Who would benefit from this post? Share here:

Join my Financial Transformation Program (25% off)

After helping tens of thousands of expats to plan, save & invest their own money with confidence, I have created this program combining private coaching, online courses, group learning, accountability and community. It has everything you need to know, the flexibility to suit your experience and life schedule, plus the support to make sure you actually take action towards a great financial future.

If the fixed period on your mortgage will expire in the next 1-2 years, or you are considering a new loan, act now or face a big increase! I’ve written this for you.

When your fixed rate ends

Fixed-rate loans are great when interest rates are going up. Your less savvy pals who built their financial house on the sand of variable rates are already squirming, while you can look on smugly.

Except that fixed rates come to an end, sometimes after a year, sometimes after 40 years (not sure I recommend those ones).

When the fixed-rate period on your loan ends, you get dumped onto the bank’s ‘Standard Variable Rate’, which loosely translates as a terrible rate to punish people who don’t pay attention.

It is determined by a variable rate (EIBOR 3-month rate in UAE, bank base rate in UK, federal funds rate in US) plus a fat margin that the bank slaps on, say 2%. Just as banks are secretly hoping you don’t pay off your credit card balance in full each month, they will make most of their mortgage profits from people moved onto this rate who don’t do anything about it.

A nasty surprise waiting for you

Let’s say you took out a mortgage in September 2020 and the EIBOR rate was 0.33%. That’s nice and low. Maybe you got a variable-rate mortgage for 1.5%, as the bank added on a margin. Or you got a 2-year fixed-rate mortgage for 2%, with the bank adding on a slightly bigger margin – still worth it if you think rates will go up. These principles work in any country (and read profit rate for interest rate when dealing with Islamic mortgages).

By the end of August 2022, the EIBOR 3-month rate is 3.2%. That’s almost 10 times higher! Those on a variable-rate mortgage are now paying interest at 4.4% (3.2% plus margin). But rates have been going up over the past 2 years, so they have had time to adjust their lifestyle or move to a fixed rate.

Those on a fixed-rate mortgage are paying… 2%. Until September 2022 when BLAM! Suddenly the fixed-rate period ends and they’re paying at least 4.9% – maybe more if the bank increases its margin after the end of the fixed period (always check the small print!).

Unlike the variable-raters, you fixed-raters haven’t had to adjust your lifestyle, and so you can get hit by a big increase in loan repayments that you may not find easily affordable. You can try to find another fixed-rate deal to ease the pain, but the rates won’t be that much lower than the variable rate you now find yourself on. Plus, every month you delay, central bank rates and mortgage rates are increasing…

Get started with my free guide:

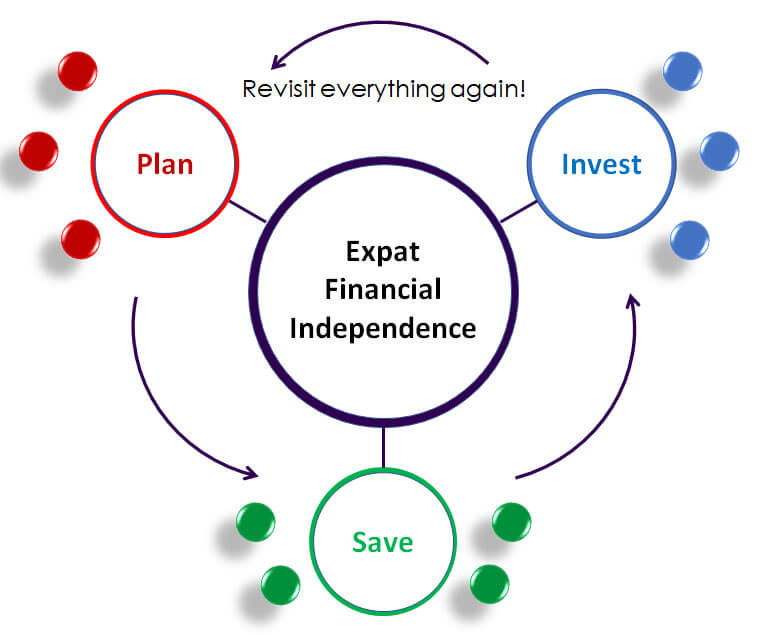

3 Steps to Expat Financial Independence

15-minute read. Discover the simple process for taking control of your finances so you never have to stress about money again.

The damage

What’s the actual damage to your wallet here? I recommend you play around with a loan calculator to see the impact. I like this one where you can see how a change impacts your monthly repayments [note the Change box requires the change not the new rate, e.g. enter 0.5% if the rate goes from 3% to 3.5%].

It also matters whether your loan is repayment or interest-only (IO). IO mortgages are great if you have an offset mortgage (I love them! More on these another day) or if you’d rather put your money towards other investments instead of building up a greater position in your property.

IO loan payments are very exposed to interest rate moves though, in a very simple way. If you have a loan of $100,000 and an interest rate of 2%, your monthly loan payment (which of course is only interest with no balance repayment) will be $167. Doesn’t matter if the loan is for 4 years or 30 years.

If you come to the end of your fixed-rate period and your interest rate jumps up to 4%, you monthly repayment will also double, to $333. Ouch.

Repayment loans are much less sensitive to interest rate changes, because a chunk of your monthly payment goes to paying off your loan balance, diluting the interest portion. Shorter repayment loans are less sensitive than longer ones, as you are paying off more balance per month.

If you have a 30-year loan of $100,000 at 2%, you will be paying $367 a month. If the rate jumps to 4% after 2 years, you will pay $477, an increase of 29%.

If you have a 4-year loan of $100,000 at 2% (or 4 years left on a 30-year loan with $100,000 remaining), you will be paying $2,170 a month. If the rate jumps to 4%, you will pay $2,258, an increase of only 4%!

As most people are on repayment mortgages, interest rate rises may not affect you as badly as you expected… unless you are already stretched. If you can barely afford your current monthly payment, then a rate rise could tip you into default.

Who’s in the danger zone?

If your fixed-rate period is ending in 0-18 months, I think you could suffer a nasty rate increase. Those with longer fixes already could be ok.

Given inflation is not coming down on its own, interest rates are likely to keep going up fast this year as central banks try to force inflation down, even if it means creating a recession.

Mortgage rates tend to jump every time a new increase in the bank rate is announced (with most GCC currency rates driven by the US rate). The key dates in 2022 are:

– September: 7th EU, 15th UK, 21st US

– October: 26th EU

– November: 2nd US, 3rd UK,

– December: 14th EU & US, 15th UK

USD rate increases could be particularly aggressive (0.5-0.75% each time maybe), with expectations that raises could calm down (0.25%) but still happen in 2023.

I don’t have a crystal ball but current market predictions are hoping rates will edge back down after 2-3 years as inflation eases. But if the era of cheap money and low inflation is over, don’t expect rates to go fully back down to where they were.

It’s hard to know whether a 2-year fix is enough or if only a 5-year fix will get you through the looming period of high interest rates. A 2-year or 3-year fix will likely get you over the ‘hump’, while a 5-year fix will give you certainty for planning and reduce the chance of another shock in a few years’ time.

So if you want get a new fixed rate, get talking to your bank or a mortgage broker now!

How to lock in a new rate

You’ll have to weigh up the benefits of a new fix against a possible early repayment penalty and new arrangement fee. Ask your bank or broker how much total interest you will pay over the next year or two with and without a new fix, then you can weigh the difference against what the new fix will cost you in fees. It’s almost always worth it.

Sometimes banks will let you lock in a rate now to start at the end of your fixed period. Also some banks will let you lock the rate on the day you apply, others only on the day they get round to accepting the new or revised loan – do check this!

Finally, beware banks advertising loans using flat rates, which makes it very difficult to compare loans of different lengths, any rate changes over time or the benefits of paying off the loan faster vs investing. Get them to convert the rate to a ‘reducing rate’, or use a flat rate to reducing rate calculator from the web.

Push your bank or broker to show you options and if you’re not comfortable with numbers, get them to show you the cost of moving to a new fix vs the benefits of avoiding higher interest rates. Try a bit of haggling to get a better rate or a fee reduction – your current bank will want to keep your mortgage business after all.

Just don’t put this off or hide your head in the sand.

Thanks

Steve

Any questions or comments? Share them below.

Join my Financial Transformation Program (25% off)

After helping tens of thousands of expats to plan, save & invest their own money with confidence, I have created this program combining private coaching, online courses, group learning, accountability and community. It has everything you need to know, the flexibility to suit your experience and life schedule, plus the support to make sure you actually take action towards a great financial future.

Who would benefit from this post? Share here:

Join Our Community

Get our articles first – practical and memorable advice on saving your money and avoiding financial pitfalls.

We won’t share your email with third parties and will never spam you.

Hi Steve

Thanks for this post – very relevant for our times. I took out my first mortgage ever off-plan ( a friend did the same). It had been variable since day 1 with 3-month EIBOR. We’re definitely feeling the increase but not sure how to move forward from here. Should we try to sell off the apartment to avoid being locked into this mortgage (it was our first experience and now we have the learnings esp post COVID about the importance of location etc…). Or do we negotiate rates with the bank? But would we be negotiating the base rate of the bank (because the EIBOR is what it is)? And why would the bank reduce their rate – assuming rates are higher now, i would assume the rate provided wouldve been lower 3 years ago. Would other banks provide a competing rate during these times – is that even possible, to move the mortgage from one bank to another, and why would another bank provide a lower rate given interest rates are going up? Sorry for what may seem dumb beginner questions but not really sure where to go from here..

Hi Joe, there are a couple of questions here. Do you like the flat? If not, you can try to sell it while prices are decent. Then you can see if you can move to a fixed-rate mortgage if you are worried about interest rates going higher (which they probably will in the next 6-12 months, but I don’t have a crystal ball). Either your bank or another bank might do a fixed-rate mortgage for you. You may have to pay to exit your existing mortgage. If you keep a variable mortgage, they tend to do EIBOR + a margin, and these margins vary from bank to bank. I think changing interest rates would have more impact though. If a 3% increase in interest rate would ruin your finances then you had better act fast… Cheers, Steve