Who would benefit from this post? Share here:

Join my Financial Transformation Program (25% off)

After helping tens of thousands of expats to plan, save & invest their own money with confidence, I have created this program combining private coaching, online courses, group learning, accountability and community. It has everything you need to know, the flexibility to suit your experience and life schedule, plus the support to make sure you actually take action towards a great financial future.

Note: If the information below looks complicated, don’t worry – once it’s set up, it is fairly quick and painless. No technical skills required. Don’t let someone take a lifetime of fees from you – believe in yourself enough to set up a couple of accounts and learn some new concepts.

Investing as an expat is mysterious. It’s not easy to find out how to do it. Everyone is either clueless or trying to sell you some terrible investment plan that isn’t even legal in your home country.

Figuring out expat DIY investing is absolutely worth it though. Let’s say you invest $1,000 monthly for 30 years. If you make an 8% average annual return from your sensible stock portfolio, minus 1% per year for all investing costs, you’ll end up with $1,227,000. More than a million dollars – nice!

Paying just 1% extra in costs reduces that total by $218,000 (and most savings plans will charge you a lot more). If you want to make the most of being an expat, you must keep currency exchange, transfer & investing fees as low as possible.

No financial company wants you to know this

Even when you hear about low-cost options like Vanguard or learn what an ETF is (see below), you can still hit a brick wall. Contact Vanguard and they will say nope, we only deal with residents in a few countries. Anti-Money Laundering regulations make servicing expats a hassle.

Even the nationals of countries outside US, UK, Europe, Canada and Australia can struggle. This article will help them as well.

I first learned about Vanguard in 2011. I sold all the actively-managed funds and stocks in my old UK ISA (tax-free savings account) and replaced them with just one fund – the Vanguard LifeStrategy 80/20 Accumulation fund. The LifeStrategy funds are great for UK residents – literally all you need.

But, living in Dubai, nobody could tell me how to invest with Vanguard as an expat. I dug around, then life moved on and I accepted it wasn’t possible. Only in 2016 did I come across a blog post comment, buried 50 comments deep, explaining how to do it. I immediately realised what a huge find this was. Unexpectedly, I got a bit emotional, because I knew then I could finally help people invest cheaply and sensibly. Here was my mission!

So let’s get into the details – I’m going to give you the keys to the expat investing kingdom. Where you live, no financial company wants you to know how to invest by yourself cheaply, because they won’t make any significant money out of it.

This is how to invest in stocks and bonds as an expat, exactly how I do it myself. I’m going to use the UAE as an example, but the principles should work for most expats (or nationals) regardless of location and country of origin.

Wherever I name companies below, it is to show you who I respect and/or who I invest with myself. I don’t make any commission from recommending these companies – I’m mentioning them because they get the job done: large, secure, cheap, efficient & with a good reputation.

Setting Up the Chain

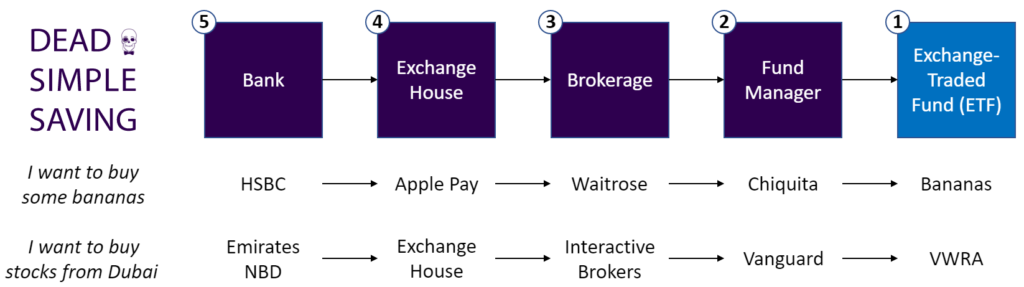

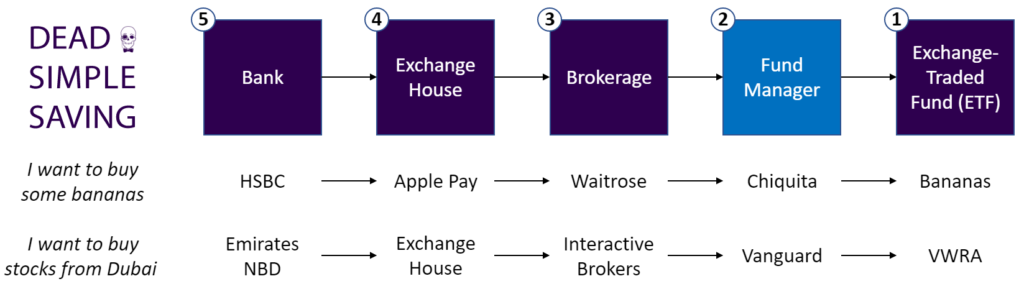

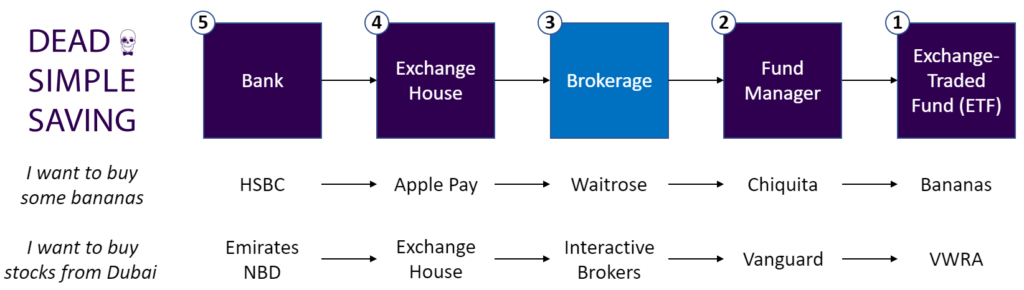

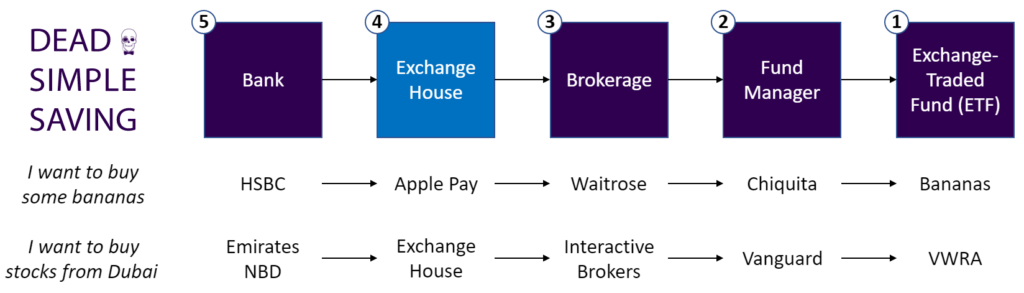

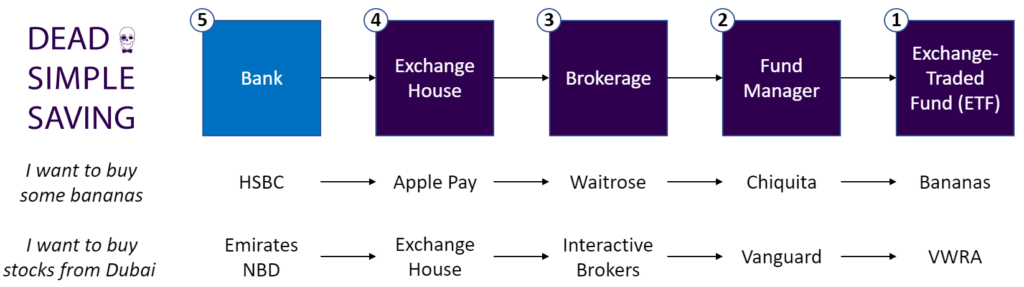

There are five links in the expat investing chain – it’s easiest to work backwards:

1. Exchange-Traded Funds (ETFs)

Like most expats, you probably want to invest in a mix of stock and bond Exchange-Traded Funds (ETFs). Mutual funds (such as Vanguard LifeStrategy) popular with those back home aren’t easily available to expats, so we have to use ETFs. In fact, ETFs are so awesome they could stand for Expat Total Freedom. They are similar to mutual funds, but are traded more like an individual stock, on a stock exchange. This makes them easy to buy and sell.

I appreciate this can be a little confusing. If you are scratching your head but determined to make progress, do consider joining my online Academy or live weekend workshop where we going into the detail necessary to give you confidence about all this.

Let’s say you want to invest in one stock ETF and one bond ETF, to keep things simple (which you should do). If you’re under 45, you could settle on 80% in VWRA (the Vanguard FTSE All-World UCITS ETF in USD with dividends reinvested) and 20% in IGLA (the iShares Global Government Bond UCITS ETF in USD with dividends reinvested). Congratulate yourself for your incredibly smart fund choices, as these funds are cheap and well-diversified.

I call this the Pac-Man Portfolio, as that’s what a pie chart of your portfolio looks like. 2 funds, nice and easy, literally all you need.

Unless you are a US citizen, you don’t want to invest in US-domiciled ETFs, i.e. those based in the US. for tax and regulatory purposes (separate to what they invest in). These may be liable for estate tax if you die (up to 40% on amounts over $60,000!) and a 30% withholding tax on dividends. Stick to ETFs domiciled in Europe (with ‘UCITS’ in their name), ideally Irish-domiciled, and you will be ok.

2. Fund Managers

Vanguard and iShares are highly-respected fund managers, managing literally trillions of dollars. Vanguard is especially awesome, as all profits go towards reducing your management fees (helping you grow your investments faster). It was founded by all-round hero Jack Bogle, who invented passive index funds and sadly passed away in early 2019.

Fund managers create mutual funds and ETFs, packaging together hundreds or even thousands of shares to create a fund with a single price. Without them, you’d have to buy all the shares in an index individually and you probably wouldn’t bother.

You can’t buy VWRA and IGLA direct from Vanguard and iShares as an expat, just as you don’t go direct to Chiquita to buy bananas. You access them via a broker, which is like a supermarket for funds.

Get started with my free guide:

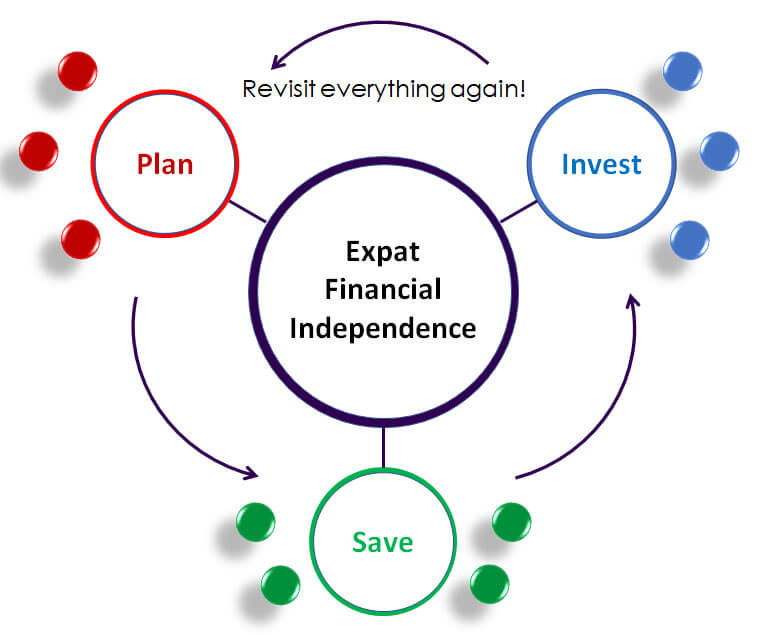

3 Steps to Expat Financial Independence

15-minute read. Discover the simple process for taking control of your finances so you never have to stress about money again.

3. International Brokerages

Most brokerages in your home country won’t allow you to open an account with them if you aren’t a resident there. Brokerages where you are resident may not have the necessary protections and abilities you’d like before investing thousands. You’re better off with an international brokerage instead.

You send money to the brokerage platform (more on that in a bit) and select which ETFs you want to invest in. They will give you a price, buy the shares and hold them for you. When you want to sell, they quote you a price, you click ‘Sell’ and should have the money within 2 days for transfer back to your bank account.

Most brokerages have a website and a mobile app that allow you to easily track your investment performance, receive dividends, buy or sell ETFs and transfer money in or out.

Brokers are required by law to keep your money and investments separate from their own money, so your assets are protected if they go bust. In the even more unlikely event that they have lost or stolen clients’ money, then you are further protected. For example, clients of US brokers are covered by the SIPC for up to $500,000 of stocks and bonds, and $250,000 of cash – this goes a lot further than you might think.

I use Interactive Brokers (IB), which is based in the US and is large, robust and cheap. They have a decent web platform and mobile phone app for investing and tracking your portfolio. You won’t be liable for US estate tax as long as you don’t invest in US-domiciled ETFs or stocks, and don’t have more than $60,000 sitting uninvested in your IB account.

Setting up an IB account requires you to fill in a few online forms and send them proof of identity and address online. After that the setup is fairly quick.

To add money to your IB account (no minimum, though transfer fees could bite into small transfers), you need to set up a Bank Wire. Enter your own bank details and the amount you want to transfer, then IB gives you an account code for the transaction.

IB is also one of the cheapest places in the world to exchange currencies. It’s very useful. They only accept major currencies though (and now AED).

Find out more about Interactive Brokers here. More expensive alternatives are Saxo Bank, Swissquote Luxembourg or Swissquote Switzerland, plus various ‘roboadvisor’ platforms. Note – these are not affiliate links.

4. Exchange Houses

You need to send money to your brokerage and the currency you earn in may not be the same as the currency you invest in.

Banks and many brokerages often have bad foreign exchange (FX) rates and can charge high fees as well. If you are transferring large amounts, poor exchange rates can cost you a lot. High fees will hurt you when transferring small amounts. So it pays to figure out the most efficient way to transfer your money.

Brokerages accept all major currencies, so if you have the right currency already, the transfer process is easy (beware of correspondent bank charges when sending USD though).

IB now accepts AED, which is a big step forward for UAE residents (sorry if you’ve just moved to Saudi). However, their AED account is in the UK and most banks don’t allow international AED transfers (some do at the branch). HSBC is the clear winner here, providing free AED transfers overseas if you use their mobile app.

IB is also great if you need to convert between major currencies, as their rates are so good. For other brokerages, you may want to exchange currencies first. You can use online currency brokers like CurrencyFair, Wise or Revolut (note my concerns here though) to get decent rates.

Beware, brokerages can be wary of these online companies and freeze the money for a few days before releasing it to you. IB seems to have a good relationship with Wise at least.

These online currency exchanges don’t have all the minor currencies though. You will need to convert your currency into a major currency before you send to your brokerage. You can:

- Shop around the various banks where you live to see who has the best rate

- Check the local exchange houses to see if their rates can beat the banks’ rates

- See if there are any money transfer apps specialising in your currency

Make sure the company you are using to transfer your money has a good reputation and is financially stable. There are plenty of horror stories. Always, always do a test transaction with a small amount before you send large sums over.

In the UAE, I have used Wall Street Exchange Priority Club, which has great service and literally the best AED to USD rate in town, excluding IB’s own rate.

5. Local Banks

Your local bank is always your starting point for your investing journey. Be prepared to set up an account with another bank if they offer better exchange rates and transfer fees. It is always good to have a second bank relationship where you are resident anyway.

To get your money to IB or to an online currency exchange, you have to be able to send your money there from your local bank. This can be surprisingly difficult. If your bank has a history of losing the bank reference code during transfers (looking at you ENBD), doesn’t allow transfer of the local currency out of the country, or charges extortionate amounts, you are much better off using another bank for your transfers.

If you want to transfer money to your broker from your bank account in your home country, similar issues apply. Major currencies are very easy to transfer, as brokerages will often have a bank account for that currency in its respective country. For minor currencies, you will face the same issues as in the country where you are resident, and the same hunt for cost-efficiency applies.

Summary

This process may sound complicated but, once you have the accounts set up and have transferred money a couple of times, it becomes fairly straightforward.

You should be aiming to invest monthly or at least quarterly – making a transfer shouldn’t take more than 15 minutes out of your day. What first seemed complicated soon becomes automatic.

Now that you know how to become an expat investor, just get started! You can practice with small amounts (e.g. $1000) to build up your confidence. Don’t leave it 6 months or more before dipping your toe in!

Not enough expats know how to invest without getting ripped off and this information is really hard to find anywhere. Please share this article with a friend, family member or colleague that might benefit from it.

Are you stuck trying to invest? Or do you have any tips that have helped you? Share your questions or thoughts in the Comments section below…

If you want to accelerate your progress, you can always use one of our courses or private coaching to bring you the clarity you need.

Join my Financial Transformation Program (25% off)

After helping tens of thousands of expats to plan, save & invest their own money with confidence, I have created this program combining private coaching, online courses, group learning, accountability and community. It has everything you need to know, the flexibility to suit your experience and life schedule, plus the support to make sure you actually take action towards a great financial future.

Who would benefit from this post? Share here:

Join Our Community

Get our articles first – practical and memorable advice on saving your money and avoiding financial pitfalls.

We won’t share your email with third parties and will never spam you.

Hi Steve,

As a French expat in Dubai for sometimes looking for advices, your article is perfect!

Using IB, I have invested on ETFs US based and get annoyed by the 30% on dividends.

Looking at your advice for Irish based ETFs reducing the tax to 15% is smart but a question comes to the performance of those ETFs.

Don’t you think that US based ETF with such big exposure, high potential growth and dividends can compensate the 15% tax difference with Irish based ETFs..?

Also, are the US based tax-exempt ETFs (VTES, VWAHX..) really tax free even for us non US residents ?

Thank you!

Regards,

Romain

Hi Romain, US-domiciled ETFs and Irish-domiciled ETFs can invest in exactly the same stocks (or bonds), the domicile is independent of the investments. The biggest issue is estate tax, if you build up a position of more than $60k in US-domiciled stocks and ETFs it is an expensive nightmare for your beneficiaries if you die.

Hello. First of all, thank you for sharing your advice. Based on what I read here, I invested in VWRA and IGLA (as well as AGGG) whilst living in Taiwan just over 2 years ago. I am now moving back to the UK. However, all my investments are currently worth less than what I bought them for. So is it still worth selling them before I move back?

Hi Phillippa, I’m glad you have found the articles useful. If you have made a capital loss, then wait until you have moved back. Then you can immediately sell (and rebuy something similar bit different, or wait 30+ days to rebuy the same ETFs in GBP). You won’t be out of the market but you will have realised a capital loss that you can use to offset future capital gains in any tax year.

Hi Simon, thanks a lot for this blog it’s been a great help to somebody new to investing. I’ve set up an account with IBKR and have researched ETF’s that I want to invest in (VWRA VANG FTSE AW USDA). First question is when it says the fund is in USD does that mean it’s best to buy the stock in USD? Or you have to buy the stock in USD? If yes, then when I send AED to IBKR’s AED account in the UK I assume they keep it in AED and I will then get an exchange rate to USD at the point of trade? My base currency on the account is GBP as you can’t select AED, hence I’m wondering what my balance will show in AED or GBP. Thanks very much!

Hi Tom, you have to buy it in USD. When you receive AED into your IB account, you have to convert it to USD (you get an excellent rate) and then you can buy USD-denominated ETFs. Base currency is just for reporting, so that’s just for totals. I recommend setting base currency to USD if you will be invested in USD-denominated funds.

Hi Steve – incredible article! I actually stumbled upon your website about 2 years ago – I was frantically looking for information on how to keep investing even when you move countries as I became a Japanese expat in London then and had to sell all my investment (luckily with no loss) I had with Japanese based broker. Fast forward to today, I still have not opened an IB account… And now I’m approaching the end of my assignment in the UK (less than a year left) and heading back to Japan. However I do not intend to stay in Japan for the rest of my life and would like to have a system that allows me to keep investing regardless of where I decide to live.

So my question is – do you reckon it’s worthwhile to open an UK IB account and start investing with GBP now and have it transferred to my Japanese IB account (I read on the IB website that they allow asset transfers) when I move back? I don’t know at this point if I keep on investing in GBP once I’m back in Japan, if I just hold onto the already invested amount for long term, or if I’d sell them when there’s no loss and immediately buy similar ETFs in local currency. I read in some of your replies where you suggested people to sell their investment when moving countries but my major purpose of setting the system up is to have the ability to keep hold of my investments / no be forced to sell like I was 2 years ago (since market may not be in my favour when I have to move countries) and not to have it lapsed.

So I just wanted to hear your opinion on whether opening an UK IB account and start investing now makes more sense than waiting until I get back to Japan and opne an IB account there. Hope this makes sense!

Hi Kiyo, it depends if you want to ever go back to the UK. No harm in putting money into a stocks ISA while you’re in the UK. If you are going to stay in Japan for the long term then you need to consider the Japanese tax system and any tax shelters (pensions, investment accoutns). There is a fb page called Retire In Japan which I think is decent. Changing currencies is no big deal and cheap inside IB – you can invest in GBP now and then switch when you return. Being forced to sell doesn’t matter, as you just rebuy immediately. No real loss. Is there a Financial Independence movement in Japan?

Hi Steve,

Great article, thanks again. I got to this place after a wonderful corporate webinar you did for us recently.

I am trying to start with this whole thing, with zero level of experience and very limited knowledge.

I was trying to open an account with the brokers you suggested (Interactive Brokers) but could not manage to pass the initial step, I believe this is because my lack of knowledge in this fields makes me unable to choose the right products/types of investment and investment objectives.

Do you happen to have any tips you can share for beginners?

Thank you

Hi Assane, I’m glad you liked the webinar! I’m doing a lot of them these days. If you want to get started with IB, I recommend taking my IB online course (or live workshop if one is happening). It covers all you need to know about the application form, setting up properly, doing a trade, making transfers and managing your portfolio. You can find out more and join here: https://learn.deadsimplesaving.com/ib-workshop-online

IMID (SPDR MSCI ACWI IMI UCITS ETF) is also a good choice now, with total expense ratio of 0.17%.

Hi Paul, yes though it has 2619 shares vs VWRA’s ~.3800. Otherwise it looks decent.

Is there a GBP vanguard ETF you recommend. I live in Thailand but intend to return to the UK in 10 years or so, so I’d rather be paying in GBP. Many thanks,

Hi Christopher, VWRP is the GBP equivalent of VWRA for example. Or V3AB is the GBP equivalent of V3AA.

I am currently employed in China and have opened an IB account looking to invest in the two ETF you mentioned. I transfer my money out from China into my UK bank account (losing some due to exchanging to GBP), would it be best to invest using USD or GBP on Interactive Broker and what would be the reason for this?

Hi Jack, IB accepts the yuan (CNH), could you try that? Otherwise you might have to experiment. GBP is cheaper to move around the world but the initial conversion might get a better rate to USD rather than to GBP. Ince in IB, it doesn’t matter which of the two currencies you use. I have a slight preference for USD, as then you can understand the ups and downs of fund values easier without exchange rate movements clouding them.

Hi Steve. I’m a UK citizen who recently moved to Dubai. After several years of investing via a Vanguard Stocks and Shares ISA in the UK, I didn’t know where to start in Dubai. Your article was extremely helpful and my wife and I have now set up IBKR accounts and are ready to go, so firstly, thank you! My question is about the suggested bond ETF (IGLA). Looking at this on IBKR it seems to have taken a huge slump in the last 2-3 years, from a peak of 5.8 in 2021 to an average of around 4.6 in 2023. I’m the first to admit I don’t know much about bonds (oh how I miss my LifeStrategy 80:20), so based on the aforementioned slump, is going with 20% IGLA still your preferred option?

Hi Dan, it’s a good question. Bond fund values have slumped because interest rates went up rapidly in 2022 and have been slowly increasing in 2023. If interest rates stabilise and eventually fall then bond funds will increase in value again. So you are buying them cheaply at the moment – perhaps not the cheapest yet but cheaply. Government bond funds, including IGLA, did what they were supposed to do during the Covid crash of early 2020, where they increased by 8-13% while the US stock market crashed 32%.

Finally a place that speaks about UAE expats and investments!

Why some ETFs in IB are traded in GBP? I mean, SMEA & SSAC are Irish in USD (according to justetf and trackinsight). Is there a way to change that? for example CSPX & EIMI are Irish traded in USD.

Hi Eva, yes you came to the right place! With ETFs, currency and domicile can be different. The domicile is the location for tax & regulatory purposes. Choose your currency and there should be a GBP or USD version that is Irish-domiciled. If you look at the ETF’s factsheet, it shows you the ticker code options on various exchanges at the bottom.

Wise recently stopped service in UAE, what service can you recommend instead (since you advocate not using Revolut)?

Hi Wolfgang, it depends where you want to send money. HSBC mobile app is great for sending AED to Interactive Brokers, as there is no fee. IB is great for currency conversion and sending to your own accounts elsewhere. Otherwise it’s CurrencyFair or Wall Street Exchange Priority Club.

Hi Steve, from what I read IBKR accepts only deposits /withdrawal from bank accounts under the owners name and not from 3rd parties . How will Wall Street Exchange Priority Club work then?

Hi Dragoslav, Wall Street is able to use the SWIFT network so the transfer flows from your bank all the way to IB’s bank. It definitely works as I have used them myself.

Hi there Steve. I am a german citizen living currently in Dubai, and currently investing in the VWRL:XAMS via Saxo but no bonds yet and interested in a Vanguard Lifestrategy ETF to replace this… as i understood from a post of Elie in the Simplyfi group on FB that would sort out then automatically the bond investment element so it would be easier to manage (got quite a lot of anxiety regarding financial stuff so would love to be able to just “invest and forget”) – confused about which symbol to look out for on Saxo to invest in the right thing, would you have some input?

You would need to invest in a EUR-denominated ETF, as Vanguard LifeStrategy ETFs are only in that currency. This ETF has various names on various exchanges (and thus brokers), but try VNGA80, VNGA8, V80A (change 80 to 60 if you want 60% equity and A to D if you want distributing dividends). If you have anxiety about financial stuff, you might want to take one of my workshops or courses!

Wow, this was a great read. Thank for the valuable information in this. I have a couple of questions, or looking for some opinions or direction for further reading.

I’m Canadian living in Germany with a German wife. We are 40 and finally serious about investing our meager savings we built up. I was thinking 100%VWCE. I have just opened our joint ibkr account and tested it out, and it’s working good.

My question is, we may move to Canada within 2 years. Should we invest in vwce or a Canadian vanguard all world ETF? If we pay into the Irish docimiled vwce for two years, will we have to sell it when we move to Canada? Or can we leave it in our ibkr account?

Hi Tim, I’m glad you liked it! If your savings are in EUR then you could buy VWCE. That’s 100% stocks though, so it’s quite risky. You might get stressed if the market crashes. It might be worth looking at something like V80A, which has 80% stocks and 20% bonds. When you move back to Canada, sell everything, convert it to CAD and then buy something similar via IB Canada or Vanguard Canada. It’s no big deal selling when you move – you don’t have to spend any time out of the stock market and IB is very cheap for doing EUR to CAD transfers.

Hello,

I’m very confused with taxes. I hold european passport, but living in Vietnam. If I will invest in mention etfs from my Vietnam account to IB. When and to who I need to declare/pay taxes? Vietnam, US, My home country? I thought I need to pay only once after I sell my invested etfs and want to cash out.

Thank you

Hi Steve, I’ve been coming back to this article every few weeks. This is a fantastic resource and it’s the kind of advice that not enough of us hear, because the only financial/investing into a lot of us are exposed to is stuff from advertisements, for products that make money off our risk-taking.

Small question: what are your thoughts on a HYSA strategy? Obviously, investing before establishing some savings is a fool’s game, and every guide worth its salt points that out quickly. I’ve been asking around, and it seems like some people I know have just been parking money in Sarwa for the interest. Rates seem pretty low across the board in the UAE, so I thought I’d ask if you have a better idea. Preferably I’d want something in Dirhams that I can have access to in an emergency. Holding in Sarwa would still require some conversions, as they deal in USD, although the interest should cover the conversion fees. IBKR gives a similar rate for higher value accounts, at lower values it’s closer to nothing.

Unfortunately my bank doesn’t seem like it can send AED to IBKR (at least not on the app/online) and their savings accounts give a pittance in interest. So I don’t think I’ll be leaving much money in there.

I’m not a US citizen so treasury bills are not an option (although some money market ETFs seem to do something similar – this is outside my understanding and I don’t think it’s something I’ll pursue).

Otherwise looking at something like 97% VWRA, 2% IGLA, <1% other (essentially gambling but hey)

Hi Duxedo, I’m glad you have found it useful! 2% IGLA seems low, but if it helps you learn how bond funds behave over time then why not. High-yield savings accounts are great if you can find them. The best offerings change every month. IB01 ETF is a bit like a savings account (US T-bills and cash). The conversion rate shouldn’t be too bad with Sarwa, or you can use IB to do the conversion if you open an HSBC account.

Hi Steve,

I’m also confused and in a dilemma on where to invest. I’m a U.K. expat in UAE. I have close to 7 figures in $ ready to invest and been advised to invest it all in Dimension 60/40 world.

Initial fee is high from a cash pay out then fees and fund fees although low doesn’t seem worth it with short term fixed deposits offering more. I know the fund is better long term but the initial fee is putting me off.

I’m mid 50’s and looking to work towards earning a passive income to reduce work hours and get on the path to retirement.

I was thinking to just do vanguard myself and leave it.

Any suggestions would be welcome.

Many thanks

Hi Jason, you could do much worse than Dimensional, but I’m also not 10000% convinced that they outperform the index net of fees. And if they do, will they continue to do so. If you want to invest by yourself in Vanguard, read my blog and maybe join one of my courses, which will cost you upfront 0.05% of your investment portfolio at most, in return for everything you need to know about expat investing. Not a bad deal I think.

Thank you for that Steve. I would like to clarify – as Polish living in Dubai – while opening account with ibkr I can see that UAE doesn’t have a tax treaty with US – means that they will apply 30% witholding tax on my interest ? Im confused- should I then tick the box saying that “my tax residence country (UAE) does not have tax treaty with US” ?

Hi Karolina, they will apply 30% withholding tax only if you buy US-domiciled ETFs or stocks. Better to buy Irish-domiciled ETFs instead and then you will only pay 15% tax on dividends. Yes, that’s the correct box.

Thanks for the excellent content Steve.

I am an Irish citizen and tax resident in Thailand. Is my best option to invest in Irish domiciled ETFs. Is there anything else I should be thinking about from a tax perspective?

Hi John, yes investing in Irish-domiciled ETFs is good for you while you are not in Ireland. You should sell everything just before returning to ensure you don’t have a big capital gain tax bill if you sold later. Beware of the Irish tax on unrealised capital gains when you do go back.

Hi, for the sake of diversification, is IWDA a good alternative of VWRA for expats living in the UAE? What do I need to look for or pay attention to in such case?

Hi Firas, I don’t think you need to diversify away from VWRA personally. It’s hugely diversified within itself and the risk of Vanguard imploding is tiny (plus you would still get your money back). IWDA is ok but only has developed markets – there isn’t an iShares all world fund, so you would need to add EIMI the emerging markets fund also. Starts to get a bit ungainly and complicated.

Hi Steve,

I’m so happy I found this article last last year. I’m a UK expat living in Thailand for over 10 years, around 5 years or so ago I started looking into investment options for my future.

I first found out about ‘robo’ investors such as Nutmeg, but they cannot be used for non UK residents. Then I started doing a lot more research into long term investment and realised it much cheaper to do it yourself via funds such as Vanguard.

I researched into investing into Vanguard funds, but the only option I could find for expats was using something like Saxo in Singapore. However you have to have a very large minimum investment to open with, which I didn’t have.

I then paused my research as I couldn’t see a way in without a large lump sum. Every few months I’d start my research again, trawling Google, reddit, boggleheads and other such investor forums but could never find a viable way.

Then I heard that they opened the Vanguard Investor Platform in UK and I thought I might be able to find a way to do it via that, but again only open to UK residents.

So my research is paused again.

After a few months I start my research again as usual, and finally I found your article in Google!

It’s so great to finally find a viable way for expats to easily invest in such funds without having a large lump sum to start with. Thank you so much for your clear and concise guide on how to do it. I cant wait to make my first investments!

Hi Max, I am really delighted that this has been helpful for you – there is a near infinite amount of unhelpful and irrelevant information out there, which is why I write this blog. Don’t forget to tell all your fellow expats in Thailand that there is an easy way to invest, as they are probably getting confused, or scammed by commission-hungry advisors.

Hello,

I am still confused. I thought that Vanguard available only for UK residents?

Vanguard’s investment platform is available in a few countries (US, UK, Australia etc.) so if you live in other countries you have to buy Vanguard Exchange-Traded Funds instead, via another platform such as Interactive Brokers, Saxo etc.

I am an Irish citizen who lived in the US for a few years and got US citizenship. I have now returned to Ireland. I still have a TD Ameritrade account where I hold some ETF’s however, they are no longer letting me buy more due to my Irish residency.

If I open an Interactive Brokers account, do they generally let US expats invest in US domiciled ETF’s such as VOO and QQQ? I am not sure how that would work for Irish deemed disposal tax? And would that money be subject to US estate tax? Any help appreciated as I am tearing my hair out and keep hitting walls with this. I just want to invest in simple ETF’s and forget about them.

Hi Emma, IB is generally more open to US expats. Yes you would be able to invest in US-domiciled ETFs. You would have to discuss the Irish tax with an Irish tax expert who also understands US taxes – this may cost you some money now but it is well worth it as your situation is complicated. As you have US citizenship, you may well have to pay US estate tax (again, get an expert to go through the details), however estate tax for US citizens is much lower.

Hello, I discover this great website, congratulations (from someone who has spent 30 years on financial markets), all is very clear and helpful. Being new in the UAE, the suggestions to avoid US-domiciled ETFs because of withholding taxes is particularly useful. In a similar vein, I wanted to confirm that if I buy US t-bills via IB for instance, then I will either have to decide to automatically be withheld some US tax and/or have to pay them at some stage ? My dilemna is that tax-wise, it’s much better to hold a short-term US gvies Irish based ETF, but because of the management fees et all, it gives me only part of the yield I would get from a direct T-bills investment….Thank you.

Hi Camille, you are right that you wouldn’t have to pay tax on interest income from T-bills and T-bonds. However, if you need the money and have to sell them, then you may have to sell at a loss. Irish-domiciled ETFs would cost you 15% withholding tax on the ‘dividends’ potentially, but would be more diversified. The management fees are pretty low for such ETFs.

“you wouldn’t have to pay tax on interest income from T-bills” ???

Are you sure about that? Everywhere I’ve googled US withholds 30% of interest income from T-bills automatically.

Compared to UCITS ETF withholding of 15% – but lower yield – you probably get the same thing in the end?

Is there really no way to invest in some offshore fund that holds US T-bills and has no tax witholding for UAE residents? Or some UAE investment fund perhaps? This leaves UAE savings accounts as the only tax-free option?

I cannot find any indication of the US government taxing US Treasury-derived interest income for non-resident aliens, whether directly or via dividends from ETFs. Every article I found suggested there was no tax on these. For example: https://www.bogleheads.org/wiki/Nonresident_alien_taxation. In a stock & bond portfolio, the bond component is held to protect your portfolio from a stock market crash. So the bond yield is less important. If you want to park some cash ‘safely for a 1-5 year purpose, then bonds and bond funds generating a decent yield could be more important. 15-30% tax on dividends isn’t that huge anyway. 15-30% on capital gains would be much more of a problem.

Thanks for this post and the insights, Steve! I’m a US citizen living in the UK with an etrade brokerage account. I tried searching for VWRA and IGLA on etrade, as well as a few other ishares UCITS ETFs but can’t find them using a search on etrade. They do have VGFPF and FTGPF, but other UCITS stocks seem to be lacking or at least using different tickers. Any insight on this?

If you’re a US citizen, you want US-domiciled ETFs not UCITS ETFs. For example, VT and BNDW.

Quick follow up:

As a US-citizen, I want to US-domiciled ETFs to avoid issues with PIFC. But if I hold US-domiciled ETFs, I will then be subject to estate taxes, correct?

(as you mentioned estate taxes with US-domiciled ETFs in your article when talking about using IB as your broker)

Hi Molly, as a US citizen you will still be subject to estate tax on your worldwide assets, but the rate is much lower than for non-US residents and citizens. You should invest in US-domiciled ETFs, not in other ones.

Hi Steve,

Many thanks for this great post. I moved here from UK 9 months ago and was struggling to wrap my head around it. I am looking to put money aside that I can use as my pension in the future and I am 40yrs old. I have 2 buckets: a) 1 lump sum deposit b) monthly investing (lets say around $1k).

I head that the Fees at IB are quite high so it might be best to use etoro for monthly investing and IB for my 1 lump sum amount.

1) What are your thoughts on this?

2) I have been googling for hours but cannot find the platform fee and custodian and dealing fee difference between both for UK expats living in UAE. Can you provide any insight?

I would like to avoid large fees eating into my investment just like you mentioned above :). If I stayed in UK Vanguard is only charging me 0.15%.

Hi Nidhima, IB’s fees are extremely low. The only thing you will pay is a trade commission of about $2-5 per trade (of up to $10,000). Plus IB gives you the actual market prices, whereas some other platforms add a spread or show you a less-good price. If you have money in Vanguard in the UK and you are happy, then you can keep it there. I wouldn’t add new money to it though.

Hi

I wanted to invest passively by buying the VOO etf, but since the interactive brokers refused my application I wanted to use etoro. Later, someone warned me not to use etoro and choose saxo bank instead because etoro is a cfd brokerage firm. What do you think is the best choice for me

Hi Ayham, it depends why they refused your application. Maybe you said you didn’t have enough experience in the application form. If you still can’t get IB to work then I’d use Saxo if you want to start building up a significant portfolio for your future. I would avoid VOO unless you are a US citizen: a) domiciled in US, exposing you to estate taxes on death, b) I prefer globally-diversified ETFs like VWRA.

I began my career in Europe some +40 years ago and married an Italian. I am a trader living in Italy , out of no where I was told that my TD Ameritrade account would be closed. WOW, then a 7 week search has me no closer to a solution. I have multiple accounts but IB told me they wouldn’t take my IRA……wow,…..You are flying a plane and all the engines stop……

Hi Thomas, sorry to hear that. Maybe look into why IB won’t take your IRA. Can you adjust the portfolio or application form and try again?

Hello, i am both US and Italian Citizen who lives in Italy.

As a US expats living in Italy should i use UCITS ETF or US domiciled ETF?

Is iShares MSCI China A UCITS ETF considered PFIC?

Thank you.

Hi Giuseppe, if you are a US investor I recommend investing in US-domiciled ETFs, then you won’t have this problem.

EU residents can’t invest in US ETFs because of PRIIPs rules. An important point for those US citizens living abroad, which I didn’t see discussed here!

Hi Matt, you can if you convince your broker that you are a professional investor, which is not that hard to do (depending on the broker). Having US-domiciled ETFs could be a pain when it comes to filing EU tax returns though, if you have to juggle both US and EU taxes.

Hi Steve

This is a great article and I have managed to open the Interactive Brokers account and deposit however whenever I try and buy any of the Vanguard products I keep getting the following message

“minimum of 2000 USD is required in order to purchase on margin, sell short, trade currency or future.”

I am completely new to this but assumed that I would be just buying the VWRA & IGLA with the cash I had deposited?

Any help appreciated.

Cheers

Tony

Hi Tony, glad you like it. Are you sure you have USD in your account? This would appear if you sent some GBP over and then tried to buy an ETF in USD. Also, change your account from a margin account to cash account, so you don’t accidentally borrow money when doing this.

Hi,

Any thoughts about REIT ETFs for non-resident aliens? I must admit I’m really struggling to find a decent one – would seem the HSBC REIT ETF may be one of the best options but not sure whether to go for it, or whether to stick with my VUSA, VWRP & VNGA80.

Thanks

Personally I think a) VWRP has real estate companies and property developers in it already, b) unless a REIT is going to be more than 10% of your portfolio then it doesn’t add much for the extra hassle, c) REITs can be horribly illiquid and not always great in a downturn. Also… not sure why you have VUSA and VWRP and VNGA80. I would pick one and stick to that (VWRP contains the S&) for example, as does VNGA80).

Hello,

I have a question about all of this. I am a US citizen living in Germany. Before I moved I had a brokerage account with robinhood in which I invested in etfs and individual stocks. When I got to Germany I continued to invest using my US brokerage account. Is this a problem? I am quite confused about what I am allowed to invest in.

Hi Nicholas, you are a US citizen so yes that should be fine. It’s up to Robinhood though if they don’t want US expats on their platform. I know so brokers can be a bit funny about it.

Greetings from the Republic of the Philippine Islands. I have been a satisfied Schwab client for many years. We were recently informed, effective 6 December 2022, the accounts of American EX-pats residing in the Philippines will be “restricted.” No incoming funds and only closing transactions will be allowed after 6 December. I sell option premium each week utilizing StreetSmart Edge. I do all my international banking (on Schwab.com) and VISA card purchases through Schwab bank. My choices are, 1. relocate to another country in this region that is not on the restricted list. 2. move to another country in this region with “partial restrictions” that do not affect me. 3. Move back to the US but that is not an option. I am a married man with a family, and none are US citizens.

US banks will not touch EX-pats. I can establish a direct deposit account with one of several Philippine banks to receive pensions. Not a perfect solution but it will work. The issue with my ROTH IRA is another matter. I have been on the Interactive Brokers site for about one week and testing the free trial account. I find it confusing and overcomplicated compared to StreetSmart Edge. I have also discovered certain ETFs (leveraged versions of index ETFs) I am currently trading require special “trading permission.”

There is no question in my mind that IB will be more expensive than Schwab to do exactly what I do now. My main concern at this juncture is determining if IB will work for what I intended to trade before I make any account transfer. The rule is, you may only transfer your IRA once a year. I have to get this right on the first try. Customer service with IB is almost non-existent. We had to place a long-distance call to ask the first few basic questions. It was not a friendly experience. I did attempt to use a live chat function on the paper trade account but a lengthy list of security questions popped up. Since I have no live account yet, it was pointless to answer and go nowhere. Any guidance will be greatly appreciated

Hi Jack, I am not an expert on IRAs for US citizens. I also think using leveraged ETFs and selling options are both really bad ideas for making money over the long term. This is your retirement portfolio, so I would stick to the boring stuff for which IB is very simple and easy. Perhaps this Schwab problem has a silver lining if it stops you investing in such things. If it’s less than 10% of your portfolio then fine, but any more than that I would avoid. In general, IB is insanely cheap and has lots of guides on how to use it. But it doesn’t suit everyone!

Hey, thanks for the article.

I’m an Australian, living in Malaysia as a Malaysian tax resident. I’m looking to invest in Australian dollars, but looking for a way to do so as a non-resident. Is Interactive Brokers a good platform for that?

Hi Anthony, yes I would say it’s a great platform for that. Low-cost and efficient.

Evening,

Am an new to investing and am going to create an IB account and follow your suggested strategy on what to invest in.

I am a UK citizen but resident here in UAE and regularly send money back to the UK. I have 2 questions if you don’t mind

1. Should I make my base currency GBP, AED or USD?

2. Is it better to set IB account to my UK bank for monthly payments or my HSBC account to here in the UAE?

Thanks in advance.

Hi James, recently IB has started accepting AED. I think it’s always easiest to invest in USD, so I would send in your GBP and AED, then convert to USD for investing. If you decide to move home to the UK, then you will have to sell your funds anyway and can convert the USD into GBP. No need to buy a GBP-denominated stock fund in my opinion, as it will be driven by USD (currency of world trade) anyway.

Hi Steve, could you please explain the point above “If you decide to move home to the UK, then you will have to sell your funds anyway and can convert the USD into GBP” – Would we have to sell? can’t we continue to invest and hold for the future. Is this due to the fact we would need to sell and re-invest as a UK resident as we would be liable for tax.

Yes, it’s a capital gains tax issue. You would probably want these investments in UK tax shelters such as a SIPP and an ISA anyway, once you move back. Also, having ETFs not in GBP and not in a tax shelter is a nightmare from a UK self-assessment tax perspective. So realise the gains and move to GBP ETFs – you are still holding for the future then. See my Moving Back to the UK online course for (a lot) more information. https://learn.deadsimplesaving.com/uk-workshop-online

Thanks for this article, Steve! I have a question about taxes on non-US domiciled funds for US citizens. From what I understand, non-US domiciled funds count as PFICs and are heavily taxed, and require extra paperwork to file US taxes, which makes them less profitable. Are you familiar with this problem? Do you have any suggestions for getting around it?

Hi Rachel, as a US citizen you can invest in US-domiciled funds instead, no need to touch non-US funds at all.

Thanks very much for the rapid reply. It’s easy for US residents to buy US-domiciled funds but seems tricky for residents in Europe. If you have any more information on this, I’d love to hear it.

With an Interactive Brokers account it should be pretty easy to convert EUR into USD and buy US-domicile ETFs as long as you enable US stock exchanges in the settings.

Steve,

Firstly many thanks for your excellent website and articles. I wonder if you could give your thoughts on opening a trading account through a local GCC bank.

I am a Brit living in Bahrain (long-term) and my bank here (Ahli United Bank) offers a trading platform (AUB Trader) with no annual or custodian fees. The commission on trades (on Irish domiciled ETFs) seems to be 0.21% with a minimum of 33GBP/EUR. The platform they use is powered by a Dubai-based brokerage franchise ‘Global Trading Network’ part of Mubasher Financial Services.

I’m trying to decide whether to open an account directly with IB or with AUB Trader. I am attracted by the ease and relative security of opening an account with my local branch (where I’ve banked for over 10 years) and not having to send wire transfers to the US. Can you see any potential downsides to using my bank’s platform? Is it risky to hold a share portfolio with a smaller brokerage firm in terms of protection compared to being protected by SIPC if I opened an account with IB? Are there any key questions I ought to ask my bank about their trading platform?

Many thanks for any insights you can offer.

Nothing against this specific bank but there is no way I would do this. 1) I wouldn’t invest via a brokerage that is linked to a bank. 2) I wouldn’t invest large sums via a developing country bank where there are no government guarantees on deposits or investments. 3) I would never use a small brokerage. 4) Keep your banking relationship and your investing relationship separate – what if you fall out with them? So that’s a no from me!

Many thanks for this Steve.

Thanks for this. I want to invest in VWRA and IGLA on Interactive Brokers but I’m supposed to pay tax on reinvested dividends in my location (Mexico). 2 questions…

1. Does IB provide info on the reinvested dividends in accumulating funds? I need to report them each quarter, not yearly.

2. In the worst case scenario, would it be worth opting for a distributing fund instead (to solve the tax reporting issue)? In that case, what percentage hit can I expect in terms of fees?

Hi Steve, the dividends reported in the factsheet of the distributing version of the ETF would be the same as that reinvested in the accumulating version. Yes the distributing version could definitely make it easier to report. If you are invested from your salary regularly anyway then the extra cost to reinvest the dividends at the same time is pretty small.

Hello,

Wow..Why is that? That sound so complicated. I thought that you need to declare and pay tax only once after you try to cash out the money from you investments…

Hi, I’m a US citizen through my mom, but also German citizen and resident in Germany (work and pay taxes here etc). I file taxes in the US to be compliant. If I were to invest e.g. 100k into ETFs or through Vanguard how will any profit need to be handled tax wise? Will it automatically be deducted via the platform or do I have to declare it? If I set up a Vanguard account and portfolio and were to move to the US for a new job in the future, would I be able to keep my account as it is? The whole tax and fee topic for me is unclear. My impression is that fees and taxes would always be more than any profit I could make (i.e. stagnant value)?

Thanks

Fees and taxes are very unlikely to outweigh any profits, especially taxes as they are paid on profits. I am not an expert on US taxes so I won’t comment too much – a quick search for US expat tax advisors will show you quite a lot of companies you can ask. Or try ChooseFI Expats fb group to get recommendations. Vanguard will not pay your personal taxes for you. If you move to US, Vanguard would likely want you to set up a US-based account and then you could move ETFs (or cash) over.

Hi Steve,

I’m currently residing in China and opened an Interactive broker account. I invested in Ireland domiciled ETF, but besides that, I also have around 55k$ invested in US stocks (Tesla, Apple).

I see it’s mentioned in the article to not hold US stocks for non-US residents but I’m not clear why.

If there’s a US estate tax that needs to be paid, that would be applied to the capital gains?

e.g. If market goes well, I sell all my stocks at USD 70k (making a 15k$ gain) and interactive broker will keep 40% of that 15k$ = 6K$?

Kindly help clarify.

Thank you

Hi Andrea, you only pay the estate tax when you die and on US-domiciled assets totalling over $60k. Nothing to do with capital gains. So you are ok for now, but if your US stocks grew a lot then you could face issues. I hope you have a large ETF portfolio as it’s very risky to hold individual stocks. You have probably experienced that in 2022 already.

Really useful article Steve, thanks very much for putting it together.

I have a Vanguard account that I opened while living in the UK about 5 years ago. I’ve continued to put a small amount in on a monthly basis from my British account but have been overseas for three years now with no plan to return I’m not really sure whether to keep on going or what the tax implications are? Might I be better off closing it down and putting it in some of the funds suggested above?

Hi Joe, if it’s an ISA you can’t contribute further to it as a non-resident, but if it’s a general investment account, you could. It can make tax advisors & accountants a bit jittery though. No need to close it necessarily, but for new money I would use a brokerage platform outside the UK, e.g. Interactive Brokers.

Good to know, thanks again!

Once the bank catches on to the fact you’re non-resident, they (or at least HSBC did with me) will stop you from placing any funds in your General investment account! Go with Interactive Brokers.

Hi Steve,

I’m in a similar situation, I have a UK account with best invest and buy etfs monthly. Does it make much difference whether I keep Investing there vs through IB from Dubai?

Do you have any recommendations for someone who can provide some tax advice?

Thanks

Andy

Hi Andy, doesn’t make a big difference if you are non-resident unless you were ever planning to become non-domicile (not that easy). Worth checking fees to convert money into GBP, send money over and use BestInvest vs using IB. Send me a DM for recommendations on tax people.

Hi steve,

Many thanks for your advise . Highly impressed with your blog. Is IBKR brokerage safe. What would happen in case of default/bankruptcy. As i plan for retirement savings through the IGLO + VWRA as suggested by you is there any other AAA brokerages available in uae?

Rgds,

Risikes

Hi Risikes, there aren’t many low-cost brokerages that I trust that are based in the UAE (though Sarwa is a decent option). Brokerages that people can use while living in UAE: Interactive Brokers, Saxo, Swissquote etc. If IB goes bankrupt, you are protected by the SIPC. I have written in detail about this here: https://www.deadsimplesaving.com/blog/expat-interactive-brokers-invest/

Thanks for writing such an excellent article. It seems little complicated for a newbie like me, but I am intrigued!

Also, I am a US citizen living in Japan as a permanent resident and yet I was able to open an account at Nomura Savings. They have a wide range of funds. I haven’t read all the fine print, but it all looks pretty good. Am I missing something big here?

Glad you liked it! The process is very simple once you get used to it. Japan probably does have some decent low-cost brokerage platforms but you will have to dig around a bit. For comparison, Interactive Brokers doesn’t have a platform fee and then charges $2-5 for each trade below $10k. That’s pretty competitive.

Hi,

I will be moving to USA at the end of this year and I am investing in VWRA ETF every month (1k USD).

I found that VT ETF is almost equivalent to VWRA and I confused if I should continue to accumulate VWRA until I move or start accumulating VT ETF.

Any advise is helpful. Thanks

Hi Ash, if you’re going to buy less than $60k VT before you move to the US, you can start buying VT no problem.

Hi there, thanks so much for this post! So i am a US citizen but permanent resident in austria. Can i as a citizen still have etfs in my us brokerage accounts?

Also, why is it bad (or not allowed) to have mutal funds as an expat?

Grateful for any tips, thanks!

Hi Coleen, yes you can have ETFs in your US brokerage accounts and if they give you access to mutual funds then those too. Many brokerage platforms don’t give expats access to mutual funds and they don’t care to give a reason either. It doesn’t matter though, as ETFs are just as good, if not better. As a permanent resident of Austria, you might want to think about whether to maintain your US citizenship or stop paying all that tax…

Great posts. Thank you.

Have a question, please. I am a non-resident Canadian living in the UAE. I have an IBKR US where I hold Canadian and US-domiciled ETFs. I will be selling my US-domiciled ETFs to avoid the estate tax as you have indicated in your posts. If I only have Canadian ETFs in IBKR-US, I assume I should be okay (Etstate tax-wise)?

Will I have Canadian estate tax implications though?

What if I transfer my IBKR US account holdings now (Canadian and US ETFs) to Questrade (Broker based in Canada)? I have a non-resident account with them and they allow both types of ETFs (US and CA). Will I be still subject to US estate tax laws?

Many thanks.

Hi Fred, as long as you don’t have any US-domiciled ETFs then you should be fine. So holding Canadian-domiciled ETFs in IB shouldn’t expose you to US estate tax issues. As you are Canadian, you will probably have to pay inheritance tax in Canada anyway (though I am no expert on this), but it won’t be nearly as punitive as the US estate tax on non-resident aliens holding US-domiciled assets.

Hi Steve,

Thank you for all of the advice. I have AED in my UAE account here in Dubai and GBP in my account back home in the UK. Does it make sense to change the AED to USD (hsbc premier seems to have a good conversion similar to revolut) and invest this in VWRA but invest the GBP into VWRP to save on another conversion? Or is it fairly inconsequential if i change the GBP to USD and put that in VWRA also?

Apologies if you’ve answered this previously and thanks again for a great resource.

Mike

Hi Mike, it’s all fairly inconsequential and comes down to personal choice. I think the fewer ETFs the better, most of the time. Wall St Exchange Priority Club & Lulu Exchange tend to have a better AED to USD rate than HSBC etc.

Hi Steve, thanks for the article. I’m moving to Dubai this year from the UK. I’m inclined to take the approach set out above. I’ll be moving money monthly for about 3 -5 years as part of my retirement planning and it will add up to a fair amount. Couple of questions:

Should I open the account with Interactive Brokers before moving to the UAE whilst in the UK?

Which Interactive brokers website is most suitable e.g. .com or .EU etc

Any thoughts on advantages of Premier Bank accounts in UAE if I was looking to save on fx for above purposes and also maximise on airlines/benefits.

Thank you.

I’m not sure where you will be moving money? Not always straightforward to invest your UAE salary back home in the UK. Wait till you have proof of address in the UAE, i.e. a utility bill or failing that a letter from your employer. When you type in .com, IB may well route you to .co.uk anyway. It doesn’t really matter, as your account will be based in the US when you’re a UAE resident. The banks in UAE will not save you on the FX, get whichever credit card gives you the benefits you want and then use Revolut or Wall St Exchange for FX out here. Get a Revolut account before you leave the UK. Then you can join my workshop when you arrive in Dubai, rather than doing it 16 years later like some people!

Cheers

Steve

Thank you for the informative article!

I am a UK/Irish expat living in Dubai and have set up an IB account. I’d like to invest in something like the Vanguard Global All Cap but can’t seem to find this in IB to buy? Am I missing something?

Hi Becca

You cannot buy mutual funds through IB, only ETFs. So you could get e.g. VWRA based on FTSE All World Index or V3AA based on Vanguard Global All Cap Index but with an ESG filter also. There isn’t an ETF based on the Global All Cap index yet (sadly).

Hello Steve,

Thank you for this brilliant article. I have been investing in US-domiciled ETFs for years without knowing there could be estate tax. This is eye opening. I am a UK non-dom living in the UK. As far as I know, I shall pay no UK inheritance tax for my non UK assets. So, if I open an IB UK account and buy UCITS ETF such as VWRA which I believe may contain some UK companies in it, would it be considered as an UK asset, hence subject to UK inheritance tax? What about ETFs that contain no UK companies it it such as S&P 500 UCITS ETF (VUSA)?

Cheers

Hi Benson, it’s the domicile of the fund that matters (where it is based for tax and regulatory purposes), not what it invests in. If you invest in Irish-domiciled ETFs you should be fine, or you can buy mutual funds as you are in the UK. UK tax for non-domiciled people is complicated and it’s well worth talking to a tax advisor. You can either choose to be taxed as a UK resident, in which case dividend income tax and capital gains tax apply, or on the remittance basis for your global assets.

Hi Steve,

Wish I had read this article sooner…

I have recently, past 2 weeks, invested into US domiciled ETFs as a UK expat in Dubai – about £2000 – with Interactive Brokers. None have made any money due to the dip in the market.

I am going to sell my positions and re invest in the Ireland domiciled equivalent ETFs.

Any guesses what my tax liability is? My assumption is that IB withhold 30% tax on any dividends I earn. And I have not made any more overall. Do I need to get in touch with a tax person…or am I over thinking!

Thanks,

Graham

Hi Graham, I wish the article had been around for me a decade ago too 🙂 You are overthinking! Just sell and rebuy the Irish-domiciled ETFs. Any calculations will be done by Vanguard but unlikely to be anything if you’ve only held the ETF for 2 weeks.

Thank you for helping thousands of people around the world, including me: excellent work!

I had a question please, I am an Indian citizen living in UAE. I set up an Interactive Brokers account like you suggested and invested in an ETF (SAWD). This is Ireland domiciled. When I sell, do I have to pay income tax or file a tax return? I know this is not required from the UAE/Indian side of things, just wondering about European/Irish taxes.

Thank you very much for taking the time to help with this query and also for all your help over the years. Please keep up the commendable work!

Hi Henry, you are most welcome. No you don’t have to do anything or pay anything while resident in the UAE. You will pay 15% withholding tax on dividends, but this is taken out automatically by Vanguard so you don’t have to do anything about it.

Hey Steve, I am a big fan of your work and this blog has helped me a lot in terms of starting my investment journey. This may sound like a very basic question but if you could help me that would be great. So I invested in VUAA which is Vanguard S&P 500 UCITS ETF USD Acc. It is domiciled in Ireland and has a low TER. Now since I am a new investor I started checking the daily % gain/loss and compare it to the S&P 500 Index which it tracks. I found that they were quite different. Can you please help in explaining the reason for this difference? Will this average out with time in the next few years?

Would really appreciate your input on this. Keep up the good work!

Hi Avantika, I’m glad the blog has helped you! I expect VUAA matches the S&P500 v closely over time. Have a look at the factsheet (google VUAA factsheet). But the London Stock Exchange is open at different times of day to the US market, so at the end of the trading day in each location the prices will be a bit different. This will get corrected immediately the London market opens again the next day. So nothing to worry about. Good point though, nobody has raised it before.

Hi Steve,

I am so glad I came across your website at the perfect time!

I am an Irish citizen residing in Malaysia and am considering opening an IB account so that I can invest in VWRA.

Could I ask if you know if there will be any issues with me being Irish (but haven’t lived there in 2+ years and will be permanently in Malaysia) and investing in Irish domiciled funds? I would use my Malaysian details to register with IB but my passport will of course be Irish. Am I also able to avail of the lower tax rates because I am in Malaysia?

Thank you so much in advance Steve and keep up your fantastic work!

Hi Karen, that’s great to hear about timing! People discover these things when they need to 🙂 No problem at all when you are non-resident, you will be treated like any expat. If you move back to Ireland, get some proper tax advice beforehand and be aware of the tax on unrealised gains in Ireland. You may want to sell everything before you move back and then reinvest once back in Ireland. Thanks, Steve

Hi, I’m a super novice.

I have a fair bit of savings in a bank back home in the UK. I’m currently living and working in Australia.

Can I use uk savings to invest in one product in £, and then regularly invest my salary once a month or something in aus $?

Effectively making one username, but buying stocks from one product in both pounds and dollars. I don’t know where I will be in decades from now, the UK is still my base, but does that make sense to do? Pay in both pounds and dollars and remove in which ever country I’m in?

Hi Francisco, yes that is fine, especially if you don’t know where you will end up. It’s not easy to access an investing platform in the UK if you are non-resident, so you could try Interactive Brokers. Then you will easily be able to transfer in GBP and AUD without cost, and if you want to invest in those currencies it’s fine. IB also has v cheap currency conversion if you end up wanting to invest in a different currency.

Hi Steve. Thanks for this very useful information.

Like a lot if expats I’m new to investing and it can be quite a minefield. I have a question for you if I may..

I am a UK citizen (non resident) working and living in Brunei which is a tax free country. As per your suggestion I have opened up an IB account and would like to start investing in Irish Domiciled ETFs. Brunei does not have a tax treaty with Ireland so what will the withholding tax be on Dividends? Are there any other tax implications you can see for my situation ?

Thanks in advance and I am looking into your Expat Investing Academy and workshops

Andy

Hi Andy, it is a minefield though you have a great opportunity earning and investing tax-free from Brunei. There are multiple layers of withholding tax so it’s quite complicated. The 15% tax on dividends for Irish domiciled funds is the tax that your Vanguard/iShares fund in Ireland pays to the US for all the dividends it receives from the US-domiciled stocks it holds. When the fund then pays you a dividend (as an aggregate of all the dividends it has received from individual stocks), you don’t pay any withholding tax at all, as Ireland doesn’t charge it. So overall, if the dividend is 2%/year, you will receive 1.7%. There are no other implications while you remain non-resident, it’s a good situation to be in. I hope to see you on the course! Steve

Hi Steve,

I have dabbled Hargreaves Lansdown in the UK and IB is definitely a different beast and I am trying to get my head around it. I have recently moved from UAE to Singapore and have used Revolut to transfer the money. I am used to looking at sectors and investing in funds that way. I have a few questions

1) I may be being stupid but I can’t see a way to do a search by sector on IB (however I am only using the free version)

2) Is the above 80-20 % investment done as ishares and vangard are solid fund managers or any other reason?

3) Do I just leave the money in these ETF’s or is it wise to diversify to other areas as time goes on. Trying to learn about investing by reading your blog posts etc

Hi Richard, IB is really good at execution (i.e. putting a limit order through really quickly) but it may be less obvious what to do. I like to take my clients through it once in a private session/online course to show them what to do, what to ignore etc, and then they are fine. Personally I think it’s a waste of effort to pick and choose sector funds as the outperforming sectors are unpredictable – otherwise active fund managers would beat the market often and they rarely do. I would use justetf or etfdb to search for sector ETFs and then use IB just for buying. Stick to the Pro version so you can buy Irish-domiciled ETFs, still v cheap as you only pay $4-5 for trades).

Vanguard and iShares (BlackRock) are huge, well respected, secure and cheap, plus their ETFs are structured well. Passive index fund management is all about scale. There are other providers but I don’t think their ETFs are as good. Once you buy the ETFs, I would just stick to them, as they are hugely diversified already. No need to buy anything else – your brain could struggle with this as it seems too easy and effortless.

Thanks Steve. So you recommend searching using morningstar/justetf fo irish ETF’s from the big companies and choose ones which are doing well (and from your point of you vanguard (say VUAG) and ishares are consistantly doing well?). Can I also ask, why one stock and one bond ETF?

Hi Richard, you only need 1 stock and 1 bond ETF because the ones you buy a global and cover almost the entire world. So you are fully diversified. There is no need to buy anything else: a sector fund, a US fund etc. The simpler your investing is the more you will save in fees and the better you will do over time, plus you will spend less time messing around with your portfolio. Vanguard & iShares have good global ETFs which are cheap and track their index accurately. So they are all you need really.

Hi Steve,

Love your work and would appreciate guidance for tax efficient Vanguard ETF investing:

1. Citizen of USA and Australia living in Australia

2. As I am already above the $180,000 AUD salary threshold in Australia, my marginal tax rate is at 45%. To minimise tax, should I set up a personal company for Vanguard ETF investing?

3. If so, should my personal company be in the USA (LLC) or in Australia (Pty Ltd) or elsewhere offshore (i.e. Caribbean, Dubai, etc.)?

4. Is investing in other foreign Vanguard ETF’s tax efficient or would domestically investing in the Vanguard ASX 200 be most tax efficient (considering franking credits) for me?

Hi Matt

I’m glad you have found it useful! I know we emailed about this but I’ll add it here in case it’s useful for others.

You need a proper tax advisor for this who understands US and Australian tax – usually they pop up with a bit of a google, or you could try ChooseFI Expats. US tax is complex and requires specific expertise, as US citizens are taxed on their worldwide income even when expats.

The danger is that the US will be able to ‘look through’ any structures that you set up.

Franking credits make Australian investments tax efficient for dividends (when resident in Australia) but I still wouldn’t put more than 30% into that, with the rest of your stock allocation in global stocks. Otherwise you’re v exposed to the Australian market.

Hi there,

Thanks for the blog post. My question is bit different. I am resident of Singapore (Indian citizen) on work visa. I wish to starting investing in US ETFs (though I am investing some individual stocks). I may move to USA (on work VISA) in next few years so my questions are (I have IBKR and TD Ameritrade accounts in Singapore) –

1) should I start buying US-Domiciled ETF or Irish-domiciled ETFs?

2) If I go with Irish domiciled ETFs and I move to USA, will I be able to continue invest in Irish ETFs? or I need to sell those of in Singapore before moving?

I am investing for long term.

Thanks

Hi Ash, best to invest in Irish-domciled ETFs while you are not resident there. If you do end up there, it doesn’t make a huge difference whether you keep them as Irish-dom or sell and move to US-dom ETFs. Your new money from your salary you could invest in US-dom ETFs though.

Thanks Steve. I asked IBKR and they said US residents cannot hold Irish ETFs. So I am thinking just go with US domiciled ETF. I am just starting with 5k USD for now and keep investing 1000 USD per month (if i can manage to do). Given the timeline that I amy move to US by end of next year, I think I won’t lose much of 15% extra on dividends.

Not sure if I am correctly planning.

Hi Ash, seems ok, especially as you are moving to the US fairly shortly and won’t build up your portfolio beyond $60k.

Morning,

Apologies if this has been answered elsewhere, when dividends are paid info your IB account. Are they automatically taxed? I am a UK passport holder (non resident) registered in my Chinese tax number in IB.

Thanks

There is a withholding tax of 15% for Irish-domiciled ETFs and 30% for other ETFs. But this is taken out a v high level by Vanguard and you wouldn’t pay any other taxes. In most places that do tax dividends, you would have to declare them later on your tax form.

Hi Steve,

Really appreciate your work, I have a bit of a question for you.

I’m a British citizen currently living in Australi and hold permanent residency here. I’ve opened an IB account in the hopes of investing in some Vanguard ETFs. However I’ve also noticed it’s possible for me to open an account directly with Vanguard on their .com.au site.

There is a chance in the future I may spend some extended time in Canada where I also hold permanent residency or back in the UK. I could settle in any of the 3.

I would like to start investing sooner rather than later. Do you think it makes more sense to start investing with Vanguard directly or via IB? Which one lends itself better to moving countries without issue?

From my understanding it will be difficult to change residency/tax info with Vanguard without withdrawing funds etc.

Thanks for any help,

Hi Simon. As you don’t have any specific timelines, you might as well invest via Vanguard in Australia. It aligns with your currency and tax regime at the moment. Not a huge issue if you need to sell later on. If you are really worried about portability, IB should be fine, though if you find yourself in Canada or UK then it’s worth using a local platform to get access to the right tax reports and tax-free accounts etc. Not sure IB is so useful for setlling in one of these 3 countries vs say Dubai.

Glad I found this! Regarding withholding tax, is this only applicable to gains or the total value of the etf held? As an example, if my VWRA is now $100k ($50k invested, $50k gains), would withholding tax apply on $50k gains or the whole $100k? Thanks!!

Withholding tax is only on dividends of your ETF. Dividends are typically 1.5-2% of the value of your portfolio per year, so you would pay 15% on that for Irish-domiciled ETFs.

Hi Steve

If I’m residing/payng tax in China I see that If I buy a US-domiciled ETF the withholding tax would be 10% because of the tax agreement between China and US. Not bad (better than the 30% WHT for countries without agreement.

However, If I want even better and want the withholding tax to be 0%, can I just buy an ETF domiciled in Ireland (UCITS)?

Hi Andrea, if you are not a US citizen I don’t really recommend US-domiciled ETFs if you have dependants, as there is 40% estate tax on these ETFs over $60k. If you went with Irish-domiciled ETFs, the withholding tax would be 15%, paid by the fund (not you) as it is investing in US assets while domiciled outside the US.

Hi Steve, this is a very good article! I have already successfully invested a very small amount in VWRA as a trial. I came across your article while researching for the legitimacy of this ETF as it was just recently offered (2019) so I am still quite scared. I am aiming to invest a large part of my savings in VWRA but I am still hesitant due to unforeseen circumstances relating to this ETF’s age. I hope it is ok to ask you several questions? What if the tax treaty between the US and Ireland changed? How did you handle the March 2020 crash? I am a complete novice so I am not sure if the VWRA volume is a cause for concern (too small compared to others)? I am not sure why there isn’t that much researchable data about this ETF and also searching around forums yields underwhelming results, it’s as if it is just known by a minority (which is kinda sus to me that it might be prone to manipulations). Maybe it may just be related to its short track record or what but I don’t know. Worse comes to worst I fall victim to the market and parted with my family’s life savings. In the best-case scenario, I chose a very sustainable and profitable instrument. I am confused.

Hi Viven, these are good questions and I’m sure many people new to this share your concerns. An analogy – the iPhone 13 has been around for a week – does that make it a bad purchase? VWRA is based on the FTSE All-World Index which has been around for decades – check out the FTSE Russell website that creates the index. Vanguard has been around for decades and is very well respected. VWRA is just an alternative of VWRD that reinvests dividends automatically, which has been around since 2012. IF you are investing for the long-term, a diversified ETF like this will do you very well.

I don’t see the Irish tax treaty changing anytime soon and certainly it won’t mean you are suddenly liable for estate tax. I didn’t do anything different in the 2020 crash – the point is to behave the same in good times and bad.

Come to my weekend workshop or online course if this is stressing you out, so you can invest more confidently and know WHY you are investing.

Thanks a lot, Steve. I may not able to attend your workshop but I think I am still on the right track and your answer to my questions are really what I was looking for. I just want you to know that I am very grateful to you and I am sure many others are thankful to you just the same.