Who would benefit from this post? Share here:

This is a great article from Thomson Reuters Regulatory Intelligence featuring us and many other voices of reason in the UAE market. It discusses some of the problems with the selling of personal savings plans here and why there is reason for cautious optimism about the future.

For example, Hong Kong has suffered from a similar plague and has made good progress via regulation in forcing disclosure of fees and banning upfront commission.

Enjoy! – Steve

Market officials urge tightening up of UAE retail wealth market regulation

4 August 2016, Peter Shaw-Smith (reproduced with permission from the author)

Dubai has developed an enviable reputation as the Gulf’s financial hub but evidence suggests the emirate is up to a decade behind mature markets when it comes to regulation of wealth management and advisory as they relate to personal savings plans (PSPs).

Industry officials and end users say the prevalence of unscrupulous advisers who charge hidden commission and fees, and impose long-term fund lock-ups, persists in the Gulf, despite the work of regulators in more mature jurisdictions, such as the UK’s Financial Conduct Authority (FCA).

Nominally, the Abu-Dhabi based Emirates Securities and Commodities Authority (ESCA) oversees investment advice, but the Insurance Authority and the UAE Central Bank are also involved. None of these entities either returned calls or could be reached for comment for this article.

Toxic

Darien Harris, creative partner at a Dubai design consultancy, rues the day he signed up for a savings plan with a local independent financial adviser (IFA). “These plans are toxic, in that the hidden fees can be as much as 4.5 percent a year,” he said.

“Unfortunately, before you know it, you have signed a contract that locks you in for 25 years. Once you realise how poorly the funds are performing, it is too late. Trying to exit [triggers] a large penalty. These products are banned in the US, UK and Australia.”

After reading a book on personal investment, Harris decided to challenge his adviser. “I surrendered my policy, took a big hit, and starting investing by myself with my new-found knowledge,” he said.

“I have now made it a habit to ask people I meet with whom and how they invest. I have managed to help dozens of people either exit one of these plans or start investing the right way. This is my way of fighting back until the regulators throw these people out.”

Smoke and mirrors

Harris said 99 percent of Dubai’s IFAs used “smoke and mirrors” to sell their products.

“There is no incentive for them to be fiduciaries when they are earning huge commissions up front,” he said.

Since these plans are mostly sold to individuals by a third-party intermediary, there is a commission or brokerage fee involved, said Ambareen Musa, founder and chief executive of Souqalmal.com, a comparison portal for financial advice.

“In a bid to drive commissions many advisers skip such information to make the plan seem less risky,” she said.

“To counter this, brokers and advisers should be pushed to fully disclose the risk element involved in investment plans, and customers urged to read the fine print before signing up. More stringent inspection and auditing of brokers by the regulatory bodies would also be a step in this direction.”

Gordon Robertson, chairman of Invest ME Financial Services in Dubai, bemoaned the very expensive products and lack of visibility on costs and performance available in the Gulf today. “The fees [tend] to be about 8 percent to 125 percent of the first year’s payments and most of the products sold are tied up with insurance,” he said on his website.

“Small wonder… people [who] want quick access to their hard earned money… are shocked to discover that even after five years it is worth less than they have paid in. This is not what people deserve.”

Investment adviser Tom Anderson, of Killik Offshore in Dubai, lists a litany of problems: unnecessary wrappers, opaque costs, underperforming assets, contractual payment plans and commission-driven sales masquerading as professional advice.

He said it could take up to 30 years for UAE regulation to catch up with developed markets. He is not confident Dubai will follow regulatory precedents such as those in the UK.

“It’s not guaranteed. The DIFC is a good start, but there is not much enthusiasm outside it,” he said.

UAE regulators recently made personal medical insurance compulsory, but are understood to be turning only slowly to monitoring IFAs, as the products involved often do not concern UAE nationals. Expats in Dubai run a risk in assuming that today’s local regulatory backdrop will keep their investments safe.

Some progress, however, has been made. In June, ESCA issued guidelines for the ‘fit and proper’ conduct of investment advice, as well as a ‘decision’ on ‘financial consultation and analysis’ in 2008.

Angry

“There seem to be some pretty angry people over here at the moment and, in many cases, with good reason,” said a Dubai-based industry participant privately. Another called PSPs a “murky area.”

“The truth is that in immature markets without robust regulation, qualification, competence and compliance there is no common advice standard,” said Graeme Field, head of corporate services at Credence International in Dubai.

“This means that clients end up with different solutions depending on where they go. I am confident that ESCA are keen to regulate this market properly and will enforce proper advice standards. Until now the market has not had a true regulator of financial advice.”

While the brunt of the dissatisfaction appears to lie in the market segment of individuals with less than £250,000 to invest, affluent investors are growing in number in the GCC.

Research by Kuwait’s Marmore MENA Intelligence., shows that high-net-worth individuals, with $1 million-plus of investable funds, grew from $1.25 million to $1.33 million in the five years to 2014.

UAE wealth is expected to grow at a CAGR of 10.7 percent from $0.68 trillion last year to $1.1 trillion in 2020, according to global management consultant Boston Consulting Group.

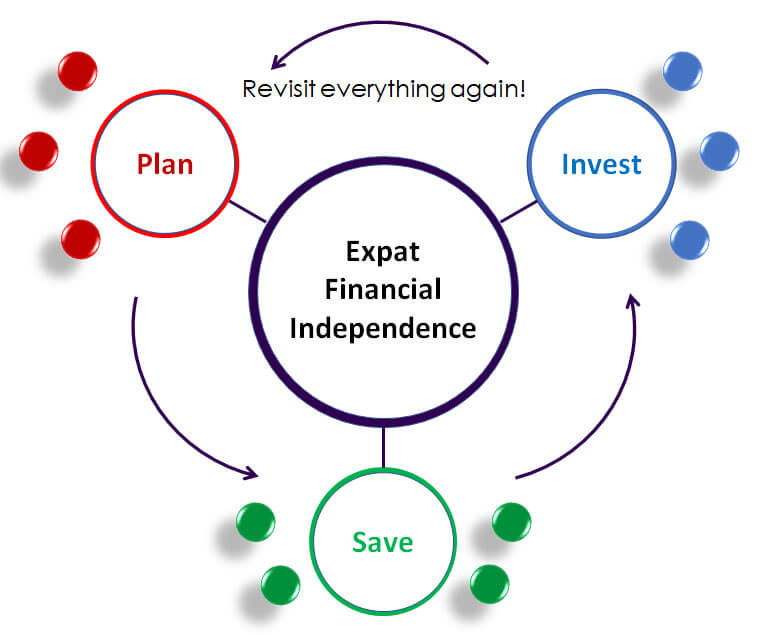

Get started with my free guide:

3 Steps to Expat Financial Independence

15-minute read. Discover the simple process for taking control of your finances so you never have to stress about money again.

Wise

“Why would you want to put your savings into such an opaque investment when there are so many cheap and flexible options available?” asks Steve Cronin, who set up a website called ‘Wealth, Investment and Saving for Expats’ (WISE) [now Dead Simple Saving] to help those who feel they’ve been duped.

“When people write about UK personal finance ‘in the old days’, it sounds exactly the same as Dubai today: advisers selling unsuitable, expensive and complex products on commission,” he said.

“Even friendly and knowledgeable advisers are promoting these savings plans because the commission is too big to ignore. Advisory companies are addicted to fast cash up front.”

A perfect storm of product innovation, consumer awareness and regulatory change is coming, which will lead to the demise of the current model within five years, he believes. He is determined to “help consumers surf this wave while

the fancy suits and Jaguars of the advisers get a good soaking.”

Cronin cited Hong Kong’s recent clamp-down on the sale of insurance-wrapped savings plans, and is calling for mandated detailing of fees paid to advisers, as well as all costs and surrender penalties.

Insurance providers may choose to exit the market, just as Standard Life exited the Middle East in 2014 and Zurich exited Singapore in 2015. There was too much reputation risk to the providers of long-term savings plans, whether a plan was ‘mis-sold’ or not by intermediaries, Cronin said.

Product potpourri

PSPs have many different names in the UAE, usually the result of the quest for novel product differentiation, often

being called offshore pensions plans, regular savings schemes, or a host of other terms, said Sam Instone, CEO of AES International, an investment adviser.

“In the UK this product type is known as a maximum investment plan, an endowment-type product. These are well known for being easily mis-sold and were largely banned many years ago,” he said.

“Many people in the federal market do not understand who the right regulator in the UAE is. Insurance companies are selling investments and investment companies are selling insurance, so there is confusion everywhere through lack of strong regulation.”

Instone suggested the creation of a single UAE financial regulator by merging the Central Bank, ESCA and the Insurance Authority, “so people can’t arbitrage between the different agencies”.

Professional standards needed to improve through learning and development, while an ombudsman and a financial services compensation scheme were also required.

Strong and highly regulated

“A strong, highly regulated financial system which protects the long-term financial planning needs of both its nationals and expatriate workforce is critical in the fulfillment of [the UAE’s] vision,” Instone said.

“Change is in the air, with regard to the definition of a financial planning consultancy. ESCA has also issued a code of conduct which certainly competes with US, European, or Australian standards,” said Sean Kelleher, chief executive of Mondial Dubai LLC, a wealth management adviser.

“Their recent training on continual professional development recording emphasized their intention to professionalise

financial planning.”

Kelleher likened coming off up-front commission to quitting cocaine. “Mondial is now in cold turkey and works a salary-plus-bonus system which can now be driven by our fee and trail income business,” he said.

“The benefit to clients of this approach is absolute transparency of costs. The benefit to Mondial is the sustainability of income from trail fees. Expat cover started its life on a fully transparent basis.”

A change from high front-end commission was irrelevant, he said. “The issue is transparency, and the price that the client has to pay. Clients are becoming more aware of charges and cost structures. They are in a better position to

negotiate.”

Peter Shaw-Smith is a contributor editor to Thomson Reuters Regulatory Intelligence. He is based in Dubai.

Who would benefit from this post? Share here: