Join my Financial Transformation Program (25% off)

After helping tens of thousands of expats to plan, save & invest their own money with confidence, I have created this program combining private coaching, online courses, group learning, accountability and community. It has everything you need to know, the flexibility to suit your experience and life schedule, plus the support to make sure you actually take action towards a great financial future.

Serious saving made simple, practical and memorable...

...with all the useful details nobody else bothers with

500 expats learning about Financial Independence – now you can too!

Saving Made Simple

Learn how you can save and invest quickly, cheaply and flexibly, so you can get on with living a fantastic life.

Saving requires a bit of discipline, which is much easier when you know why you are saving and how much you will need. Investing sounds complicated and an entire industry wants you to think it is. But investing sensibly can be very simple, especially in the age of global index funds.

The hardest thing will be investing regularly while ignoring all the chatter from your mind and the media. Your brain wasn’t designed to deal with stock market swings, so get it out of the way and stick to the rules. We’ll show you how to do that too.

If you’re bored by personal finance books and numbed by numbers, this is the place for you.

Join Our Community

Get our articles first – practical and memorable advice on saving your money and avoiding financial pitfalls.

We won’t share your email with third parties and will never spam you.

Start Here

If you’re new to saving and investing, click the button to get started with 10 simple steps to Financial Independence.

Blog: latest posts

Updated! The Unbiased Guide to Expat Investing

Discover how to invest in stock and bond funds (ETFs) as an expat – cheaply, quickly and sensibly. Maximise your saving power while you work abroad!

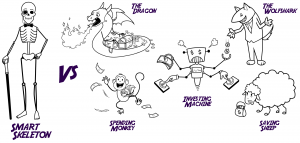

How to tame your monkey mind – the psychology of saving & investing

You have to train your brain to accept that yes, you will become great with money, you will stick to the path and you won’t let your monkey mind get in the way.

Are you a Dragon sitting on your pile of cash?

Dragons love to sit on their big pile of cash, gold and property. But their excess cash gets eroded by inflation and they miss out on stock market growth.

Interactive Brokers – Death & Estate Tax Update

Many people have been nervous of using Interactive Brokers because the company is based in the US. It has clarified estate tax and fund/ETF domicile issues on record in the past few days, so I wanted to pass the info on to you and reassure you.

Tired of Your Job?

You may be wondering if you should quit your job. Here are some common reasons:

– You’re bored

– The work is too demanding and stressful

– The work environment is toxic

– You’ve received a better offer elsewhere (but what if…)

– You want to move back home/elsewhere

– You can afford to stop work and be financially independent aka ‘retired’

Blog: Investing (funds, ETFs, brokers, currencies & transfers)

Interactive Brokers – Death & Estate Tax Update

Many people have been nervous of using Interactive Brokers because the company is based in the US. It has clarified estate tax and fund/ETF domicile issues on record in the past few days, so I wanted to pass the info on to you and reassure you.

Updated! The Unbiased Guide to Expat Investing

Discover how to invest in stock and bond funds (ETFs) as an expat – cheaply, quickly and sensibly. Maximise your saving power while you work abroad!

Revolut Warning

Revolut is useful. But when I made a list of red flags today, it quickly grew to at least 10 concerns. I don’t think that’s good enough.

Blog: Planning (mindset, current situation, future needs)

Tired of Your Job?

You may be wondering if you should quit your job. Here are some common reasons:

– You’re bored

– The work is too demanding and stressful

– The work environment is toxic

– You’ve received a better offer elsewhere (but what if…)

– You want to move back home/elsewhere

– You can afford to stop work and be financially independent aka ‘retired’

Resilience: coping with the unexpected loss of people, jobs & investments

The sudden loss of a person//job/investment that’s been a constant in your life can leave you feeling untethered and vulnerable. How can you anchor yourself and those around you in advance?

Could inflation be good for you? Or hit you harder than others?

Is there any silver lining when it comes to inflation? For some people, maybe there is. Let’s have a look at who will benefit and who will get squeezed…

Blog: Saving (income, expenses, debt, cash)

Are you facing a fixed-rate loan disaster?

If the fixed period on your mortgage will expire in the next 1-2 years, or you are considering a new loan, act now or face a big increase!

When your bank is suddenly no longer your friend

Everything in these real-life stories of debt, uncooperative banks, job loss and pain is fully preventable. That’s why spreading basic financial literacy is so important.

Card fraud – protect yourself now

As if we don’t have enough to worry about these days, card fraud cases have been growing rapidly in the past year. Whenever I see it mentioned on a facebook group, there are 20-30 other people joining in with their own stories of fear and frustration.

Don’t let this happen to you. Here are some simple steps you can take to protect yourself.

Blog: Troubleshooting & terrible savings plans

Scams

It’s so important to think about who you are going to trust to handle your money. Many of us like to think the best of people and companies, that they have our best interests at heart. It is painful to discover both dishonesty and incompetence out there.

UAE: gratuities, allowances and what makes a good employee saving scheme

Who would benefit from this post? Share here: Share on facebook Share on linkedin Share on twitter Share on whatsapp Share on email The end

Why don’t people trust financial advisors?

Who would benefit from this post? Share here: Share on facebook Share on linkedin Share on twitter Share on whatsapp Share on email Listen to

Join my Financial Transformation Program (25% off)

After helping tens of thousands of expats to plan, save & invest their own money with confidence, I have created this program combining private coaching, online courses, group learning, accountability and community. It has everything you need to know, the flexibility to suit your experience and life schedule, plus the support to make sure you actually take action towards a great financial future.