Who would benefit from this post? Share here:

Join my Financial Transformation Program (25% off)

After helping tens of thousands of expats to plan, save & invest their own money with confidence, I have created this program combining private coaching, online courses, group learning, accountability and community. It has everything you need to know, the flexibility to suit your experience and life schedule, plus the support to make sure you actually take action towards a great financial future.

For once, I’m going to go easy on you. You don’t even need a plan – written down, signed, witnessed, tucked away in the safe.

You just need to know what a plan would look like, so if things get bad, you can pull one together fast. If you’re the sort of person who likes to plan, great. If not, make sure you don’t have a big knowledge gap that you would struggle to fill at the same time as trying to stay afloat.

I do not have a crystal ball but there could be challenging financial times ahead in the next 18 months. How should you adjust your planning, saving & investing?

Mindset

Sit somewhere quietly and think… how are you going to cope with the world going through tough financial times? Where are you weak and strong mentally? Where are you weak and strong financially? Do you need to change anything about yourself or your finances before the wave hits? Have a chat about all this with someone close to you.

Numbers

What’s your net worth (assets minus liabilities)? What are your liquid assets (that you could turn into cash in a week)? Is your cashflow in and out particularly lumpy and vulnerable to a shock? What’s your monthly savings rate (% income left after expenses)?

If you lost 50-100% of your income for 6 months, what would happen to these? Many people had to go there in 2020 and sadly we could end up back there again – could, not will. Don’t panic but now’s the time to plan.

Goals

How would a recession impact your future? If you’re about to retire, move country, change job or extend yourself hugely with a big house purchase, the impact could be large.

But if you have a relatively secure job and resilient finances, the impact might be pretty small. If you’re 30 and the recession delays your financial independence by a year or two, it’s not a huge deal.

Income

What would you actually do if your income dropped by 50-100%? Create a plan now, when you’re feeling ok, so that it’s there for you should you ever need it.

Is your whole family income vulnerable or just yours? Think through the practical steps you would take, where to get other sources of income quickly, which expenses to chop and which not, what to sell, where to go, who to ask for help. Can you make your loan payments and rent?

Get started with my free guide:

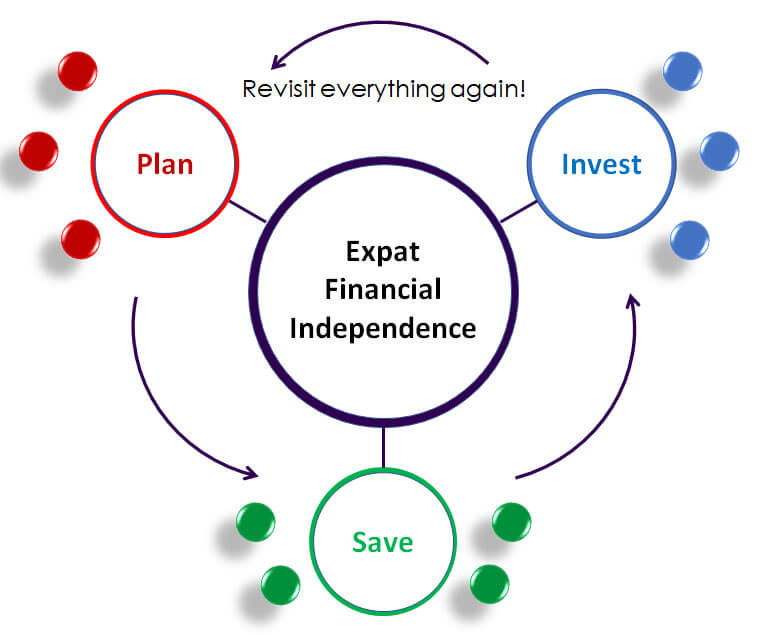

3 Steps to Expat Financial Independence

15-minute read. Discover the simple process for taking control of your finances so you never have to stress about money again.

Expenses

Now is the time to practice a bit of frugality. Just test the brakes – do they work? If you are living far beyond your means, you won’t be able to come to a sudden stop.

Inflation is affecting different types of products & services very differently – gas, food, clothes, flights, car rental, electronics. Be aware of what is increasing the most and see what you can do to stop your bills in that area increasing mindlessly at the same rate.

Some gentle expense-tracking, budgeting, saying no to things and to people – start building these muscles as you are going to need them.

Don’t be the person that spends more than their monthly income.

Debt

Being on The National’s Debt Panel, I see this a lot. People get up to their neck in debt and then lose their income.

Look at 2 scenarios:

– Could you make all loan payments for 6+ months if your income halved (or worse)?What if you have a tenant that can’t pay rent – could you cover your buy-to-let mortgage payment?

– Could you make loan payments if the interest rate increased 50-100%? It’s happening right now… do you even know if your loan has a fixed or floating rate?

Are you paying off your credit card balance in full every month? If not, FIX THIS NOW. Do whatever it takes. In a few months, the financial world could be tougher and your debt will have grown larger.

How close is your loan balance to the value of your house or car? If it’s within 20%, you might want to pay some extra balance off. Having a loan value greater than the value of the asset makes you vulnerable to the bank deciding it’s a problem.

Cash

Do you have 6 months of total expenses sitting in bank accounts, accessible within a week? This is really what will get you through a recession without blinking, even if you lose your job.

Do you have too much faith in one bank? What if your main bank failed or blocked withdrawals? You don’t have to go too far to find someone with that experience.

Yes, you probably should keep some money offshore, maybe 50%+ of your cash.

Investments

Are you investing in risky stuff? It went up in 2020? We’ve seen things explode this year – Netflix, Luna/Terra etc.

It’s time to admit that you are not an investing genius who can pick stocks and time the market. If you got lucky, now’s the time to cash in and move to some more sensibly stuff (like a globally-diversified index fund).

Crypto (outside the top 2), NFTs, peer-to-peer lending, crowd-sourced projects or real estate, individual stocks (including the company you work for), one sector or one country funds…all this can crash fast and may never recover. I wouldn’t waste more than 10% of my investment portfolio on this sort of thing. You can thank me later.

Remember, a recession is a great time to invest. You can buy shares in a stock fund cheaply and hold it for decades. Practice thinking through what you are going to buy, how much, when (hint – on a regular basis) and how you will calm yourself when the markets inevitably crash.

Bonds? That discussion is probably for another time. There’s always an excuse not to buy bonds but… they are cheap right now, so if you buy a bond fund with the expectation that it may not do much for the next couple of years, it will sit in your portfolio for many years and support your fantastic retirement.

In summary

You will find tough economic times much easier to cope with if you know how to get through them. Do a bit of learning and thinking now, then you will be much less stressed when times do get tough.

Everyone in the world of Financial Independence is rooting for you to do well and help you get through it all when you stumble or panic. You’re not alone.

Got any questions or comments? Add them below…

Join my Financial Transformation Program (25% off)

After helping tens of thousands of expats to plan, save & invest their own money with confidence, I have created this program combining private coaching, online courses, group learning, accountability and community. It has everything you need to know, the flexibility to suit your experience and life schedule, plus the support to make sure you actually take action towards a great financial future.

Who would benefit from this post? Share here:

Join Our Community

Get our articles first – practical and memorable advice on saving your money and avoiding financial pitfalls.

We won’t share your email with third parties and will never spam you.