Who would benefit from this post? Share here:

Join my Financial Transformation Program (25% off)

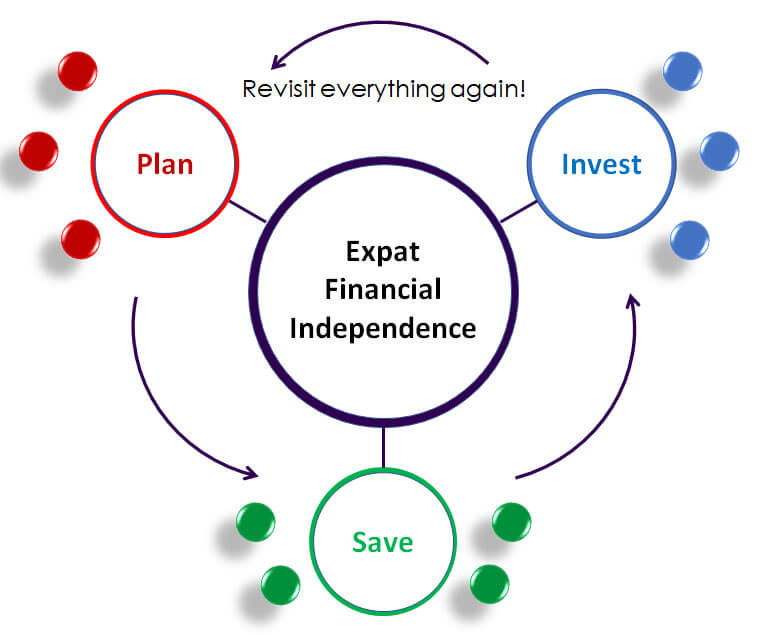

After helping tens of thousands of expats to plan, save & invest their own money with confidence, I have created this program combining private coaching, online courses, group learning, accountability and community. It has everything you need to know, the flexibility to suit your experience and life schedule, plus the support to make sure you actually take action towards a great financial future.

I get asked a lot about asset protection. You are investing tens or hundreds of thousands with a brokerage or two, so it’s a fair question.

Interactive Brokers is by far the cheapest brokerage for people living in developing countries. I use them myself (and I don’t have any further affiliation with them). They are large, well-capitalised and secure. The extra capital protects them against shocks, unlike Robinhood which had to scramble to raise money in January. But what would happen to your money if IB failed?

Safeguards

Our assets are kept in a segregated account, ringfenced from the rest of IB’s assets. IB has several ways to safeguard our assets, such as holding excess cash buffers against various operational risks. It also does not trade for its own profit – the two messiest brokerage bankruptcies (Lehman Brothers and MF Global) were caused by huge losses from proprietary trading, i.e. employees trading the brokerage’s money with the aim of making a profit for the company.

As IB is not linked to a bank, it is a much more straightforward entity, so if it did go bust, it would be fairly simple to accountholders and the location of assets. Lehman raided its brokerage arm for capital and there were many other types of claimants for the leftover cash and assets.

It’s worth noting though that brokerage clients of Lehman and MF got back 100% of their assets… it just took 5 years for some of them to get it all back.

Entities

For all IB’s operational and financial safeguards, there is always a very small risk that any company gets wrong-footed and fails. At this point, the Securities Investor Protection Corporation (SIPC) steps in, with its mandate to protect the client assets of all US-based brokerages. So this applies to all customers of IB LLC (based in US) and IB UK (whose assets are held by IB LLC). This doesn’t apply if your account is with the new IB Ireland or IB Luxembourg (that’s Brexit for ya, sorry).

To check which entity holds your assets, log in to the Client Portal, go to Reports, click on Activity and then click Run. The address of your IB entity will be shown at the top of the Activity Statement.

SIPC

The SIPC will move all clients’ assets held in IB LLC to another brokerage within a week or so and you will be notified about the process for reclaiming your cash and investments – typically this involves filing a claim form.

You may get full access to some or all of your assets within a month or two. This depends on whether all the clients’ assets have been found or not. If they are, you get everything back. If not, everyone gets the same percentage of their assets back. So if only 90% of clients’ assets can be found, you get back 90% of your assets.

IB keeps some of its own cash in the segregated account to reduce the chance of there being a shortfall for clients. And there is another layer of protection – the remaining 10% will be made up to you in cash by the SIPC… but only up to a limit.

Get started with my free guide:

3 Steps to Expat Financial Independence

15-minute read. Discover the simple process for taking control of your finances so you never have to stress about money again.

Limits

Each person with an individual account has a protection limit of $500k for cash and securities (stocks, bonds, ETFs etc.), though within that limit cash is only protected up to $250k. This includes ETFs domiciled outside the US and purchased on a stock exchange outside the US. This protection also covers non-US citizens and non-US residents, as long as their assets are held with a brokerage entity based in the US.

One caveat is that cash not in USD will be reimbursed only if you were about to use it for investment in securities. This is a bit of a grey area, but it’s best not to hold too much cash in a brokerage account anyway and certainly not more than $60k – it would be exposed to 40% estate tax on your death above this threshold.

Let’s look at some examples – QAnonald brokerage collapses and the SIPC can only find $9 billion out of the $10 billion cash and securities belonging to clients, that’s 90%.

Karen has $1 million in cash. She gets back $900k (90%) from the general pool of clients’ assets. SIPC makes her whole with another $100k.

JimBob has $10 million in cash. He gets $9 million back from the general pool, but the SIPC can only give him an extra $250k. He loses 750k for trusting one brokerage firm too much – ouch.

Forrest has $5 million in exchange-traded funds (ETFs), valued on the day the trustee gets appointed to oversee QAnonald’s liquidation. He gets $4.5 million back from the general pool, the SIPC makes him whole with another $500k in stocks or cash.

Eric has $6 million in exchange-traded funds (ETFs). He gets back $5.4 million from the general pool, but the SIPC can only give him $500k. He loses $100k.

Rules

Note that it’s pretty safe to invest more than $500k in an individual account. There is less than one case of failure per year out of 3,524 US brokerages. And it’s hugely unlikely the brokerage will collapse with ALL client assets missing.

In fact, the average recovery rate of all client assets in the SIPC’s 50-year history is 99.3%, leaving the SIPC to make up the remaining 0.7%. Only 0.05% of people claiming money from the SIPC’s protection program exceeded its limits and lost out. IB has additional insurance protection above the SIPC limits, though it’s maxed out at about $150 million across all its clients.

So it’s very unlikely you would ever lose out, but there’s also a way to get even more protection from the SIPC. Here are the rules:

- An individual account gets $500k protection (with a $250k sub-limit for cash)

- If you personally have two individual accounts with the same brokerage, that $500k is shared across the two accounts

- But if you have two individual accounts with different brokerages, each account gets $500k protection

- If you have a joint account with somebody else, that joint account is treated like a ‘person’ and gets its own $500k protection, separate from your individual account(s). Every joint account you have with a different person (e.g. your wife, your 18-year-old son) has $500k protection

- Trust accounts, IRA accounts (US-residents only) and custodial accounts for children also get their own protection limits

If you have an account with IB Ireland or IB Luxembourg, you are not covered by the SIPC and your protection limits are €20k instead.

I do encourage you to read the Interactive Brokers Group Strength and Security page and FAQs, as well as the SIPC website. I have done a lot of digging on this to get you the most up-to-date and accurate information but, as usual, I reserve the right to be slightly or completely wrong.

Do you have any questions or comments? Share your thoughts in the Comments section below…

Join my Financial Transformation Program (25% off)

After helping tens of thousands of expats to plan, save & invest their own money with confidence, I have created this program combining private coaching, online courses, group learning, accountability and community. It has everything you need to know, the flexibility to suit your experience and life schedule, plus the support to make sure you actually take action towards a great financial future.

Who would benefit from this post? Share here:

Join Our Community

Get our articles first – practical and memorable advice on saving your money and avoiding financial pitfalls.

We won’t share your email with third parties and will never spam you.

Hi Steve,

Just saw that IB announced that they’ve implemented additional funds coverage called Insured Bank Deposit Sweep Program, which provides up to USD 2.5 million of Federal Deposit Insurance Corporation coverage. This seems to be on top of SIPC.

Just in case you might want to update this post.

Thanks Jim. Unless you are a US citizen, anything over $60k USD in cash deposits would be subject to 18-40% estate tax if you died. So the deposit sweep program isn’t going help non-US citizens much.

My IB account is within their US entity. I am a Spaniard living in China, and planning to retire and establish tax residency in Panama. For the Spanish tax authorities, that requires that I have my center of economic interest in Panama too. From a tax perspective, where is the money in my IB account: In the US, in my country of current residence, or in my country of citizenship? Thanks!

Hi Fernando, I can’t claim to be a total expert on Spanish tax details, but in general withholding tax on dividends and US estate tax (after death) are based on fund domicile (e.g. Irish UCITS), income and gains taxes are based on residency (China) and inheritance tax is based on citizenship (Spain, possibly changeable over time).

I’ve yet to sign up for IB, but would ideally like it covered with SIPC protection from the US or UK entity. Do you happen to know what decides which entity you get added to. As a Brit in Taiwan, I would assume it would link with the UK entity. Any pro’s cons between US and UK IB that you know of?

If your base currency is in USD, there is a high chance you will have an account with the US entity. The US entity manages the stocks etc for UK entity clients anyway, so it doesn’t make much difference. You still have SIPC protection.