Who would benefit from this post? Share here:

Join my Financial Transformation Program (25% off)

After helping tens of thousands of expats to plan, save & invest their own money with confidence, I have created this program combining private coaching, online courses, group learning, accountability and community. It has everything you need to know, the flexibility to suit your experience and life schedule, plus the support to make sure you actually take action towards a great financial future.

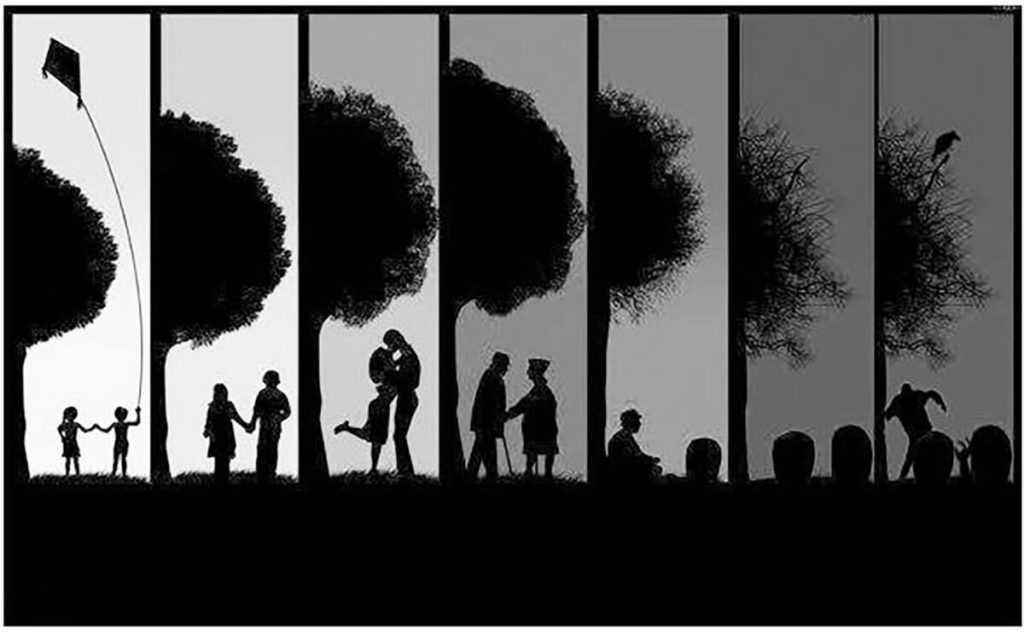

I believe there are 7 phases of expat life. Sadly most people skip the real money-making stage and go straight back to being an ex-expat. Don’t be like them! Being an expat in a low-tax country is an incredible opportunity. You can earn and invest virtually tax-free. Of course, you’ll pay tax in other ways like mindless bureaucracy, but that’s a different story.

Too many people waste this opportunity by spending too much money and not building up an investment portfolio for their future. Then they don’t have much to show for themselves and their future looks uncertain. If this is you, then we need to talk! It’s never too late to fix the situation… while you’re still an expat.

Here are the seven phases of expat life:

– Ignition

– Arrival

– Honeymoon

– Social Maturity

– Financial Maturity

– Departure

– Nostalgia

If you stay stuck in the Honeymoon phase and then get dumped back to your home country, you won’t have much to show for yourself apart from a sore liver and some good stories.

I want to make sure that you move into the Financial Maturity stage and emerge with little debt, a fabulous investment portfolio and confidence about your future.

Let’s have a look at how to move through each phase successfully, so you can make the most of your expat life.

1. Ignition

Some people are born an expat but many of us actually have to do something to become an expat. This immediately sets you apart from all the people back home who never really did or changed anything. You created this initial spark of action and you lit the fire. Don’t let it fizzle out and don’t let it consume you.

If you think you will be returning to your home country one day, it’s worth a bit of long-term planning to make the most of your allowances and do things that are hard to do as an expat. For example in the UK, that would involve:

– Maxing out your ISA (tax-free savings account) allowance for the year

– Moving any (useless) cash ISA into stocks & shares ISAs

– Setting up Junior ISAs for your kids

– Setting up a small little SIPP (pension) if you have never had one, so that on your triumphant return from being an expat you can bosh up to £160k back into the UK pension system

Make sure you have a cash buffer (ideally 6 months’ total expenses) and a moving fund that is going to cover moving country and getting settled down. In places like the UAE, opening a bank account doesn’t always happen that quickly, so you will need money to survive on.

2. Arrival

A wall of admin is going to hit you like the hot air when you step out of the airport terminal. Accommodation, phone, utilities, bank account. Make the most of any support your new company (if employed!) offers. Get organised. Try to start two banking relationships, so you are not over-reliant on one bank.

Ask other expats for tips and pitfalls to avoid, immediately. Scammy advisors seem to know when people arrive in the country and will want to sign you up for a savings plan in your first week. Get street smart fast.

It may take up to a year before you make any genuine friends rather than colleagues and acquaintances. You will probably be working hard from day one – don’t let it stop you trying new things. Get out and about. Be a bit shameless reaching out to colleagues and friends of friends, so you are not sitting there alone.

If you came out as a couple, pay attention if one of you is feeling adrift. The ‘trailing spouse’ doesn’t have the instant social network and distraction that work provides.

Remember your values, because you’re about to get very distracted…

3. Honeymoon

This place is fun! You’re earning lots of money, tax free! You have some friends and this place finally feels like home! There are lots of impressive and successful people to keep up with, but it’s ok because you’re earning lots of money.

You have to go through this period of high spending, fancy eating, over drinking, staycay, vacay, so that eventually you have had your fill and you stop.

It is fun. Make the most of it. I’ll save the downsides for the next phase because for now life is a party.

Get started with my free guide:

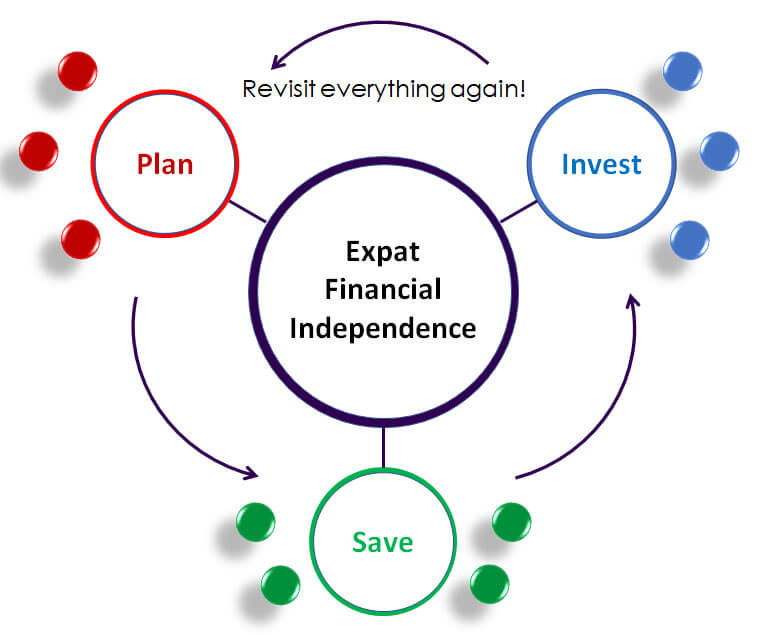

3 Steps to Expat Financial Independence

15-minute read. Discover the simple process for taking control of your finances so you never have to stress about money again.

4. Social Maturity

There will come a time when you are done with brunches. You’ve travelled around the region, you’ve done the staycations, you’ve been to the bars and the fancy restaurants. You’ve filtered through your acquaintances and you’ve made some good friends who get you.

You’re also a bit older (brunches age you fast!) and a bit tired. A quiet evening with friends is fine most of the time.

If you do not reach this phase, there is a problem. The Honeymoon is not sustainable. It is Neverland, bad for your liver, bad for your wallet, bad for your career. You have to pace yourself if you are going to last the distance.

There is a hole in the heart of every expat, from leaving behind family, friends, ageing parents. From seeing your home country evolve away from what you’re used to. From being a bit rootless.

You fill this hole with work, with buying nice things, with partying a bit too hard. The friends and family who know you best may not be around to take you to one side and tell you to sort yourself out. You have to do it yourself.

If you do not reach social maturity, there is no way you will reach financial maturity, unless both are thrust upon you by a paycut, job loss, a death. These will more likely cause social loss and financial loss, which are much more abrupt and painful.

Ask yourself, am I a socially mature expat? Or am I living like there’s no tomorrow? Well, there is a tomorrow and there is also a distant future that will require some retirement income. As an expat, a pension is a rare beast.

5. Financial Maturity

Financial Maturity comes with pain and experience. You wake up one day and realise you must get your finances sorted out. Or your credit card balance gets out of control. Or you realise you have been seduced into a crappy long-term savings plan. You vow never to let anybody take control of your money again.

Hopefully at this point, you start reading the DeadSimpleSaving blog, join our Expat Investing Academy, sign up for coaching sessions, whatever works.

If you do not reach Financial Maturity, you are leaving this town with nothing but memories. Do not be that person. Again, only you can sort this out yourself. Everyone else is happy for you to spend.

An extended Honeymoon phase leads to excessive debt, no money left over at the end of the month. You spend excess money because you miss home, because you work hard, because you’re too busy, because you are keeping up with the Jones.

You must identify and tackle all the issues driving your lack of financial progress. Don’t keep your head in the sand. Find like-minded people trying to improve their finances and distance yourself from people who cause you to spend excessively. Get a mentor if necessary, to teach you and hold you accountable.

You are good with money. Repeat it in the mirror every day. You are going to use this expat opportunity to secure an amazing future.

Understand what drives your thinking around money, calculate how much you actually have and what you can save each month. Categorise your expenses and ruthlessly filter anything not providing real value. Set some goals for your investments and your time to ‘retirement’. Re-build that cash buffer of 6 months’ expenses if it’s been depleted.

If you have card or loan debt with an interest rate of more than 5% per year, do not rest until it is paid down. That is your life’s focus, for the time being. The other side will be so much better, I promise.

Think about what will generate income for you in retirement. Will it be stock & bond funds? Will it be property? A business you’ve started? A pension or two? Start planning your ideal mix of these, get educated and start pouring your money into them. Now.

You have your cash buffer and sinking funds for education, a new house, car, wedding etc. Everything else, all the cash sitting around doing nothing in the bank, all your left-over salary, can go into your investment portfolio.

Congratulations, you are a financially mature expat and it will transform your life.

6. Departure

Some people have to bundle out of the country within a week. It’s usually linked to having debt or no spare cash. The rest of us can plan our exit from in a more orderly fashion, and you really need to. A bit of planning here can go a long way.

First, plan how to close down all your bank accounts, utilities etc, as trying to do this remotely is unimaginably painful and international phone calls are expensive.

Second, understand the tax laws of the country you’re moving to. No need to start more than 18 months out from departure, as the laws can change a lot. But don’t leave this to the last minute.

Read articles, read books, ask questions on community forums and, most importantly, get some proper tax advice, preferably from a tax expert in that country who understands expats and isn’t tied to a company trying to sell you financial products like offshore bonds. This isn’t easy so tread carefully.

You may need to sell all your stock & bond funds before you move back, to reset your capital gains and avoid future tax (e.g. UK) or to get out of non-domestic funds not approved in your home country (e.g. Canada). You’re not getting out of the stock market because you will jump back in as soon as you’re home. Just a little tax-saving detour.

Tax laws dictate the rules of the game. It’s not particularly fun but a basic understanding and some good advice will ensure you don’t lose the momentum you have built up as a financially mature expat. You’re going to do things properly!

7. Nostalgia

When you are shivering back in the cold, tax-heavy country you call home, you will look back fondly on your expat days. You may see it as a missed opportunity and think, ‘I wish I had made the most of my time there’, as you poke miserably at the coals in the fireplace.

Or you can smile and thank your expat journey for transforming your finances and making you an infinitely more worldly, wealthy and impactful person than everyone else shivering around you.

Many of you have not reached this stage yet. There is still time to make the most of the amazing financial opportunities expat life can give you. If you are reading this not feeling very financially mature or even socially mature, it’s never too late to get started.

Thanks for reading.

Steve

Got any questions or comments? Add them below…

Join my Financial Transformation Program (25% off)

After helping tens of thousands of expats to plan, save & invest their own money with confidence, I have created this program combining private coaching, online courses, group learning, accountability and community. It has everything you need to know, the flexibility to suit your experience and life schedule, plus the support to make sure you actually take action towards a great financial future.

Who would benefit from this post? Share here:

Join Our Community

Get our articles first – practical and memorable advice on saving your money and avoiding financial pitfalls.

We won’t share your email with third parties and will never spam you.

Hello Steve,

I am reading this post after listening to you speak on the Teach Middle East Podcast.

I started investing in a Stocks and Shares ISA last March and was disappointed to find I would not be able to continue investing in it once I move to the UAE later this year. However, listening to your tips has taught me that this is possible.

Many thanks,

E.

That’s a good podcast! You can’t add to it now you are in the UAE but you can keep it and change what funds it’s invested in etc. When you’re expat, you’ll be able to invest tax-free fairly easily if you follow the guidelines on this site. It’s worth putting as much as you can into an ISA and maybe even a SIPP before you leave – it will be waiting for you (considerably larger) when you return.

Enjoy Dubai!

Steve

Can u please advise in detail tax implications for expats other than US and European origin for investing in UCITS like VWRA based out of Ireland.

Is there a 41% exit tax on income gains and on dividends?

Appreciate your feedback

Hi Farhan, you will pay 15% withholding tax on your dividends but that’s it – unless the country you are resident in taxes you. There is no exit tax for expats, this is for Irish residents.

Wow, I guess my time as an expat in Japan helped me skip to stage 5 and financial maturity the day I arrived in the UAE. I have no idea who this Steve Brit fellow is but he pretty stole my personal blueprint to financial success. I feel like I should be the one giving the lectures!

I’m glad this framework resonated with you Ted, it comes from over a decade of being an expat myself.