You could try opening a US-based USD account with Wise or HSBC, then you can move your E-trade money without leaving the US.

Hi – does anyone know if ADCB or ADIB allow international AED transfers?

Hi Ali, it looks like they don’t. Possibly at the branch, you could ask them there.

Hello Steve – very interesting article. Do you know under which entity/subsidiary my IB account would be as an expat living in Dubai? In other words in which jurisdiction/regulator/laws would my IN account be? Many thanks.

Hi Mak, your account will be based in the US, though for estate tax purposes the domicile of your investments is more important (i.e. avoid US-domiciled ETFs as a non-US citizen).

Hi Steve, If I were to invest in SCHD etf, which is domiciled in the USA, what implications does it have for a U.K. citizen who is a expat living in the Middle East. Especially if and when I want to leave the Middle East what implications does it have?

Hi Kishore, I’m not sure why you would want a US dividend ETF instead of a global stock ETF. What if the US market does less well? What if dividend stocks don’t do well or stop paying dividends in a recession? Also you should avoid US-domiciled ETFs and get Irish-domiciled ETFs instead. If you have more than $60k, you are exposed to estate tax on death (up to 40%). On your dividends, you would pay 30% withholding tax. Then when you need to move back home, you should sell the ETF if you have made any gains, so you don’t have to pay capital gains tax in the UK.

Hi steve, like you said I realised that it was not worth while. The only ETF I have is VWRA.

Hi steve I have a similar problem/question. Me and my wife are joint account holders on interactive brokers. I am a British expat based in qatar. I have one ETF VWRA and I invest in about 5 or 6 individual stocks. In the unlikely event of one of the account holders demise, would it be considered that the other person inherits the equities? Would the surviving person have to pay death tax?

Yes the other person gets it if you have ‘joint tenancy with rights of survivorship’ selected when you first set up the account. If you have over $60k in USD or US-domiciled stocks/funds, then they may well have to pay the estate tax for non-resident ‘aliens’.

Hi Steve, as VWRA is an Ireland-domiciled ETF, even though my IBKR account is in US and the ETF is denominated in USD, wouldn’t I be relieved from paying US estate tax? Does the currency overrides the domicile of the ETF?

Hi Joao, the only factor that determines US estate tax on funds is domicile. If you use Irish-domiciled funds, you don’t have to worry about it.

As an FYI – Emirates NBD have stopped AED to AED transfers to international accounts. Is there a workaround that people are using?

Hi Matthew, still seems to work for me. It doesn’t when you update to the new app. The workaround is to get an HSBC account, can’t do anything else with ENBD it seems.

Hi Steve,

thanks a lot for sharing this! Great news!

To share my experience, I tried HSBC AED-AED from the web portal, and it was 147 AED. Then I tried it from the HSBC APP (on Android) and its completely free, but not sure if that is a permanent thing as it mentioned something about promotional fee is 0 AED. (Also, since a few months you can create a new payee via the app, no need to do it from the web portal anymore)

The conversion to USD in my IB account was also not straightforward for me, as the conversion tool didn’t work (was telling me that I’m missing the trading permission, but I don’t). I got in touch with IB and they explained that AED.USD pair is not supported by IB and that I have to BUY USD.AED instead to convert you Dirhams to Dollars. That could explain why the conversion tool is working if you enter USD amount instead of AED amount, will try that next time.

Dear Jo: Thanks for the useful advice. I have a couple of dumb questions. As an American, sending money to the US from Dubai, am I the beneficiary? Secondly, is the beneficiary bank Interactive brokers or is it the intermediary bank (Citibank)? Feel free to answer after Boxing day.

Hi John, the beneficiary is IB, the beneficiary’s bank is IB’s bank (usually JPM or Citi). IB is not a bank, so it needs a bank account somewhere.

Steve, how long does the conversion take before you see the $’s in your account?

Hi Orlagh, it should be instant. Sometimes the order is not executed to become a trade immediately, but then you should see that in the Orders & Trades page (under Trading). Otherwise the USD should appear in your cash immediately (see Portfolio > Cash Report).

Hi Steve, thanks for these instructions. Can you confirm/clarify the following? I’m using ENBD to do the international transfer to send AED to IB. On my ENBD screen top to bottom it shows the following:

1. Beneficiary name Intercative Brokers LLC

2. Remittance Country: UK

3. Beneficiary Country: USA

4. Bank Name: JP Morgan Chase National

5. Bank Address – 25 Bank Street, Canary Wharf London

6. Transaction Fee – the first option is automatically selected “please debit my account for your charges…”

I tested this method with 500AED and it arrived as AED in my IB account as AED. However, it was 80 AED down and 420 AED arrived at IB. Before I max up the amounts can you confirm the info above looks correct and shed any light on the 80AED fees? I have ENBD Priority Banking Account. Many thanks.

You have the entries right there. Strange, I wasn’t charged at all for the same thing. I think there is some variance across account types etc. You can ask ENBD what the charge is for? Are you sure you sent it in AED?

Hi Steve, on the fees part of the ENBD laptop version which of the 3 transaction fee options below do you select?

Transaction Fee

1. Please debit my account for your charges and correspondent banks charges

2. Please charge beneficiary for your charges and correspondent bank charges for the TT amount.

3. Please debit my account for your charges, Benf. will bear charges of your correspondent banks for the TT amount.

It was definitely 500 AED from ENBD and arrived in my IB AED account as 420. Full transfer request details used below:

Beneficiary details

Account type: IBAN Number

Beneficiary IBAN Number* GB77CHAS60924276921607

Beneficiary country* UNITED STATES OF AMERICA

Beneficiary Flat/Unit Number* One

Beneficiary Building Name Pickwick Plaze

Beneficiary Street/Area Name* Greenwich

Beneficiary City Name* Connecticut 06830

Email

Phone Number

SWIFT code* CHASGB2LXXX

Bank Name* JPMORGAN CHASE BANK NATIONAL ASSOCIATION

Find bank

Bank address* Canary Wharf 25 Bank Street LONDON UNITED KINGDOM

Transfer Code* Own Account Transfer

Details of Transfer*

Reference2*

I’d like to clarify as I have AED waiting to be invested but wary to send a larger amount when I’m not sure what the charge will be.

ENBD reply to my query below:

Hi Mr. S, my name is Foad, and thank you for writing to us. Please note for any transfer through online banking, Emirates NBD does not charge the customers. The amount which has been charged is the correspondent bank charge which you have selected to be debited from transfer amount while submitting the transfer. Correspondent bank charge means, the charge taken by the correspondent bank for processing of the transfer and crediting it to the beneficiary. The correspondent bank charges are dependent on the amount, the banks involved and the geographical locations through which the payment is routed. However, you can view the applicable Correspondent Bank Charge for International Transfer via the following steps in Online Banking: – Go to Pay & Transfer – Choose Transfer – Select International transfer – You will find the good to know info which also includes a link to the Correspondent Bank Charges. For any other questions, feel free to visit our FAQs https://www.emiratesnbd.com/en/customer-care/faqs. Thank you.

Hi Steven, I would go for number 1. I don’t think it makes a huge difference though – the charge hits you one way or another. It should be a fixed fee, so it doesn’t matter if you send larger amounts.

Happy to hear that Interactive Brokers is now in UAE as well and accepts UAE Dirham at the market rates.

This will give the expats residing in UAE (i.e. more than 80% of the population) a great option to invest.

Currently, people in UAE invest mainly in Real Estate but with IB accepting UAE Dirham, investors will now have another great option

Hi Steven

Did you manage to get to the bottom of this? I’ve had a similar issue using a regular ENBD account, but ENBD say it isn’t them who have made the charge, whilst the IKBR website says it shouldn’t be them either.

Thanks

Beth

It’s a fixed correspondent bank charge, neither IB nor ENBD – usually an intermediary like FAB.

I didn’t get a clear answer. As Steve says it seems to be a correspondent bank charge which I assume may be JP Morgan in the UK as they route the money to IBK? Steve suggests it’s fixed fee so in theory 80AED regardless of amount? If anyone has tested this theory I’d love to know as I’m not comfortable sending large amounts if its a % charge and you have no clear way of working out what it is or who from? Quite frustrating. Thanks.

Hi Steve thanks so much for this update. I’ve successfully transferred a test amount to IB via Revolut. IB platform won’t let me exchange to USD unless I upgrade account to ‘margin’- can you advise ? thanks so much

Jo, try entering an amount in the USD row (to convert to) rather than the AED row (to convert from) when converting the currency. Silly difference but it works!

Hi Steve,

Are you sure regarding ENBD and transferring Dirhams outside of the UAE.

I went through the process you mentioned using ENBD’s online portal (the new updated one).

You type in the IBAN, it recognizes it’s the UK. The next step only allows you to transfer GBP, EUR, and USD. No option to select AED.

Let me know if this is confirmed again because it doesn’t show on my end – or at least to have clarity for others who follow this post and face a similar situation as mine

.

Thanks

Joe

Lots of people have done it without problems but the new app has removed AED-AED transfers. Perhaps the new portal also (though it works ok for me). Try also to choose the beneficiary country and enter the SWIFT code before you put the IBAN in, may help.

Hey Steve, thanks for all these guides throughout the years. I’m in a position to get started in the near future, although I’ve seen these reports of ENBD slowly removing international AED transfer options. Has anything changed since November? While I don’t mind using the web portal as opposed to the app, going through a whole song and dance with an exchange house sounds like a whole logistical mess (more points of failure etc). Also don’t fancy opening an account with another bank to make things like this easier.

Also, thoughts on benefiting from IBKR’s cash interest rates for savings? They’re higher than what I can find here, but might be harder to quickly access in case of emergency.

People who upgraded to the new ENBD app seem to have lost international AED transfer capabilities. If you are on the old app you should be ok. Otherwise open an HSBC account and use the mobile app for transfers – you don’t have to move your salary or anything so it’s not a big hassle really.

IBKR’s cash rates are good, though I wouldn’t keep more than $60k in there due to estate tax issues. I also wouldn’t keep large amounts of non-USD currency in there, as they may not be fully covered in the (unlikely) event of IB collapsing.

Hi,,

I have the issue.. I am using FAB (First abu dhabi bank).. I entered all bank details as in the wire instruction. But when it ask me the currency of the account there is no AED. While it shows other GCC country currencies (Saudi Arabia, Bahrain and Kuwait).

I don’t know how we should tackle this issue.

Hi Asem, I don’t think FAB allows international AED transfers. You could ask them or try at the branch directly.

Hello,

I have the same issue here.

Did you find a solution?