Who would benefit from this post? Share here:

Join my Financial Transformation Program (25% off)

After helping tens of thousands of expats to plan, save & invest their own money with confidence, I have created this program combining private coaching, online courses, group learning, accountability and community. It has everything you need to know, the flexibility to suit your experience and life schedule, plus the support to make sure you actually take action towards a great financial future.

Is there any silver lining when it comes to inflation? For some people, maybe there is. Let’s have a look at who will benefit and who will get squeezed…

We have been trained to think of inflation as unremittingly awful. It’s suddenly hit 7.1% in the UAE after several months of seeming immune. It reminds me of the region ‘decoupling’ from the financial crisis for a few months in 2008…

Meanwhile, Citibank is forecasting the UK could hit 18% inflation next year due to rising energy bills. Ouch.

It’s worth a quick reminder of what this means. You take the prices of various household products and services a year ago: a bottle of milk, a pair of trainers, a second-hand car, electricity bills. How much more expensive are they now? That percentage difference is inflation.

Hitting 7.1% in July is in comparison to July 2021, not June 2022 – fortunately.

So if someone gave you $1000 to buy things with in July 2021, the equivalent would be someone giving you $933.71 today to buy the same things, as they’ve all become more expensive. If you had kept that $1000 tucked away in your current account for a year, you can see how inflation erodes your buying power.

It’s not all bad news though.

Good for: skilled workers

If you are talented, then the increase in the cost of living gives you an excuse (if you needed one) to ask for a pay rise. If your employer refuses, there is probably another decent job out there for you.

One way high inflation rates become entrenched over time is from big pay rises boosting demand for goods and services, which increase in cost, leading to a demand for pay rises and continued expectations of high inflation.

People’s expectations of future inflation seem to be a big driver of actual inflation, which is why central banks are so keen to show they’re getting inflation under control.

So your pay rise isn’t going to help the world recover from inflation, but if you feel you are underpaid and undervalued, now is the time to do something about it.

Good for: people with mortgages

Let’s say you buy a flat for $200,000 with a mortgage for $100,000, with inflation at 5% per year. Property prices generally keep up with inflation over time, unless super-high inflation crashes the economy (which could still happen).

So if your other assets and your salary keep up with inflation, your mortgage has become smaller relative to them. If your mortgage was 4x your salary of $25,000, now it’s 3.8x your salary of $26,250, and that’s without even paying any of the balance off.

This may not play out over a year, especially if you don’t get that pay rise, but you can see how it works over several years or the entire length of your mortgage.

The people who will benefit most are those with a fixed-rate, interest-only loan. Being interest-only, the full balance will remain for many years to be eroded by inflation (though having to pay interest on the full balance all those years counters this).

A fixed-rate loan will protect you from interest rate rises, which usually follow an uncomfortable increase in inflation. By making it more expensive to borrow money, and more enticing to save money rather than spend it, the central bank increases interest rates hoping to bring inflation back down.

If you have a variable (or floating) rate loan, or your fixed-rate period is ending soon, please please rush to get a new fixed rate before they go up even further.

Good for: landlords

Inflation is pushing up the value of your property, eroding your mortgage and… you can increase the rent in line with inflation. You don’t have to, of course, but inflation and the general increases in rent all around you make it reasonable to do so.

Many landlords seem to be completely unreasonable and are making up excuses to kick tenants out so they can jack up the rent, but that’s another story.

Bad for: renters

You don’t have a property that can increase in value, and that increase will make it more expensive to get one. Meanwhile your rent is going up.

BUT that doesn’t mean you should rush to buy a property right now. There is nothing wrong with renting if you’re not ready to make a 7-10 year commitment. High inflation can also cause recessions and property crashes when high interest rates stop people wanting to buy.

Get started with my free guide:

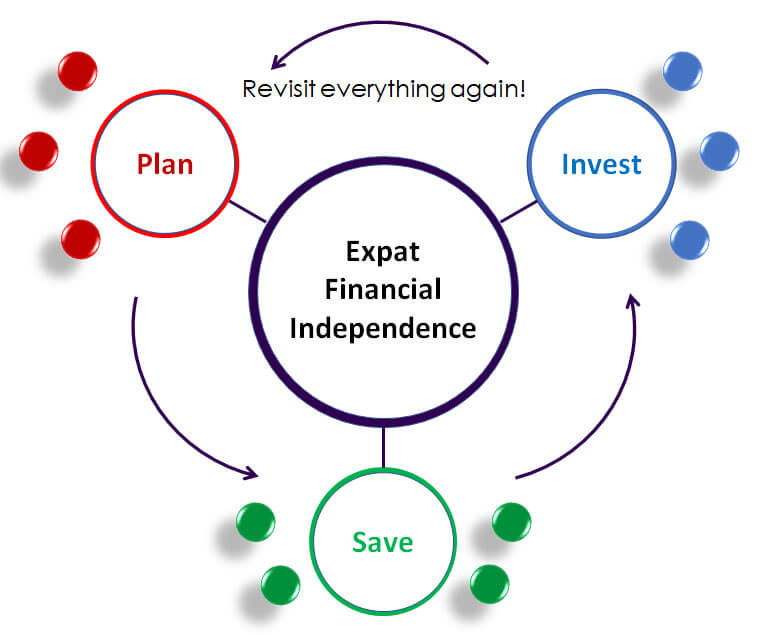

3 Steps to Expat Financial Independence

15-minute read. Discover the simple process for taking control of your finances so you never have to stress about money again.

Good for: energy stocks and bank stocks

The price of energy tends to increase during periods of high inflation (and this time energy costs are the main culprit). If you work for an energy company or are invested in them, large bonuses and stock price increases are heading your way.

Same for banks, which find it easier to make money when inflation causes interest rates increase. They can put up interest rates on loans (income for them) immediately and aggressively, while increasing rates on deposits (a cost for them) slowly.

Now, you know I don’t recommend buying individual stocks but your nice globally-diversified passive index fund will include energy and bank stocks, so you benefit.

Bad for: green investors

If you have a fund like the Vanguard ESG Global All-Cap UCITS ETF (V3AA) then it doesn’t have any energy stocks and you are going to underperform the standard global all-cap index that does have them. But that’s the choice you make with such funds, and at least you are investing in line with your beliefs.

When inflation, interest rates and energy prices go back down, you’ll probably outperform the standard index again, so don’t worry.

Bad for: growth stocks e.g. tech

In 2020 and 2021, you could make loads of money by investing in tech stocks. Many of my private clients worked in tech and invested in tech and I felt I had to warn them about future years when tech might not do so well.

I didn’t expect that to happen so soon, but it has. Growth stocks are made attractive by their companies’ huge future earning potential, rather than their ability or willingness to pay fat dividends now.

Just as your future mortgage balance gets eroded by inflation, so does the future earnings of growth stock companies. A billion dollars in 10 years’ time suddenly isn’t all that big a deal. Inflation and higher interest rates hammer growth stocks, which is why we’ve been seeing all your favourite tech stocks taking a beating.

Bad for: bonds

It never feels like a good time to buy bonds. As a bond is a promise to pay back your money in the future, high inflation and high interest rates reduce the bond’s value, in the same way they erode growth stock future earnings and your mortgage balance.

So inflation is bad for bonds and that’s why both stocks and bonds have been drifting downwards. Inflation-linked bonds can protect against this but then they suffer when inflation returns back down to earth.

Could bond fund values fall even further? Yes, for sure. But right now they are cheaper than they have been for years. If you want them to protect you from market crashes when you’re retired, now might be a good time to load up on them cheaply.

What next

There are ways to navigate any situation the global economy finds itself in. All you need is some talent that can earn you money, emergency cash, not too much debt and a willingness to invest (in yourself and in the markets).

These interesting times aren’t about to get any less interesting soon. Have a plan for what to do if inflation and interest rates go higher. And have a plan for what to do if they go lower. Now that’s something fun for you to ponder over the weekend.

Thanks

Steve

Any questions or comments? Share them below.

Join my Financial Transformation Program (25% off)

After helping tens of thousands of expats to plan, save & invest their own money with confidence, I have created this program combining private coaching, online courses, group learning, accountability and community. It has everything you need to know, the flexibility to suit your experience and life schedule, plus the support to make sure you actually take action towards a great financial future.

Who would benefit from this post? Share here:

Join Our Community

Get our articles first – practical and memorable advice on saving your money and avoiding financial pitfalls.

We won’t share your email with third parties and will never spam you.