Who would benefit from this post? Share here:

Join my Financial Transformation Program (25% off)

After helping tens of thousands of expats to plan, save & invest their own money with confidence, I have created this program combining private coaching, online courses, group learning, accountability and community. It has everything you need to know, the flexibility to suit your experience and life schedule, plus the support to make sure you actually take action towards a great financial future.

The sudden loss of a person/relationship/job/investment that’s been a constant in your life can leave you feeling untethered and vulnerable. How can you anchor yourself and those around you in advance?

Most British people were scrabbling around on the floor after their eyes popped out on reading of the Queen’s sad and sudden death this week. She was meeting Prime Minister Boris Johnson on Tuesday and then King Charles III was meeting Prime Minister Liz Truss on Friday.

Like most countries, the UK seems to lurch from one crisis to the next. The Queen was a background constant in our lives. As we plunged out of Europe, Scotland threatened to leave the Union and we rotated through Prime Ministers – the Queen, for 70 years, was still there.

Until she wasn’t. Suddenly the future is current reality. Everything seems a bit disjointed and uncertain. How is this going to play out? You start to understand, just a little bit, those medieval (or dragon) kings and their obsession with the stability of the realm and their succession.

What’s the plan

To minimise vulnerability at the national level and flailing about at the individual level, there is a clear plan. The heir becomes sovereign immediately on death.

A general process for the death of monarchs and a specific process for the death of this monarch whirs into action. It has been polished and rehearsed. There are clear steps showing everyone involved what to do.

Newspapers and tv channels pumped out obituaries and nostalgic programmes immediately. How? They had all been written in advance. Boris complained that the BBC had approached him asking for a tv interview talking about the Queen in the past tense. (Do the same with your friends & children haha.)

As courtiers, ministers and journalists felt shocked and sad, they dug out the protocol manual, dusted off the pre-prepared information and followed the tramlines that had already been laid down.

Get started with my free guide:

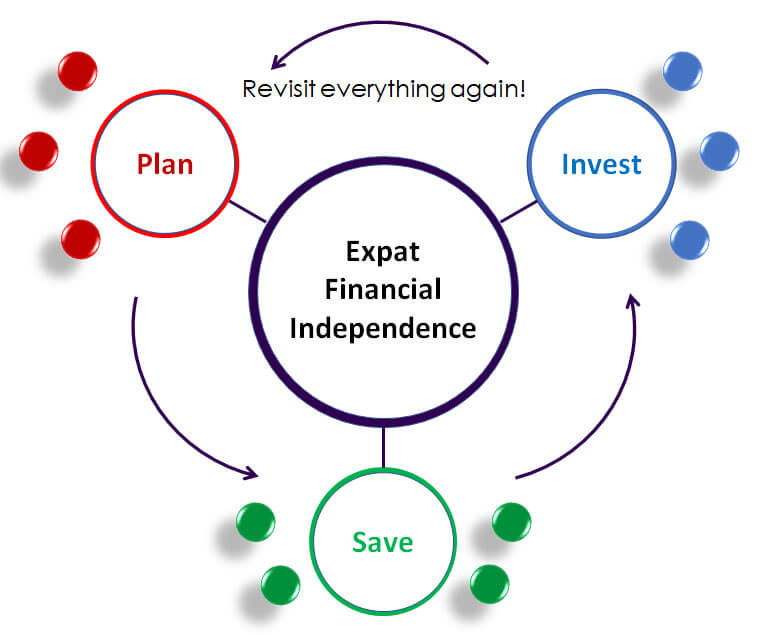

3 Steps to Expat Financial Independence

15-minute read. Discover the simple process for taking control of your finances so you never have to stress about money again.

Where are your tramlines?

Death, job loss, evacuation, market crashes: think about them, discuss them, write down guidelines and share them with those who need to know.

Death/illness of a parent, sibling, spouse, yourself:

– legal (will)

– financial (bills, insurance, provision for others, tax)

– practical (which hospital, body, funeral, bank & investment accounts, passwords, home, dependants)

– responsibilities (who will take over anything they do)

– mental (lead yourself/others through this)

Some people compile a ‘death book’ (don’t love the name) with everything people need to continue on after you.

Job loss:

– Financial plan for carrying on without salary

– Cash buffer (6 months’ expenses)

– List of critical vs reducible expenses

– List of other companies or alternative careers

– Network of useful contacts and visibility in your industry beyond your employer

– Mental support plan to get you through this

– Plan for moving country fast, what would be problematic?

Market crashes (let’s say 50%) or bank runs

– Mental plan (how will you/others feel, how can you avoid panic)

– Financial plan (how finances would be affected, if at all, what to change or not change)

– Network plan (where to get or give support)

– Practical plan (passwords ready, knowing how to sell or move assets immediately)

The steps you need to take are usually obvious when you are clear-headed and think about them. So think about them, when you are clear-headed (i.e. now), not when a crisis hits. Your personal realm depends on it.

Thanks

Steve

Any questions or comments? Share them below.

Join my Financial Transformation Program (25% off)

After helping tens of thousands of expats to plan, save & invest their own money with confidence, I have created this program combining private coaching, online courses, group learning, accountability and community. It has everything you need to know, the flexibility to suit your experience and life schedule, plus the support to make sure you actually take action towards a great financial future.

Who would benefit from this post? Share here:

Join Our Community

Get our articles first – practical and memorable advice on saving your money and avoiding financial pitfalls.

We won’t share your email with third parties and will never spam you.