Who would benefit from this post? Share here:

Join my Financial Transformation Program (25% off)

After helping tens of thousands of expats to plan, save & invest their own money with confidence, I have created this program combining private coaching, online courses, group learning, accountability and community. It has everything you need to know, the flexibility to suit your experience and life schedule, plus the support to make sure you actually take action towards a great financial future.

The party is over. It’s time to be awesome. But being awesome takes effort and few people can be bothered to put any effort towards anything on 1 January. This month is like the first day of the working week, a bit depressing but also a chance for renewal.

Now, in these precious few days of early January, is the time to stop and think, dream and plan. If you want your 2021 to be better than your 2020 (and who doesn’t), don’t skip this process, even if it’s painful. Especially if it’s painful.

Here are 3 easy ways to win at January. You will ideally have a piece of paper (remember those?).

1) Review the bits of 2020 you could control

2020 sucked, I get it. Let’s move beyond that. It didn’t all suck, and sometimes that was because you took action with foresight and responsibility. There were lessons to be learned – well << Test First Name >> you’d better learn them, because life won’t suddenly become easy in 2021 and beyond.

Think about the bits of 2020 that you could control. If you’re a pilot, maybe you lost your job – you couldn’t control that. But maybe you’re a pilot and you lost your job with a pile of debt and no cash buffer. You could control that. And you can control how you respond to this challenge – with despair and wallowing or with fire and creativity.

It’s best to write these things down on paper using a pen. Plenty of studies show tapping on a keyboard doesn’t connect to your brain in the same way.

– All the good things about your 2020

– All the bad things about your 2020 (try to make these two lists roughly equal in length – there’s a challenge)

– Where did you react well to an unexpected problem?

– Where did you react badly? Why?

– What did you have under control?

– What was out of control even though you probably could have done something about it? Why?

– Where did you do a good job of managing your finances (for ‘tis a blog about personal finance)

– Where could you have managed your finances better (planning, saving, investing)

– What went wrong in 2020 that you can going to make damn sure never goes wrong again? How are you going to ensure this?

– Feel free to add similar questions to prod your brain

– What are the lessons you learned in 2020? How will you change your behaviour in January to demonstrate you have learned these lessons? How can you track and measure this? Who is going to hold you accountable?

2) Make a resolution with deep roots

In January, people stop things, people start things. A week later they are back to their old habits. So pick one thing you’re going to change, but add multiple layers to it. Nobody can create a new habit without repetition, reinforcement, removal of temptation. Have a plan. Change your environment.

Let’s say your going to stop eating meat for January. Start with why (thanks Simon Sinek, good book). Why are you doing this? Meat is bad for the world, you are overweight, you got long COVID and your health is woeful, you have no money etc. Nope, you need positive reasons. You will live to see your grandchildren, you will save lots of money that you can invest etc.

What is going to cause you to fail? Put a big chart on your wall so you can cross off the days. Set a reward for making it to Feb (not a juicy steak). Get your friends and family to hold you accountable, with lots of praise and severe penalties. Compile a list of meat-free recipes and restaurants that deliver.

Message your friends and warn them you will need help getting through this. Practise in your head saying no to those friends who will enjoy tempting you – picturing yourself confidently rising above their miserable attempts to drag you back to their cholesterol-filled ways.

Get started with my free guide:

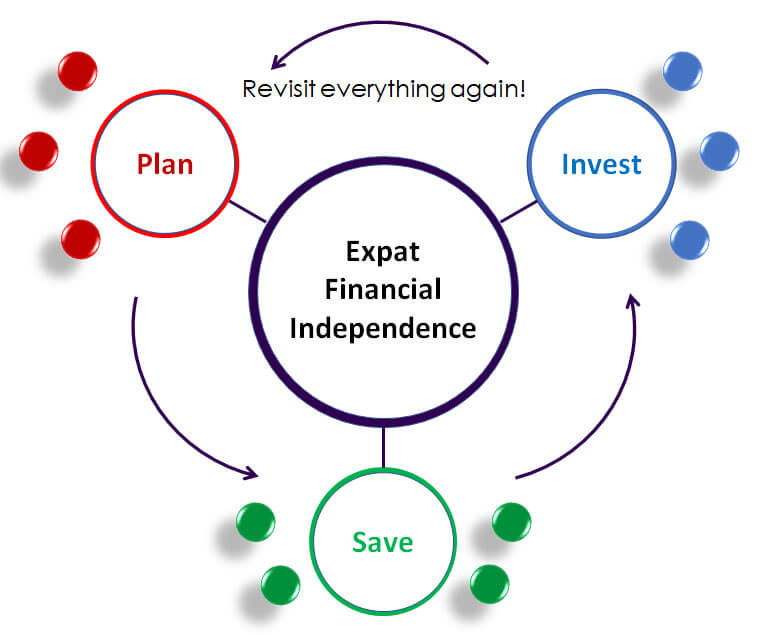

3 Steps to Expat Financial Independence

15-minute read. Discover the simple process for taking control of your finances so you never have to stress about money again.

3) Give yourself a purpose

What is the point of your life? Do you really exist to provide food and money for your partner and kids? Or to help the country you live in produce more aluminium? Or to sell more widgets to companies? No you don’t. You may find yourself doing these things, and that’s ok. But they have to be part of a broader purpose.

You can get through a job you don’t enjoy if it points to something better in the future where you are fulfilled. You can make money in a tough career as long as you don’t piss it away on things you don’t really need but distract you from your tough career.

You must have a purpose. Then every dollar you own must be given purpose, propelling you forwards. Get a piece of paper out and write THE POINT OF MY LIFE IS. Write down some ideas and link them to things that will get you towards. While you’re at it, write down some things your life is NOT for.

Don’t expect this to be an easy exercise. But January is not about being easy. That was December, and December is over now soldier. Easy path -> hard life. Hard path -> easy life.

You are not alone on this journey.

If you are tired of not having enough money, not knowing whether you have enough money or now, getting screwed over by banks and advisors, having crappy savings plans that don’t grow as fast as the S&P500 (that’ll be all of them), not knowing how to save money, not knowing how much you need for your future, not knowing how to escape from the treadmill of working and spending, not knowing what to invest in or how… we can help you.

I created the Expat Investing Academy program to help you fix all these things. Whether you are terrible with numbers or work for a bank already, we will transform your ability to manage your own money.

We’ll show you how to grow hundreds of thousands, even millions of dollars, simply and sensibly with little time or effort. And this, starting this January, will open the door to having an amazing life, full of purpose, ambition, impact and happiness.

Questions? Comments? Add them below!

Join my Financial Transformation Program (25% off)

After helping tens of thousands of expats to plan, save & invest their own money with confidence, I have created this program combining private coaching, online courses, group learning, accountability and community. It has everything you need to know, the flexibility to suit your experience and life schedule, plus the support to make sure you actually take action towards a great financial future.

Who would benefit from this post? Share here:

Join Our Community

Get our articles first – practical and memorable advice on saving your money and avoiding financial pitfalls.

We won’t share your email with third parties and will never spam you.