Who would benefit from this post? Share here:

I’m proud to serve on The Debt Panel of The National newspaper in the UAE, but it can be depressing. Almost every question is from someone who has over-loaded themselves with debt and cannot see a way out. This week’s question was a classic example of this.

I owe the banks almost Dh180,000 and was paying properly until 2016, when I lost my Dh10,000 a month job at a multinational company. I struggled to get another job for four months before eventually joining the insurance sector to secure some income. While I was unemployed, I used savings to make my repayments. I signed up for the credit cards to make online purchases and for the loan to clear fees from my degree; some of it was also given to my family.

In total I owe:

Loan 1: Dh90,000

Credit card 1: Dh60,000

Credit card 2: Dh20,000

Credit card 3: Dh7,500

Total: Dh177,500I now earn Dh6,000 and stopped repaying my loan and credit card 1 in July last year and the other two cards in December. I started receiving threatening calls and letters and even sought help from charity organisations but they could not help. I am Pakistani but was born in Dubai and have lived here my entire life. I do not want to leave the country and want to keep my name clear as I have never been in such a situation before.

My monthly expenses are:

Rent: Dh1,500

Groceries: Dh1,000

Mobile: Dh500

Family: Dh3,000

Total: Dh6,000

What can I do?SZ, Dubai

Get started with my free guide:

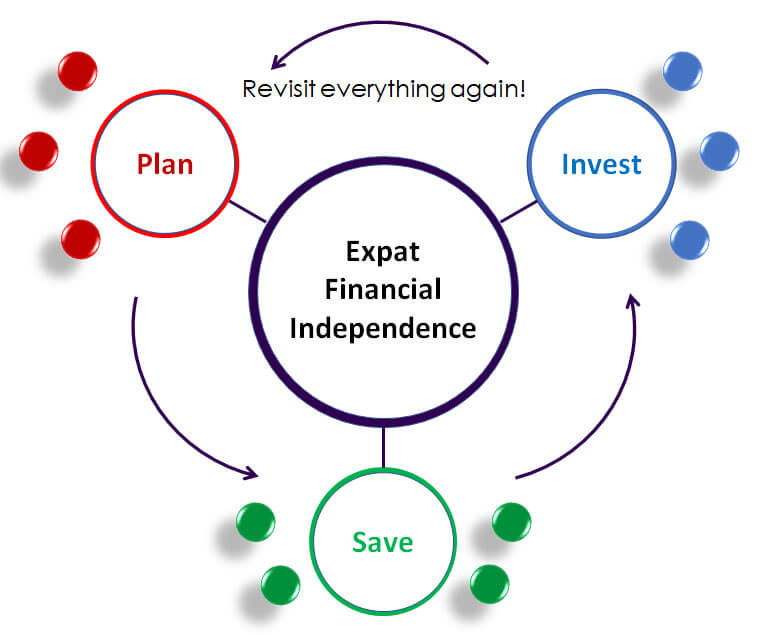

3 Steps to Expat Financial Independence

15-minute read. Discover the simple process for taking control of your finances so you never have to stress about money again.

There are tens of thousands of people struggling with debt in the UAE right now. There are probably hundreds of thousands of people who would have real problems if one or two things went wrong – they lost their job, a relative got sick etc.

Where this guy went wrong

SZ built up a huge debt burden on cards and loans, far beyond what even his previous salary could handle. Sadly, banks here will let you do that – you have to police yourself.

He was likely making the minimum payments each month, thinking that was fine. Banks are very happy with that, as they get to charge you more interest. But your credit card debt balance is building up rapidly – remember a monthly interest rate of 3% per month equals 42.5% per year due to compounding of the interest.

This makes you extremely vulnerable if something goes wrong. You must not put yourself in this situation! When SZ lost his job, he discovered he could not make any payments at all and defaulted. Now the banks are chasing him and he feels he might have to leave Dubai.

His monthly expenses are currently equal to his new salary, so he can’t pay off any debt. Paying 500 AED for his mobile and 3,000 AED to his family seems excessive though. He will have to tighten his belt severely to get through this crisis.

What he can do

- Admit he has a problem – to his family and especially to his banks. He cannot hide from this or face jail and financial ruin

- Ask his primary bank (or any other bank) for a consolidation loan across all his loan and card debt. This will stop the card balances ballooning, though he should also avoid outrageous 40% interest rates on some consolidation loans! He should talk to the most senior person possible, as they are more empowered to help him, and emphasise his determination to repay the debt

- Keep looking for a job with a multinational company (as loan interest rates are lower) and find ways to increase and/or supplement his income, including selling belongings, doing tasks on fiverr and helping neighbours

- Reduce his monthly expenses as far as possible, especially mobile phone and family commitments

- Pay off the debt as fast as possible with any monthly savings he can make. This includes asking his company, friend or family for a loan. Pay off the debt with the highest interest rate first… unless you have severe motivation issues in which case pay off the smallest debt first so you have a small win to keep you going

- Avoid building any more credit card debt! He should stop using the credit cards immediately – maybe even hide them in a block of ice in the freezer to prevent temptation…

The standard Save Yourself formula

In my recommendations above, I’m using my standard formula for getting yourself out of debt:

Admit the problem > Renegotiate the debt > Boost your income > Slash your spending > Pay off the debt as fast as possible

It really works! The hard part is going through each stage methodically and sticking with it until you are debt free…

Here’s the original article in The National with my recommendations for SZ on The Debt Panel.

Illustration: Alex Belman, The National

Who would benefit from this post? Share here: