Who would benefit from this post? Share here:

The National has a Money Clinic every three weeks or so for readers’ questions.

This week I explained what to do if you find yourself trapped in a long-term savings plan.

Having invested into equity and bond funds over the last two years, I can no longer put money regularly into my savings plan. I have some US$100,000 invested. What should I do? Let it sit there until I can afford to start investing again? Break it and incur the penalty of paying 25 years of fees up front but use the money for something else? AL, Dubai

[Good question AL and you are not alone. If you are struggling with this yourself, please contact us.]

People with 25-year savings plans keep them for just 7.6 years on average. So this question is very relevant for many.

These plans are like a nasty virus. You’re stuck with them for a long time and they are painful and expensive to get rid of. If you go anywhere near most financial advisers in the UAE, you are almost certainly going to catch one.

Why? Because advisers make so much upfront commission that they train themselves to be very persuasive. If you sign up to invest $1,000 monthly for 25 years, your adviser may get $12,000 immediately. That’s why AL is facing a large exit penalty.

So let me vaccinate you: do not ever buy such a plan, for five years or 25 years. AL would say the same, I’m sure. Now tell your friends, family and colleagues.

People with existing plans should consider how many years into the plan they are, then find out:

a) Which funds are being invested in

b) The maximum withdrawal amount without penalty

c) The full surrender value to exit the plan completely

Then they have several options:

1) Exit the plan and fight for reimbursement. There is a large penalty, with loss of most or all of the first 18 months’ investments. If it’s possible to demonstrate that the features, costs, surrender penalties etc were not properly explained, the product provider may reduce or waive penalties. Expect a fight. Some advisory companies in Dubai have sold savings plans without being licensed by the UAE Insurance Authority. Such policyholders could complain aggressively and may be reimbursed.

2) Exit the plan and reinvest on a cheaper, flexible platform. Taking a big hit is painful. But over 15 to 20 years, lower annual expenses will more than make up for a large initial hit. Try the free Compound Interest Calculator at moneychimp.com. Investing in Vanguard or iShares passive tracker exchange traded funds (ETFs) offers better value, via an offshore platform like Interactive Brokers, TDDI Luxembourg [now Internaxx] or Saxo Bank.

3) Stop paying into the plan. Beware ongoing management fees and dormancy penalties (after 24 months) eroding what remains.

4) Keep the plan and reallocate funds. Some people prefer to keep paying in what they can and adjust the asset allocation to a sensible mix of stocks and bonds, regional diversification and slightly lower fund management fees.

Have a look at the original article here to see another response to the question.

Get started with my free guide:

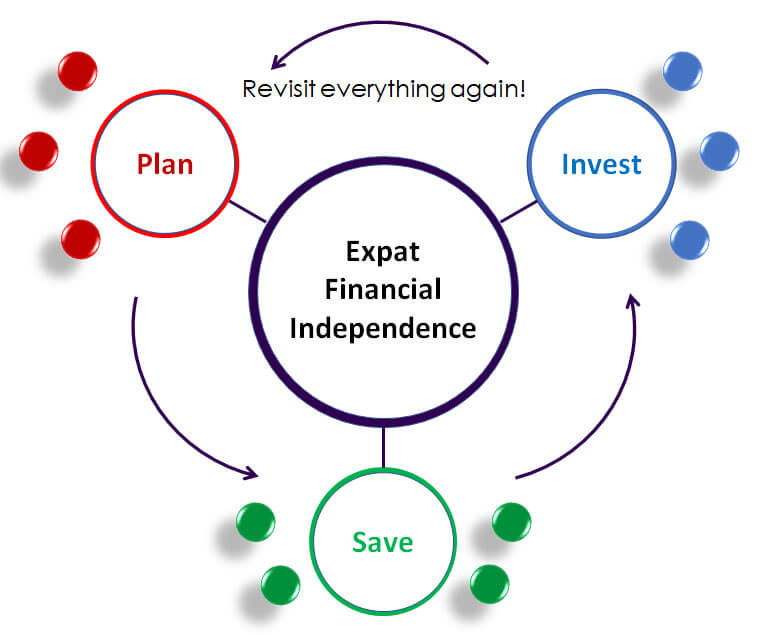

3 Steps to Expat Financial Independence

15-minute read. Discover the simple process for taking control of your finances so you never have to stress about money again.

Who would benefit from this post? Share here: