Who would benefit from this post? Share here:

Financial advisors are often trying to get expats to invest in long-term savings plans. They sound good in theory but 99% of the time they are completely inappropriate. You will probably either make unimpressive gains or lose money. So just say no and tell your friends to say no too. Here’s why. Almost no financial advisor on commission is going to tell you this, which is why I have to.

1) The advisor selling them does not have your best interests at heart

You meet the advisor at a social event or through a phone call. He (or she) seems like a friendly, knowledgeable guy. Or a sleazy salesman, in which case you won’t invest anyway. He drives a nice car. You may go to his impressive office. He sits down with you for an hour and gives you free advice about planning for your future. He recommends a long-term savings plan.* You’ll be able to ensure you save regularly, get access to impressive funds and have low fees later on in the plan. They’ll even add to whatever you put in initially!

Your advisor is persuasive. You sign the documents and feel relieved. You’re proud that you’ve finally got this part of your life sorted. Maybe he gets out the champagne.

Except [insert record scratching sound here] you’ve just signed up for a nightmare.

Let’s rewind. Who pays for the nice car, impressive office and champagne? After all, he’s given you all this free advice. Well, you pay for it. The moment you signed, the savings plan company gave your advisor a huge upfront commission.

Let’s say you agreed to invest $1000 for 25 years. They will get your monthly investment x half the number of years of the plan – that’s $12,500. If you try to get out of the plan early (and almost everyone does), you’ll never see that money again.

So do you think your advisor is thinking about you when he recommends such a plan? No, he is salivating at the commission. Or sweating under sales targets from Head Office.

This is why you should not accept free advice from an advisor that is paid on commission. They will not tell you the best thing for you. Learn to invest for yourself or find an advisor that charges per hour or as a percentage of your assets (and takes no commission!). They will be less biased.

It pains me that many smart and pleasant financial advisors would be highly recommendable if only they stayed away from these savings plans and offered low cost, flexible platforms.

2) They are extremely complex

The documentation for these savings plans runs to tens of pages. They are deliberately hard to understand. Clever people have spent a lot of time figuring out how to make money off you at every stage, usually without you noticing. After all, they have to fund the lifestyle of the financial advisors, platform administrators, fund managers and brokers.

3) They have high fees and hidden charges

Some savings plans are worse than others, but in general you can end up paying 3-9% a year. A few percent may not seem like much, but over time these costs will drag down the value of your portfolio. If you are paying 4% a year in fees and the stock market averages 8-12% a year, then you are losing 33-50% of your profit every year in costs.

Your advisor may show you how the plan management fees decrease over time – it looks like a great deal. But there are other layers of fees, some hard to spot. The funds you invest in charge a management fee too. Because you are not investing directly in these funds there is a ‘mirror’ fee. Brokerage fees for buying and selling stocks will be in there too.

If you had decided to invest your money in a Vanguard passive index-tracker fund instead, the management fee could be as low as 0.08% (plus some minor platform and dealing charges). Your advisor had better recommend some amazing funds to overcome that disadvantage every year.

Get started with my free guide:

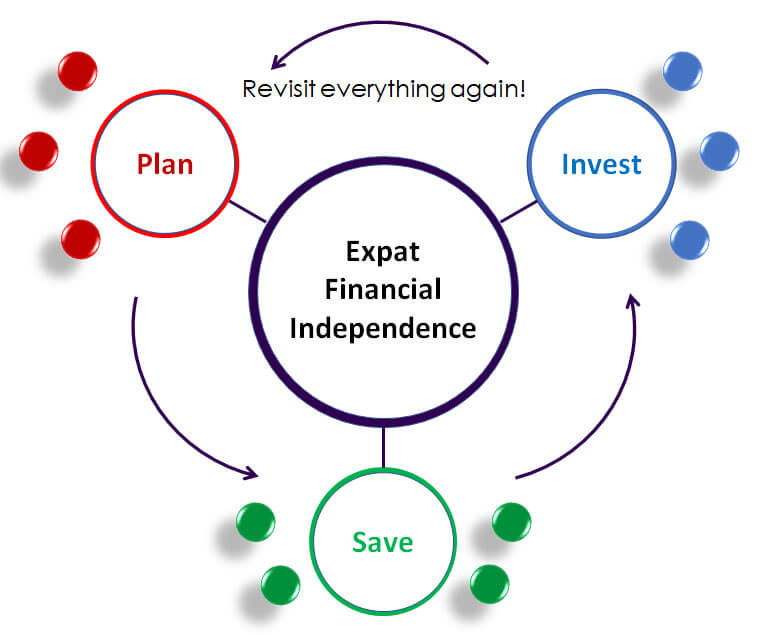

3 Steps to Expat Financial Independence

15-minute read. Discover the simple process for taking control of your finances so you never have to stress about money again.

4) They are often invested poorly in risky assets

What are these amazing funds? Well they probably aren’t as amazing now as they were last year. Your advisor may have shown you some blistering fund performances and projected a great future from there. Often, people’s savings plans are packed full of gold, Russian and Asian funds, just because they were hot at the time of signing. These risky assets then perform terribly and your portfolio ends up worth less than you invested.

Unfortunately, many financial advisors aren’t very interested in managing your portfolio over the years. They got all their commission upfront and now they’re too busy chasing new clients. Advisors come and go frequently, so yours may well have left the company by now anyway.

Now every person’s case is different but here are some guidelines I apply to my own portfolio:

- I avoid structured notes with an upfront fee (often 4%) and some form of capital guarantee. Trust me on this

- I avoid funds with management fees above 1.5%. I prefer funds charging below 0.5%, but let’s avoid the bad stuff first

- I focus on index-tracker funds for my core investments (i.e. 80% of my portfolio). It’s impossible to identify which active funds will outperform these, so don’t bother

- I invest in a mix of stocks and short-term bonds. Having the same percentage of bonds as your age (or a bit less) is a good starting point

- I make sure the US and Europe are well represented in my portfolio. They make up 60% of the world’s market value after all

- I try to invest regularly, avoid guessing when is best to invest and don’t fret too much if the market goes down – if you’ve got a long time horizon then the market is going on sale!

5) You will lose a lot of money if you try to exit before the end of the plan

One day you will check your savings plan and realise you have less in there than what you put in. Or you’ll compare its performance to the S&P 500 stock index and notice it did much worse. You’ll be fed up with the costs and the bad investments. You’ll want out.

This is when you discover the nastiest surprise of all, one that your advisor probably forgot to tell you about. If you try to get your money out, you could lose up to 100% of it, depending on how far through the plan you are. The exit penalties for leaving these plans are enormous.

You will have to make a tough decision:

A) Stay in and take control of the investments yourself, seeking unbiased advice

B) Exit, take a hit and invest the remaining money properly in low-cost funds.

You’ll be amazed how lower fees can overcome a big hit to your portfolio if you have a time horizon of 10 years or more. Make a decision as soon as you can.

And so to summarise

Long-term savings plans are some of the most toxic financial products around. There’s a reason they have been banned in the US, UK and Europe. This article should help you avoid them.

Don’t just listen to me though. If you are really thinking of investing in one, go and find 5 other acquaintances from slightly outside your close friendship or work circles, and ask about their experiences with such products. You might be surprised at the number of sad stories out there.

If you have already invested in a long-term savings plan, there are ways to resolve your situation. It’s a painful realisation but others in a similar situation can show you the way.

If you want some ideas on what to do with your money instead, then join our community here. After all the headaches above, you’ll be pleased to know it can be pretty simple.

Share your thoughts in the comments section below.

* It might be an offshore pension or life insurance investment plan instead (or as well!). While these have their uses, I would note that they have the same problems with very high fees and inflexibility. There are always cheaper and simpler alternatives.

Image adapted from original on youinc.com

Who would benefit from this post? Share here:

Great post, I’m literally standing at crossroads today with a couple of such products advised by a few “financial advisors” but am reluctant to sign on the dotted line just because of the costs and the apprehension that markets wont perform the same as they did in the last decade, essentially giving me nothing.

However, my goal is to save for my child’s education (15 year horizon available) and want to make sure that he get’s the best education even if i am not there. What would you recommend? Should i buy a term/whole of life insurance separately and build wealth separately through mutual funds? Also, I believe term insurances, although cheap, cover only 20-30 years and no benefit on survival, although premiums are low. Would you recommend whole of life insurance (with investments built in) products with may be double the monthly premium as term insurance, but at least there is an encashment value?

Would love to get some advise and direction here. FYI I’m an Indian passport holder residing in UAE, am 34 and my child is 3

Hi AV, we are glad you found it useful! You are right to doubt the fees, high fees may leave you with no growth. As for the market performance – none of us knows what will happen in the future! It’s a great goal to invest for your child’s education, you can book a session with Steve to get detailed guidance on how to set up an education fund and an investment portfolio on your own, booking under this link: DeadSimpleSaving.as.me

i am a Chinese investor and i have joined a global saving plan 3 years ago.Of course i regret. Could you tell me what is the best choice i can make now? To surrender or to go on with minimum monthly pay,or do something else? I’m looking forward to get your advice, if you see this message please reply it.Thank you.

Hi Kang, it’s usually always better to either get out completely or take the max partial surrender. Even the max partial will be eroded by fees. Don’t add any more money to it, no point in wasting more money on it. Even if you take a hit now, by investing sensibly you will make so much more over time. Send me a message if you want to some help taking control of your finances. Thanks Steve

Great post. Some well-meaning moron from my company’s HR invited a Dubai Wolfshark company to my office. I was abroad. They left a flyer on the notice board. I printed the above blog post and put it next to it.

Thanks Phil! HR teams really need to understand the consequences of letting these people in. Well done for taking action!

I have one of these. I hate it and don’t know what to do. I am confused, the company that manages it has a very high staff turnover and I am meeting new consultants every quarter. I want out but don’t even know where to begin.

Hi Jolene. Sorry to hear that you have found yourself in this situation. Can you please send some more details using the form on the Contact page? The first thing to do is check what the plan has been invested in and whether that compares appropriately to the mix of global stock markets and what the fees are for each fund. If you want to leave, there will be a surrender penalty but you can usually make the money back fairly rapidly and then zoom past to grow a nice healthy portfolio.