Who would benefit from this post? Share here:

The end of service gratuity is a relic of the old UAE that, along with the one/two rent cheque, hasn’t quite gone the way of the dinosaurs yet.

Before we get to the main message, two useful side-notes:

- The gratuity is based on your basic salary, ignoring any housing/travel/school allowances. Negotiate any new contracts accordingly!

- Your housing or travel allowance doesn’t have to be spent on housing or travel. It’s all money… Much better if you can spend less on rent and save some of that allowance. Or, going back to 1., see if you can get your entire allowance converted into basic salary! You can thank me when you leave.

Mercer and Zurich have teamed up to offer a new corporate savings plan for companies to offer their employees in the UAE. This will help build up the gratuity or encourage saving in addition to it. I’m all for employees saving regularly through the discipline of the money coming straight out of their salary before it hits their account (or wallet).

But sometimes corporate savings plans are no better than the long-term savings plans I complain so much about – high fees, hard to escape and invested poorly. One of my small pensions in the UK is fairly rubbish and will take hours of effort to transfer to something better.

Get started with my free guide:

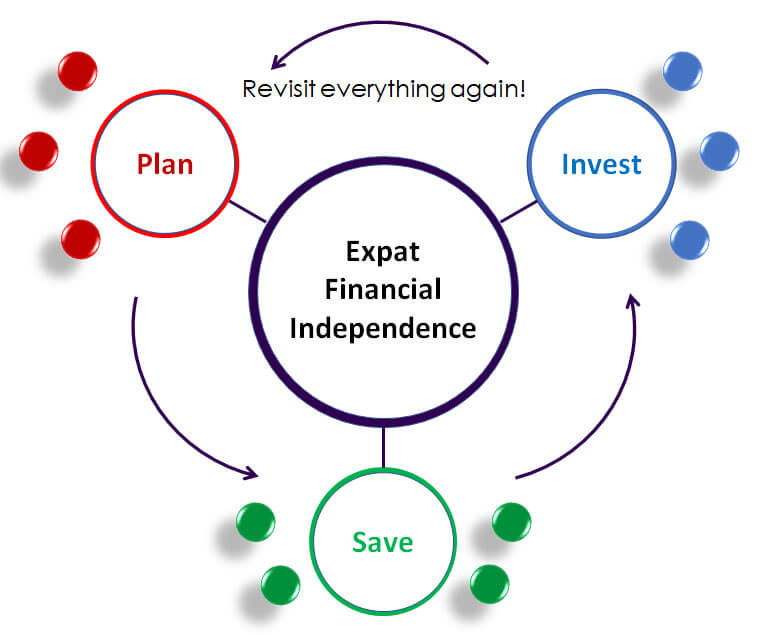

3 Steps to Expat Financial Independence

15-minute read. Discover the simple process for taking control of your finances so you never have to stress about money again.

I don’t have any details about the Mercer/Zurich MySavings plan, so I can’t comment on that. But if you are an individual receiving such a plan or an HR manager/company owner considering one for you staff, make sure you check alllll the details thoroughly, including:

- Total fees (upfront fees, platform fees, fund selection fees, fund management fees, mirror fees, transaction fees and especially surrender fees)

- Commission paid upfront to advisors promoting the plan and paid by fund managers for recommending their fund (trail commission)

- Flexibility to close or transfer the plan if the employee decides to leave or the company decides to move to another provider. Beware of surrender/exit penalties!

- Investment options – are low-cost, diversified, passive index-tracking funds available? You knew I would say that, right?

- Reporting – will employees get regular reports on what their plans are invested in and how they are performing? Will the reports be easy to understand? Will cheap alternatives to their existing funds be easy to find?

If your employer is not matching your contribution and your plan is charging you more than 1-2% total per year, you might be better off saving by yourself. As long as you make sure to save regularly. Find out more about how to do that here.

Here’s the original article in The National where I commented on the new Mercer/Zurich plan.

Photo: Jaime Puebla, The National

Who would benefit from this post? Share here: